🌐 Climate Tech, 2023 in review

Hi all, and welcome to the new subscribers who joined us in the last week.

This is part two of a three-part series on the Industrial Transition in 2023. Last week, we covered everything in Robotics and Manufacturing. Next week, we'll cover developments in tech geopolitics and defence.

If you have 2 mins, I would love to get your feedback on this newsletter here 🙏🏼

tl;dr on Climate in 2023:

Record renewable deployment especially in solar and wind, driven by the energy crisis and subsidies. 440 GW added in 2023, 50% more than 2022

China dominates renewable supply chains and manufacturing with over 80% of solar exports and 50% of lithium-ion batteries

Grid interconnection struggles to keep up with explosive growth in renewables, leading to project delays. Interconnection queues grew 40% in the US

Potential nuclear resurgence with 22 nations pledging to expand capacity. High costs and long build times are still a challenge but new SMR designs emerging

Numerous technology breakthroughs in decarbonising industrial heat, batteries, fusion, geothermal, solar fuels. Innovation accelerating and costs falling

Climate funding peaked in 2021 and is down 50% YoY. Growth of infrastructure funds focused on net zero transition

Technology

We added more renewable capacity in 2023 than in any other year, 50% more than in 2022. Approximately 440 gigawatts of renewable power, largely solar and wind. This is driven by an unfolding energy crisis and increased government subsidies. Many countries are succeeding in cutting their energy demands, European power needs are down 5% in 2023 (though much is driven by weaker Industrial demand).

Tailwinds - European countries have introduced numerous policy changes to expedite the permitting process for large-scale wind and solar projects. Additionally, China is expected to significantly increase its contribution to global renewable capacity additions, with the country set to deliver the majority of new offshore and onshore wind projects, as well as solar PV projects globally by 2024. As a reminder, China is >60% of net renewable capacity additions:

Solar everywhere - Solar has accelerated at a pace most analysts were unable to predict, with >360GW of solar power was installed globally in 2023. The bottleneck is no longer capital and appears to be grid access, permits and labour for installation. Solar is the fastest deployed energy source ever:

Headwinds for wind power - a topsy turvy year for wind power. 2023 was a record year for installed wind capacity with 107 GW. Northern European countries, such as UK and Denmark, continue to invest heavily in wind. The world’s largest offshore wind farm in the North Sea started producing energy in 2023. The economics and viability of wind power came into question. Wind developer Orsted announced a $4 billion write-down and cancelled two offshore wind projects in New Jersey. They cited supply chain and interest rate challenges.

China dominates supply chains - We have seen China’s dominance across a number of the technologies and resources needed for the transition. China accounts for more than 80% of global solar cell exports, more than 50% of lithium-ion batteries, more than 20% of electric vehicles and 60% of rare earth and critical minerals. China’s dominance is driven by consistent government support, strong and low-cost domestic supply chains, and a massive home market driving economies of scale.

Grid capacity - all of this new renewable capacity is great though we are struggling to connect it to the electricity grid. Interconnection queues grew 40% from 2022 to 2023 in the US. The UK’s grid currently has a 5 year waiting time for new energy projects.

Nuclear resurgence? Nuclear has started to make a resurgence, as nations focus on resource nationalism and face steepening timelines to decarbonise their grids. At COP28, 22 nations pledged to triple Nuclear capacity by 2050. According to Pew Research, 57% of Americans favour Nuclear, up from 43% in 2016.

Common refrains about Nuclear are high costs due to lack of standardisation, high regulatory hurdles and 6-8 year build times. Germany just turned off its three remaining Nuclear plants. France, which generates 65% of its electricity from Nuclear, decided to speed up their deployment of new plants. Poland and the Ukraine have inked deals to build Small Modular Reactors (SMR).

These (very) Small modular reactors are an emerging area, they are factory-fabricated, transportable and rapidly reduce installation time. There are some interesting new companies such as Radiant Industries, who are building container-sized reactors, Avalanche Energy which is miniaturising Fusion, Finland’s Steady Energy, who use small Nuclear for district heat and Seaborg, nuclear power barges. Uranium prices have recently spiked in anticipation of increased demand.

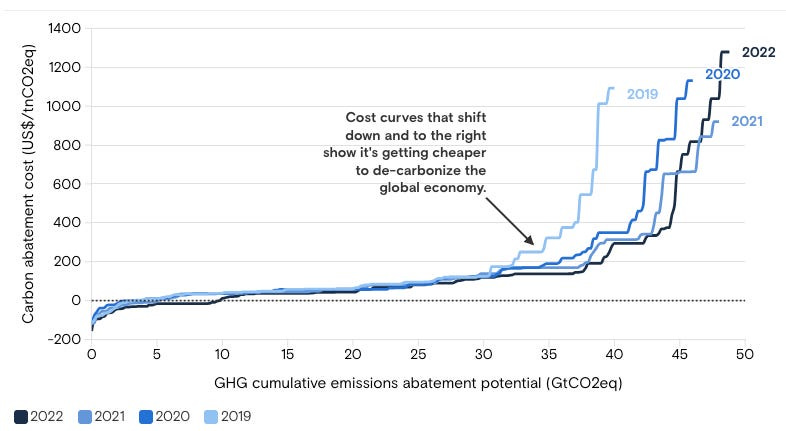

Net zero is getting cheaper - As more capital and talent move into the collective fight against climate disaster, cost curves are declining. Incremental capital mobilised for decarbonisation is now more cost-effective and continues to lower the cost to decarbonise, as per this Goldman research:

Carbon market falls - the validity of the Voluntary Carbon Market (VCM) once again came into question. The largest supplier of carbon offsets, Verra, was investigated, revealing that 90% of their carbon offsets were “phantom credits”.

📈 Technology breakthroughs

There have been several new and important breakthroughs in the fight against global warming. Industrial heat, so hot right now - it was a big year for young companies decarbonising industrial heat. Notably, Atmos Energy, a heat pump for industrials, UK-based Odqa which utilises jet engine technology and solar to produce high temperatures and Antora who piloted their heat battery technology last year.

Batteries - the race to dominate battery standards continues. Producers are increasingly moving away from lithium-ion to sodium-ion (SiB) and solid-state. China currently leads in SiB production, though Northvolt released a new sodium-ion battery. Chinese EV maker, Nio, launched a new solid-state battery, whilst many Western producers are still “years away”. We also saw progress in nickel-hydrogen batteries, from EnerVenue, which were used in the 70s for NASA space flight.

Limitless energy - 2023 saw promising progress in limitless energy with consecutive breakthroughs in fusion from the US’s National Ignition Facility. Microsoft agreed to purchase power from Sam Altman-backed, Helion Energy, showing early yet distant commercial applications.

Fervo Energy successfully ran a 30-day test of enhanced geothermal systems (EGS) producing abundant heat from the earth’s crust. DeepMind improved our prediction of complex and chaotic weather systems using AI. Twelve broke ground on a commercial-scale facility in the US to produce jet fuel made from water, electricity, and CO2, to power existing airplanes.

Policy

The big policy news continues to be the US’ Inflation Reduction Act (IRA). Biden’s 2022 infrastructure bill is designed to provide $369bn in capital for ‘Energy Security and Climate Change’ in North America. In 2023, there were 186 projects announced, totalling $60bn taking advantage of IRA tax credits. This subsidy has been fast to pull project financing demand to the US;

Your turn, Europe. In response to this, the EU made amendments and expanded its Net Zero Industry Act (NZIA), initially proposed in March of 2023. Notable changes propose that the list of 8 strategic net zero technologies be expanded to also include 16 listed sets of technologies, such as alternative fuels, nuclear power and biomaterials production technologies. At the time of writing the NZIA is still being negotiated in European Parliament.

Critical minerals. The EU just passed a resolution to enable more domestic resupply of critical minerals. This presents a quandary for European governments keen to use Chinese minerals and technology to transition to net-zero but also to cut their dependence on China. Some newer startups, like Magrathea, Lilac and brineworks are using new extraction methods to replace mining.

COP28 was held in the UAE, symbolic given the State's current reliance on fossil fuels. Signatories agreed to “transition away” from fossil fuels. They also agreed on commitments to triple renewable energy capacity and double energy efficiency by 2030. Progress was also made on adaptation and climate finance, including operationalizing the Loss and Damage Fund. The UAE unveiled a $30B fund, Alterra, to finance global climate solutions, with a dedicated focus on emerging markets

ESG - It was a big year for ESG or more specifically an increase in anti-ESG sentiment in the US. Almost 50% of US states either have some type of anti-ESG law in place or have placed blacklisting ESG action high on their legislative agendas. Though, in Europe, ESG ETFs are still growing.

Financing

Venture capital funding on an absolute basis is down 50% from 2022 and 70% from the highs of 2021. On a relative basis climate technology, is becoming a larger part of the venture investment landscape. It has gone from being 1% of total venture funding in 2013, to 11% in 2023 (according to PwC).

There is a mismatch in venture capital’s allocation to climate sectors on a GHG emissions basis. Industrials, Food and Agriculture and Built Environment consist of 73% of GHGs, yet only 27% of venture funding.

The big dogs are here - large asset managers and infrastructure firms are increasingly moving into climate funding. $6.5bn of Alterra’s $30bn fund is going to BlackRock, TPG and Brookfield climate funds. BlackRock’s CEO, Larry Fink, has been a long-term proponent of using corporation actions to enable climate-positive strategy in corporations. The firm recently launched ‘Decarbonisation Partners’ in partnership with Temasek and acquired infrastructure asset management firm, GIP for $12.5bn.

FOAK financing - capital to build first-of-a-kind climate assets, typically needed within a startups commercial growth phase, remains an issue. These projects, often sit in the gap between venture capital and infrastructure investing. Some of these issues have been partly solved in the US with the IRA. We have seen an increase in strategic investors step into this gap. LanzaJet has partnered with both ArcelorMittal and Indian Oil to build facilities. Fervo Energy’s test was aided by a commercial agreement with Google, which is pursuing carbon-free data centres.

Notable funding rounds

H2 Green Steel (€1.5bn), Northvolt (€1.2bn), Verkor ($2bn), Zenobe (£870m), Cognital (£500m), Electric Hydrogen ($280m), Our Next Energy ($300m), Enpal (€215m), Ohmium ($250m), Kobold Metals ($195m)

Please note: some of these funding rounds may combine debt, equity and grants.