🌐 Robotics & Manufacturing, 2023 in review

Hi all, welcome back. Hope you had a good break and are ready to tackle 2024.

The tl;dr on what happened in robotics and manufacturing in 2023;

An increase in reshoring has spurred a manufacturing boom in the US

Sanctions are not stopping China, they’re using their manufacturing expertise to ship lots of new tech in EVs, batteries, robotics and even semiconductors

GenAI has accelerated the development of generalisable robotics, with humanoids and autonomous vehicles seeing huge progress and funding

Inside the factory, Tesla changed the game with the Gigapress. Lots of new software and AI for design (CAD) and machining (CAM)

New business models for robotics emerged, increasing customer adoption

Financial markets were variable, rationalisation of mature players and large funding rounds for US hard tech companies

🌐 Macro backdrop

Boom - The big story is the US’s manufacturing boom, funded by the Inflation Reduction Act (IRA) and Chips Act. These acts are $422bn, Biden-enacted subsidy packages designed to stimulate investment in critical industries such as manufacturing and semiconductors, cutting reliance on China. The acts have worked fast (chart below). This has sped up the digitisation of existing industrial lines and is providing tailwinds to new talent and startups entering the space. With a US presidential election in 2024, and the potential for a Trump return - some of these subsidies might come into the political crosshairs.

An emerging Silicon Valley for hard tech - Los Angeles, El Segundo to be precise - has emerged as a new hub for aerospace, robotics and advanced manufacturing, enabled by the depth of talent in local companies like Tesla, SpaceX, Relativity Space and legacy aerospace companies like Northrup Grumman and Boeing.

There have been several noisy startups that have been bringing vigour to this nascent community, such as Varda Space, Anduril and Machina Labs (featured in video below). Musk biographer, Ashlee Vance, has a good feature on this new scene:

🇨🇳 China, the other Silicon Valley for hard tech

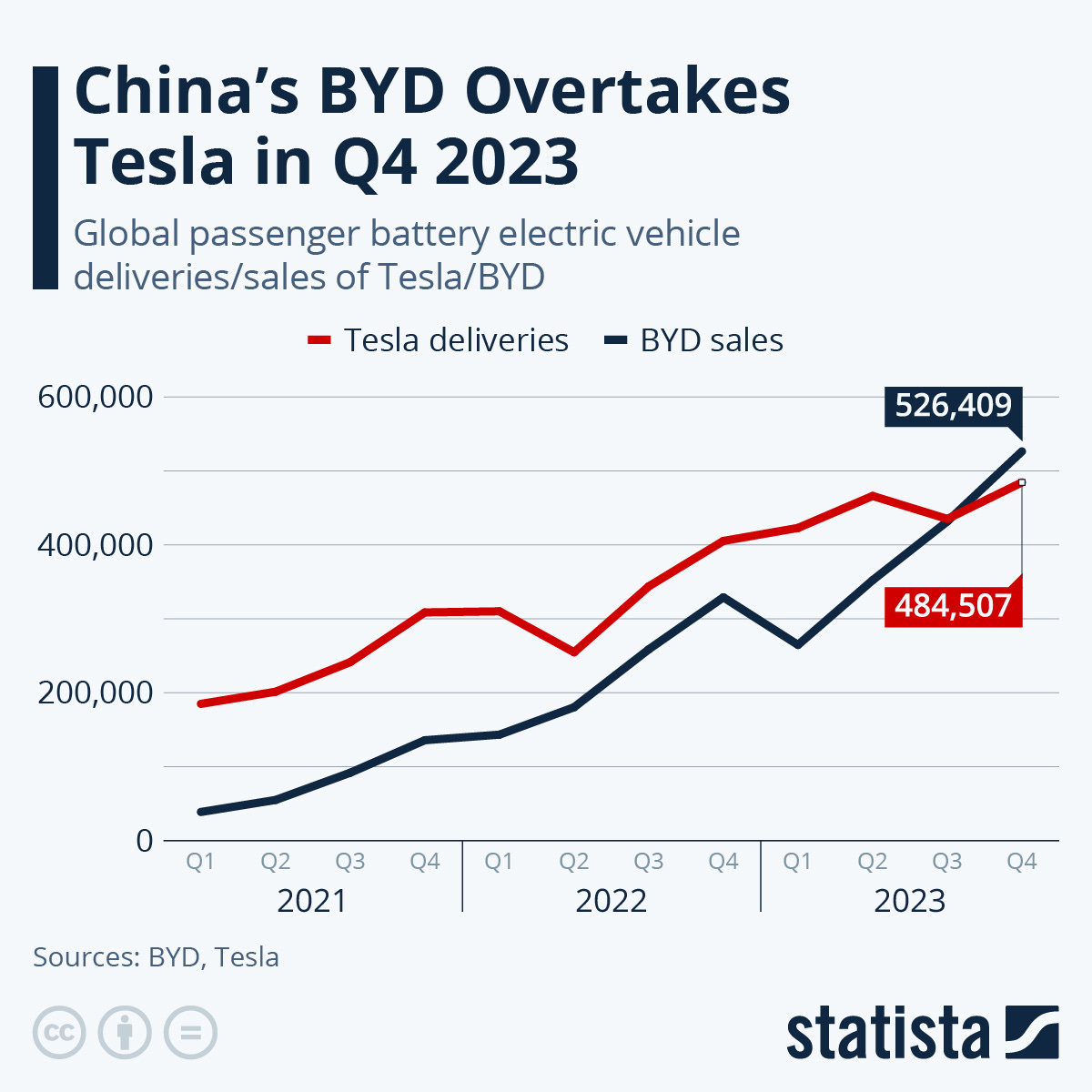

In my view, China’s battery electric vehicle (BEV) producers are the most interesting companies on the planet right now. Chinese BEVs like BYD, Xpeng, SAIC and NIO are vertically integrated and use the scale of their domestic market to massively lower production costs. These companies are at the forefront of many new technologies at scale, NIO launched a solid-state battery and has shipped a 5nm chip for autonomous driving, BYD is an automaker, LFP battery producer and semiconductor IDM. We have seen other local companies enter the fray, consumer electronics company Xiaomi has started making BEVs. Drone maker, DJI, launched ADAS systems for cars, taking on Tesla and Mobileye. In 2023, China overtook Japan as the world’s largest auto exporter and BYD just overtook Tesla in terms of BEV sales in Q4 ‘23;

‘No semis, no problems’ - After stringent semiconductor sanctions imposed by the US on China’s semiconductor market. China has been aggressively buying semiconductor manufacturing equipment. They plan to build 18 chip fabs in 2024, to ensure their domestic capacity. Local chip fab SMIC is producing advanced 7nm for Huawei.

Germany’s automakers are struggling- The Munich auto show in September was dominated by ‘cheap’ Chinese BEVs. Germany’s domestic automakers (VW, Mercedes and BMW) have been slow to transition from mechanical to electric vehicles. This can be explained by CEO-led dissonance on BEVs and is reflected in poor sales and impaired core businesses. They don’t have the competencies in battery production and electrical and software engineering needed to produce BEVs. They are unlikely to acquire these skills, VW’s software division, Cariad, is cutting 2,000 jobs. VW and Audi have recently partnered with Chinese XPeng and SAIC for battery and ADAS technology, partly shifting core competencies and profit pools to Chinese counterparts

Geopolitical exports. China has a capacity for 40m EVs a year compared to a domestic market of just 25m vehicles. No doubt, they will pursue export-driven growth to Europe especially, even if that means discounting vehicle ASP. They are also likely to dominate low-cost lagging-edge semis needed for EVs, dogfooding their production and likely using this to increase geopolitical leverage.

🤖 Technology

Big changes inside the factory - Gigacasting - Once again, Tesla changed the car game, this time by innovating the vehicle manufacturing process. Tesla has implemented ‘Gigacasts’ from the Italian IDRA Group. These die-cast presses weigh between 6,000 and 9,000 tons and can produce very large, single metal parts using huge compressive forces. Tesla uses these large parts for, say, the underbody of the Model Y. Traditional automakers would need 400 components for the same part. This dramatically reduces the need for robots, welds and sequential processes in its manufacturing line. Following Tesla, other carmakers such as Toyota have moved rapidly to adopt this technology.

Software and AI are also having an impact on CAD and CAM, the design and machining of parts. Some interesting products were released like CloudNC’s CAMassist a co-pilot for machining, Zoo’s text-to-CAD design tool, Generative’s parallelised design engine and many others. Software best practices are coming to manufacturing.

Let’s get Digital (Twins) - This new need for data and analytics is powering new digital twin use cases, allowing physical operators to replicate, monitor and test their environments in silico. Meanwhile, digital twins, modular architectures, and quick reconfiguration capabilities increased manufacturers' agility in responding to changing shifts in supply and demand. Hyperscalers (cloud providers) and software companies are increasingly moving into embedded software/hardware and industrial platforms:

📗LLMs and robotics, from task-specific to general?

Recent developments in large language models (LLMs) have enabled rapid progress in robotics and embodied AI. LLMs provide sophisticated environmental perception and robust language and image processing capabilities which have been leveraged to advance embodied systems. For example, LLMs have achieved remarkable successes on few-shot planning and navigation tasks that demand accurate decision-making.

This has driven a shift away from traditional robotic learning and towards combining classical robotics with language and vision models. LLMs need embodiment through exploratory experience in the physical world to unlock higher levels of intelligence. Numerous new datasets for embodied AI have been released, like PhysObjects, Open-X Embodiment and Ego4D.

Progress using these language models has given rise to Vision Language Action Models (VLA) and Vision Language Models (VLM). These multi-modal models, integrate both vision and language data. VLAs can translate visual and linguistic inputs into action, and use VLMs as a foundation for pre-training on large-scale vision and language data. DeepMind has been releasing lots of research in this space, such RT-2 and RoboCat multi-modal models:

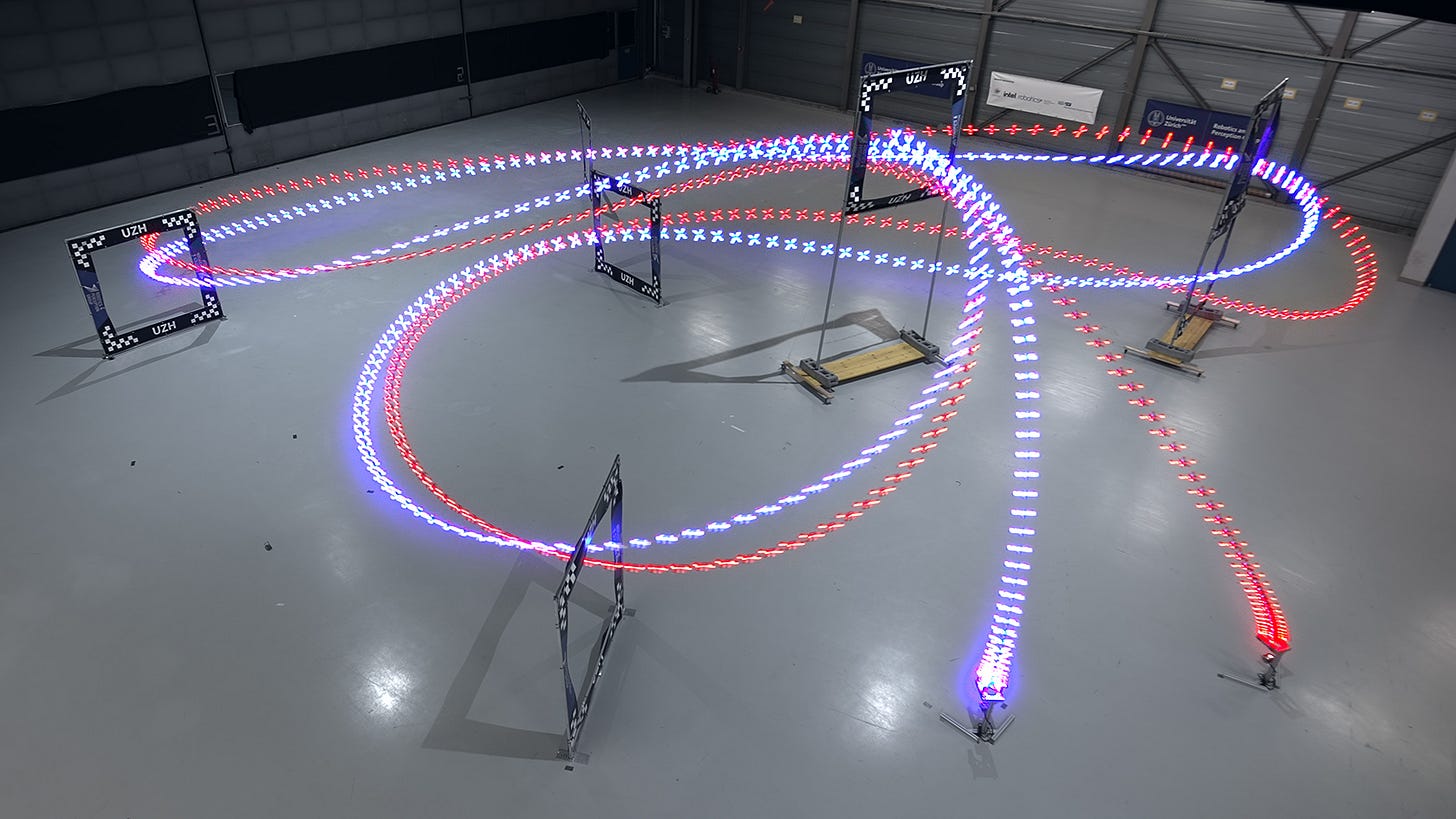

Along with LLMs, these models show new abilities such as better understandability from text-to-action, action-to-text, generalisation performance and emergent capabilities. There has been interesting work, such Octo, a generalist robot policy, and Nvidia’s Agent Driver, a language agent for autonomous driving. There have also been breakthroughs recently, such as a reinforcement learning-trained autonomous drone that beat the world's best human drone racers.

🚘 Autonomous Vehicles - heaven and hell

Autonomous vehicle startup Wayve, is an emerging leader in the field of generalisable robotics and Embodied AI. This year they released AV2.0 - large, unified deep learning models that can control multiple parts of the vehicle stack, from perception and planning to control. In June, they released GAIA-1, a foundational world model, which generates synthetic world scenes to train autonomous vehicles (video below) and LINGO-1, a natural language commentator for their foundation models.

Waymo has also made strong commercial and safety progress. Waymo did over 700,000 driverless rides in 2023, expanding their service territory in Phoenix, San Francisco, LA and Austin. They partnered with Uber and reduced injury-causing crashes by 85%. Cruise however paused all its driverless operations in October, after California revoked its licence after a series of road accidents involving pedestrians. The CEO, Kyle Vogt, resigned in November. This naturally is leading to questions about its viability as a business going forward.

Keep on truckin’ - there have been shifts in autonomous trucking. Several companies had shakeouts and falls, like Embark, TuSimple and Waymo’s trucking division Via. Aurora, Gatik and Kodiak are emerging as leaders - Aurora opening its first commercial route, Kodiak did so too with Maersk as a partner.

🤖Humanoid Robots - accelerating progress

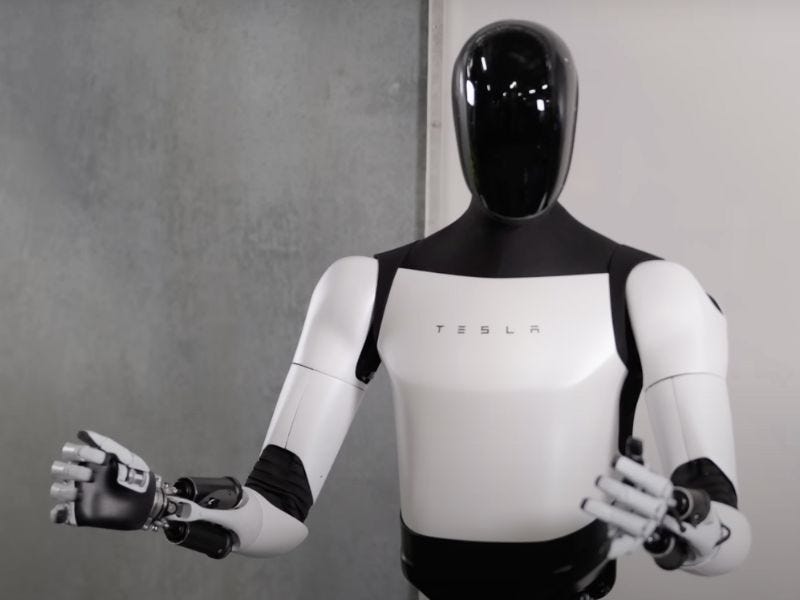

The potential for generalised learning is renewing interest in form factors such as humanoid robots, capable of general tasks and built to navigate a world built for humans. These robots have made huge progress over the last 18 months.

Multiple companies are vying for leadership including Agility Robotics, Apptronik and newer players like Tesla’s Optimus and Figures. Agility is arguably leading, they announced the world’s first robofactory and have partnered with Amazon (and GXO Logistics) to test their Digit robot within a warehouse;

Interestingly, Agility where able to ask their humanoid Digit to ‘pick up trash’ and the robot was able to accurately do the task and discern between trash and recycling bins. There is still some strong debate about whether generalised commercial robots make sense versus fixed, task-specific or even mobile ones.

Humans first, now robotic dogs? China’s Unitree, who is also building a humanoid, released a cheap quadruped robot dog that is stacked with tech. Whilst this is a toy today, it’s not hard to see it evolving towards commercial applications in search and rescue, military or industrial inspection like Swiss-based Anybotics.

💰Financing

New business models, robotics goes full-stack

2023 saw marked changes in business model innovation for robotic companies. Driven by decreasing technology costs, and an increasingly costly and tight labour market. These companies have moved from selling robots to customers, with lengthy integrations to providing the service directly themselves. For example, PaintJet uses robotics for industrial painting, Avid does commercial cleaning and Built Robotics and Luminous installs solar panels.

Companies like Electric Sheep and Metropolis are even acquiring the customer-facing businesses, ripping and replacing the tech with robotics and benefitting directly from customer cash flows. Also using in-field customer data to improve the product. Electric Sheep for example - have built landscaping robots, the company acquires landscaping businesses in the US, they install automated robots to undertake the work, expanding margins and free cash flow.

Deaths, divorces and financial derangement in the industrial sector

Consolidation. The financing landscape in 2023, has been a case of out with the old and big funding for the new. Many mature industrial companies were rationalised. The sector saw increased consolidation such as Rockwell's acquisition of AMR developer Clearpath Robotics, Ocado's acquisition of 6 River Systems, LIG Nex1's acquisition of Ghost and Stratasys’s acquisition of SPAC darling Desktop Metal.

A cash crunch pushed some companies to spin off non-core assets to raise cash like Intel IPO’ing its FPGA unit, Softbank’s ARM IPO, and Blackberry IPO’ing its IoT unit. Companies like Toshiba were delisted and taken private again. In public markets, industrial tech IPOs like Korean Doosan Robotics and Rainbow Robotics saw strong debuts, up 90% and 225% respectively in 2023.

Hard tech startup funding - saw strong interest from VCs in the US especially, driven by an evolving geopolitical order and need for hard solutions to society’s most critical problems. There were notable large Series A fundings like Saronic ($55m), Regent ($60m) and Mach Industries’s $79m at $335m valuation. There were many large, notable later-stage rounds like; CMR Surgical ($165m), Skydio ($230m), ShieldAI ($200m), Lillium ($192m), Agility ($150m), 1x ($100m), 42dot ($88m), Anybotics ($50m), Figure ($70m), Automata ($40m), Machina Labs ($32m)

Hope you enjoyed! Catch you next week

If you have 2 mins, would love to get your feedback on this newsletter here 🙏🏼