🔥RTN23 : ARM and NVIDIA get that money

+ IPO window reopening, nanomaterials, Nvidia earnings, Industrial Policy

Hi all, slightly amended format this week, let me know your thoughts!

“We estimate that approximately 70 per cent of the world’s population uses Arm-based products”

Is ARM going to open IPO window?

ARM filed to go public last Monday. The Cambridge, UK-based company produces and licences semiconductor IP, and was acquired by Softbank for $32bn in 2016. ARM is potentially selling up to $10bn in stock, with a target market cap of $60-70bn. Arm is likely to be the biggest US IPO since Rivian went public in November 2021.

In 2018, Softbank sold 25% ownership of ARM to its Vision Fund for $8bn. Softbank just bought that stake back from Vision Fund for $16bn, booking a 2x return for Vision Fund in a related-party transaction (“no conflict, no interest”) and valuing ARM at $64bn (which is handy!).

C.R.E.A.M

This listing, I fear, is as much about Softbank’s need for cash as is it about ARM. In 2022, Softbank secured a $8.5bn margin loan, secured against 75% of ARM and with a covenant stipulating that ARM would announce to go public before September 2023. To add to this, Softbank and the associated Vision Fund have been beleaguered with mounting losses.

ARM has a near monopoly on IP for smartphone chips, with 99% market share. However, this IPO comes at an auspicious time, with both technology markets roiling after ‘21, valuation multiples at a multi-year low and global smartphone growth stalling.

There are a few things going on here;

Softbank is pushing ARM to go public on the back of weakening fundamentals (details below) given its need for short-term liquidity and cash returns

Technology investors are waiting for more liquidity within markets - with the global liquidity currently frozen, and a >$1tr of late-stage private companies looking for an exit or soft landing

ARM is listing on the NASDAQ (v the London Stock Exchange), which is a further snub to local UK and European capital markets which continue to lose technology champions to the US main market

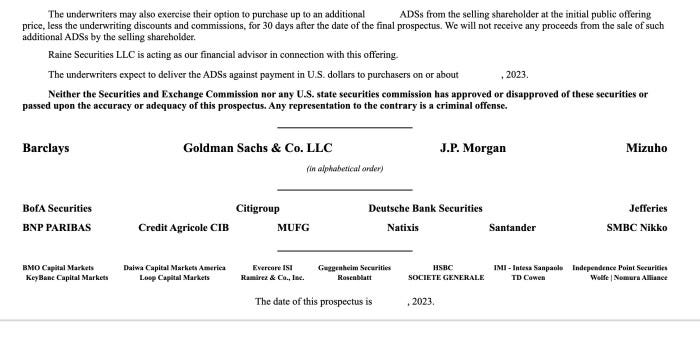

The listing has no less than 28 banks listed on its prospectus(!). Remember that margin loan? Well, turns out there’s a link between the lead bankers in this IPO and those who provided the facility. Softbank has a veracious appetite for capital

Whilst ARM’s IPO is sizeable and amidst a drought of notable tech listings, it will prove to be an interesting test of markets. Whilst the company’s fundamentals are weak, it does have core strategic value across key technologies, like mobile, edge and low-power CPUs and GPUs. For this reason, Amazon and Nvidia have been touted as potential cornerstones of the IPO, given they have historically coveted the company.

More or Less?

Instacart and Klaviyo filed S-1s last week and will go public in the coming months. Companies like Databricks, Stripe, Canva and Snyk are also rumoured to be considering going out and will, like others, be closely watching investor appetite.

ARM’s IPO will likely not signify the reopening of the IPO window, though if successful might represent the handle being turned. We need to see a return to strong investor demand for listings and an increase in valuation multiples before boards, en masse, consider raising from public markets.

Top Stories

Nvidia just posted a colossal quarterly earnings beat - earnings are up 854% YoY!

A new Python alternative that works with most accelerated compute hardware

Tesla Powerwall users can now sell power back into the grid in Texas

AI battery chemistry startup, Mitra Chem, raises $40m Series B from GM

Domain awareness startup, Picogrid, clinches large DoD contract

Thermal energy storage startup, Rondo Energy, raises $60m from energy majors

Apple strikes exclusive deal with TSMC for 3nm chip production (paywall)

The world’s largest offshore wind farm was opened in Denmark

⚡️Energy, Materials and Climate

A Deep Dive into Nanomaterials by Pace

Nanomaterials are materials characterized by their nanoscale dimensions, typically ranging from 1 to 100 nanometers in size, their discovery can be traced back to Richard Feynman in the 70s

Nanomaterials exhibit unique properties, given higher surface-to-area to-volume ratios which make them sturdier and more durable

Nanomaterials are classified by dimensionality (0D, 1D, 3D, 4D) and materials composition (carbon, metal, semiconductor, lipid)

Synthesis and fabrication techniques have advanced significantly, enabling precise control over size, shape, composition and structure of nanomaterials

Integration of nanomaterials into products and technologies has progressed through advances in nanomanufacturing. Scalable manufacturing processes like self-assembly are being developed to produce nanomaterials at an industrial scale. This is helping transition nanotech from lab to commercialization

Altering the fundamental structures of materials opens up a lot of possibilities in Environmental (Water/soil treatment, contaminant removal) and Energy (petrochemicals, improved solar panels, higher capacity EV batteries, efficient fuel cells)

Interesting companies: FabricNano, VSParticle, E-Magy

🌍 Policy and Geopolitics

Great watch, with The Economist’s Mike Bird and Noah Smith - two vocal commentators on the West’s new Industrial Policy, China and Green Tech

🦾 Manufacturing and Robotics

ARM is a semiconductor IP company. They architect, develop, and license high-performance and energy-efficient CPUs, taking a royalty every time the design is used within a device

Arm CPUs run a majority of the world’s software, including operating systems and applications largely for smartphones, tablets and personal computers

ARM’s growth is largely based on expanding beyond smartphones to new segments (data centre, automotive, consumer electronics), expanding offerings of SoC and IP (interconnects, security IP and memory) and expanding its availability to new customers like startups

Financials:

Revenue fell -1% YoY to $2,679 million in FY23 from $2,703 million in FY22

Net income fell -29% YoY to $524 million FY23 from $676 million in FY22

Gross profit margin of 96% w/ operating income margin of 25%

Commentary:

China: 25% of ARM’s revenues are from China, which given the US and EU’s push to limit export of key technologies to China, places these revenues at risk

Additionally, ARM’s China business is run by a local company that neither ARM nor Softbank control

Core revenues: Over 50% of their revenues are from smartphones, where it has >95% market share. Though, the smartphone market is currently decelerating, at a 6% CAGR

Its 5 largest customers account for 57% of total revenue

Many of its core CPU designs are not suitable for AI and accelerated compute

Valuation: Its implied valuation range would require a 120x P/E ratio, approximately two times higher than their comps (which are also healthily priced)

It’s hard to see valuation support for a $60bn+ market cap, though we’ll soon see if there’s enough investor demand to sustain a higher multiple

ARM by most measures is a phenomenal company, unfortunately, it’s been the subject of much horse-trading by Softbank :(

How could we make this newsletter better? Leave a comment below