This is the final part, of my three-part series on what happened in the Industrial Transition in 2023. In case you missed it, be sure to read my Robotics & Manufacturing and Climate Tech reviews

Overview

Last year was marked by ever-increasing geopolitical tension. With war continuing in Ukraine, a new, devastating war in Gaza and increased tensions in the Middle East. Houthi rebels in the Red Sea targeted “Israel-aligned” ships from the UK and US, adversely affecting global trade flows and pricing.

The two dominant global powers, the USA and China, continue to impose economic sanctions on one another. Whilst Xi Jinping travelled to San Francisco for talks with President Biden, this rapprochement has not signalled the end of tensions or trade wars. The US’ 2022 semiconductor export controls were expanded in 2023 to include even more leading-edge chips. These sanctions could lead to a Chinese invasion of Taiwan, home of the most advanced semiconductor manufacturer, TSMC.

Europe remains divided on issues of industrial and technological capacity. Whilst there is a war raging 900km from Berlin, the UK, Germany and France continue with business-as-usual, “peacetime” policies. Pronounced commitments of increasing defence budgets towards NATO’s 2% target have not been met. Poland, which shares a border with Ukraine, has been fast to evolve its military capacities and energy independence. Finland has joined NATO and Sweden has just applied, due to security concerns from neighbouring Russia.

As this new world order is cast, technology remains the common and critical battleground. The definition of technology is expanding to include energy security and industrial capacity. Countries are digesting a shifting global order. In a multi-polar world, sovereignty in leading-edge technology and the ability to align with new trade clusters is critical.

Defence - from ‘analog’ to ‘digital’

The Ukraine sandbox. The war in Ukraine continues to serve as an unwelcome testing ground for new military technologies. It continues to demonstrate important battlefield lessons for Western militaries in areas such as command post operations, use of drones, cyber warfare, and networking capabilities:

Some commercial technology is more effective on the battlefield than specialised military technology. An example is the ubiquity and expendability of small, commercial-off-the-shelf (COTS) drones for reconnaissance and targeting. Even whilst jammed by electronic warfare, their low cost has made these drones expendable. Much of this capacity has come from smaller, private companies such as Quantum Systems and Velos

Beyond drones, we have seen rapid adoption of other commercial technologies, from open-source intelligence (OSINT), Starlink connectivity, and 3D printed parts and armaments. These commercial solutions have been invaluable for speed, agility and capacity

The conflict showed that cyberwarfare can be a prolonged fight rather than a decisive blow. Take the role of hacker "armies" - IT volunteers in information warfare undertaking disruptive cyberattacks and data thefts on Russian assets, even if their direct impacts are limited

Ukraine's ability to achieve a degree of "sensor to shooter" networking and data sharing in combat pointed to new opportunities for NATO allies on initiatives like Joint All-Domain Command and Control (JADC2)

Modernising defence

The all-domain domain - The development of defence technology is accelerating as militaries recognise the need to modernise procurement, expand capacity, and move from “analog” to “digital”. Defence forces are moving from siloed domains (land, sea, air, space, cyber) and largely mechanical vehicles to multi-domain systems driven by AI, software and unmanned robots.

The US Department of Defence (DoD) has recognised the importance of this shift. The US Deputy Secretary of Defense, Kathleen Hicks, announced last August the Replicator program. Replicator has a relatively simple mission:

The express goal of this program is to field 1000s of dispensible, low-cost, autonomous robots (namely drones), to counter China’s mass systems - in all domains. These capabilities:

"can help a determined defender stop a larger aggressor from achieving its objectives, put fewer people in the line of fire, and be made, fielded, and upgraded at the speed warfighters need without long maintenance tails"

This is a production scaling exercise, to prove that the Department of Defense can rapidly mobilise an industrial base against an aggressor when needed. The Industrial base of countries like the UK and US, has been described as “hollowed out”.

The DoD, with support of industry and Congress, significantly expanded the Defense Innovation Unit (DIU) to help the Pentagon leverage private-sector tech and hired ex-Apple VP, Doug Beck, to run it. Under Beck, the DIU is undergoing a significant shift (DIU 3.0) and is now less focused on proving the viability of new technologies and more on scaling existing ones. Beck’s appointment signals a new entente between the DoD and Silicon Valley. The DIU has enjoyed a surge of new interest and funding after Ukraine demonstrated the utility of commercial hardware.

Use of drones in warfare

Drone warfare will dominate current and future conflicts, as we have seen in Ukraine and with the Houthis’ interference in the Red Sea. Drones provide huge asymmetry; it cost the US and British Navy $2m to shoot down a single, $2000 Houthi-controlled drone. They offer precision strikes that surpass traditional methods and are cost-effective compared to traditional aircraft.

Additionally, drones enhance safety by providing vital intelligence, surveillance, and reconnaissance (ISR) capabilities, whilst reducing human casualties. Forces are now investing more in semi-autonomous drone swarms and the means to combat enemy drone swarms kinetically.

Eric Schmidt, the ex-Google CEO, is rumoured to be launching a new attack drone startup. Existing players, like Skydio, who historically have been more concentrated on consumer use cases, continue to move into military applications. Anduril launched ‘Roadrunner’, a reusable Autonomous Air Vehicle (AAV) for aerial threats.

Cyberattacks increasing, deepfakes coming?

Cyberspace is an active battleground, with state-sponsored attacks on critical infrastructure and ransomware increasing worldwide. Last year, the Chinese military ramped up its attacks on critical US infrastructure, namely a water utility in Hawaii, a major West Coast port and at least one oil and gas pipeline.

Progress in Generative AI and deepfakes, coupled with over 70 elections in 2024, means the likelihood of non-domestic election campaigning is nigh on guaranteed.

The Pentagon continued implementing its Zero Trust cybersecurity strategy across networks and systems. Under zero trust, networks are always assumed to be compromised. This means continual checks to make sure each user is allowed to access different information, rather than letting users who pass security checks have free reign over a network. The Pentagon released an update to their Zero Trust strategy in 2023.

Tech Geopolitics - a complex backdrop evolving into resource security

AI - It was undoubtedly the year of OpenAI’s ChatGPT. However, it was also the year that governments started taking AI capabilities more seriously.

“The AI wins routinely, the best pilot you’re ever going to find is going to take a few tenths of a second to do something — the AI is gonna do it in a microsecond.”

Governments recognise the need for AI to power their most critical defence capabilities and that enabling the private, domestic development of AI models is the best way to achieve this. But they’re in a quandary - they also perceive a need to protect citizens from “AI threats from bad actors”.

The UK led with its ‘AI Safety Summit’ in November, which brought together leaders from industry, academia and government to coalesce around a realistic plan to ensure safe AI development. The US quickly followed suit and the EU published the most comprehensive regulation of AI yet. Unfortunately, comprehensive is not the same as capable, leaving Europe’s chances of AI sovereignty - from semiconductors to models to applications - in a tough spot.

Semiconductors - Trade sanctions on the use of chips were expanded in 2023. The US imposed further restrictions on China’s use of leading-edge semiconductors like Nvidia’s A800 chip, which was created for Chinese customers to circumvent 2022 trade restrictions. The US forced Dutch chip-making equipment firm, ASML, to restrict exports to China. The UK announced two new national HPC clusters, AIRR and Isambard, though these pale in comparison to the capabilities of private clusters in the US. Additionally, there have been private European efforts to ensure compute sovereignty from AI companies like Aleph Alpha and data centre provider Evroc.

Financing

DefenceTech - Last year, defence investing went from taboo and “non-consensus” to “consensus” amongst venture capitalists. This was buoyed by increased government spending and large funding rounds such as Anduril’s $1.4bn Series E, Skydio’s $230m Series E and Shield AI’s $200m Series E. Venture-backed startups are looking to step into the gap left by defence primes, who are struggling to provide the leading-edge technology now needed for modern defence.

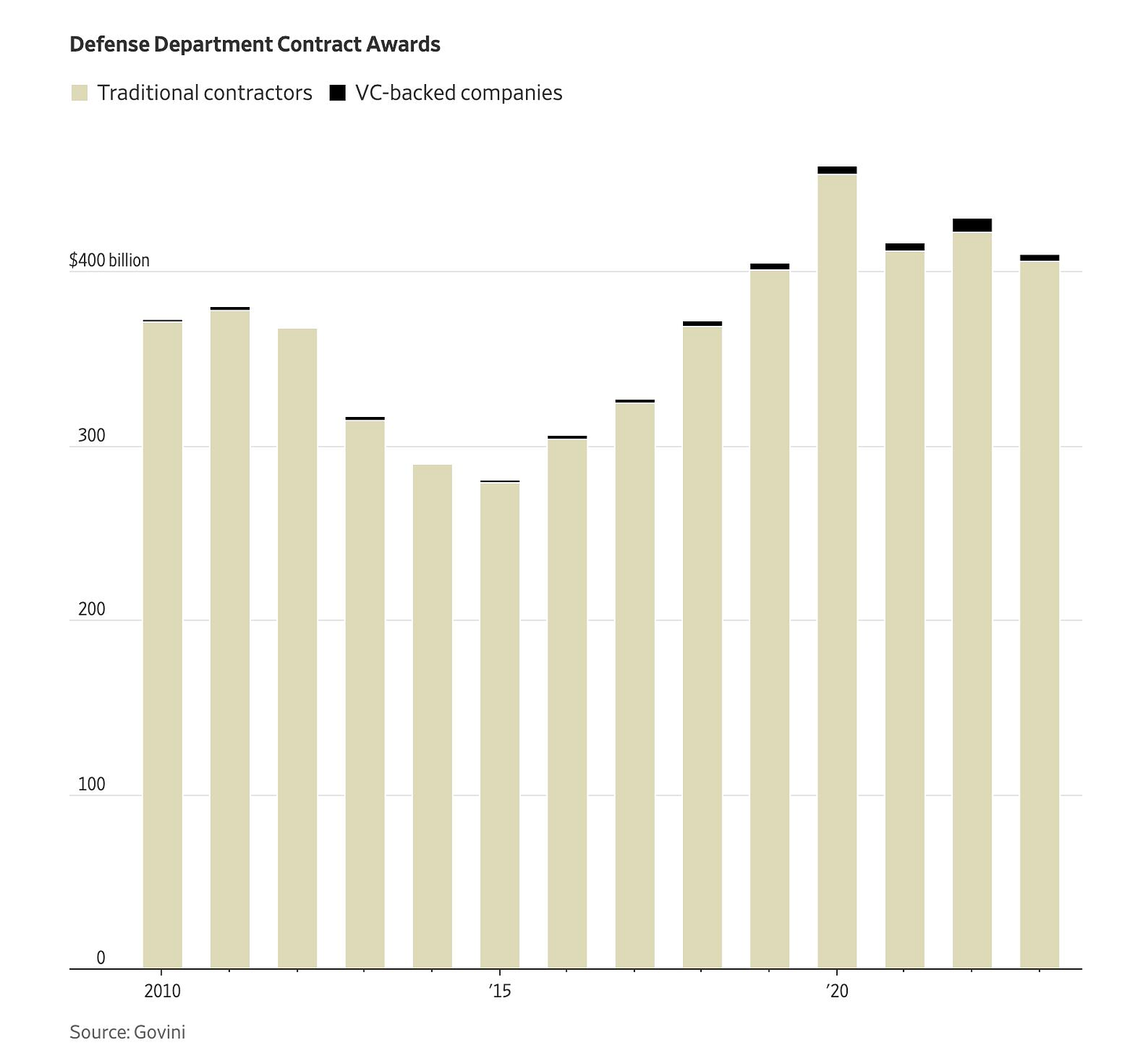

Overfunded or underappreciated? Whilst this new excitement is getting coverage, there are still relatively few pure-play defence companies who raise venture. This is particularly true in Europe, where 2023 saw low double-digit defence deals of which, arguably, two are notable - Quantum Systems and Helsing. In the US, $5bn has been invested in defence startups in the last three years, yet the Pentagon has awarded less than 1% of its $411bn spend in 2023 to those companies (more below). More mature tech companies such as Palantir and Anduril have crossed the government procurement chasm and been proficient in securing large contracts.

Net new VC dollars - Numerous new funds have been set up to focus on defence investing, including the NATO Innovation Fund (€1bn) and US Innovation Technology ($3bn), alongside defence stalwarts like Lux Capital and Founders Fund. The hope is that new capital and talent will be driven by mission, increasing capital and opportunity.

Notable rounds in 2023

Skydio - a US-based drone manufacturer, raised a $230m Series E from Linse Capital, Andreessen Horowitz, Next47, IVP, DoCoMo, NVIDIA and UP.Partners

Shield AI - a US and UAE-based AI pilot for aircraft, raised a $500m Series F (equity and debt) from US Innovation Technology, Riot Ventures and ARK Invest.

Vannevar Labs - a US-based workflow platform for national security, raised a $75m Series B, from Felicis, DFJ Growth, Aloft VC, General Catalyst, Point72 Ventures, Costanoa Ventures, and Shield Capital

Helsing - a pan-European AI platform for defence, raised a €209m Series B from General Catalyst, Saab and Prima Materia

Quantum Systems - a Germany-based drone manufacturer, raised a €63m Series B from HV, DTCP, Project A, Thiel Capital, ScaleUp Fonds Bayern, Omnes Capital, and Airbus Ventures.

Excellent stuff