What the West can learn from China's deployment of Nuclear power

tl;dr: Nuclear is back on the policy and technology agenda, pulled by AI’s vast electricity demand and pushed by net-zero constraints. Yet, Europe and the US face a diseconomy trap of bespoke, delayed, over-budget projects, while China has turned nuclear into an industrial product line; fleet builds, standardised designs, domesticated supply chains, and a deep pipeline of new technologies from SMRs to thorium.

Nation Scale problem

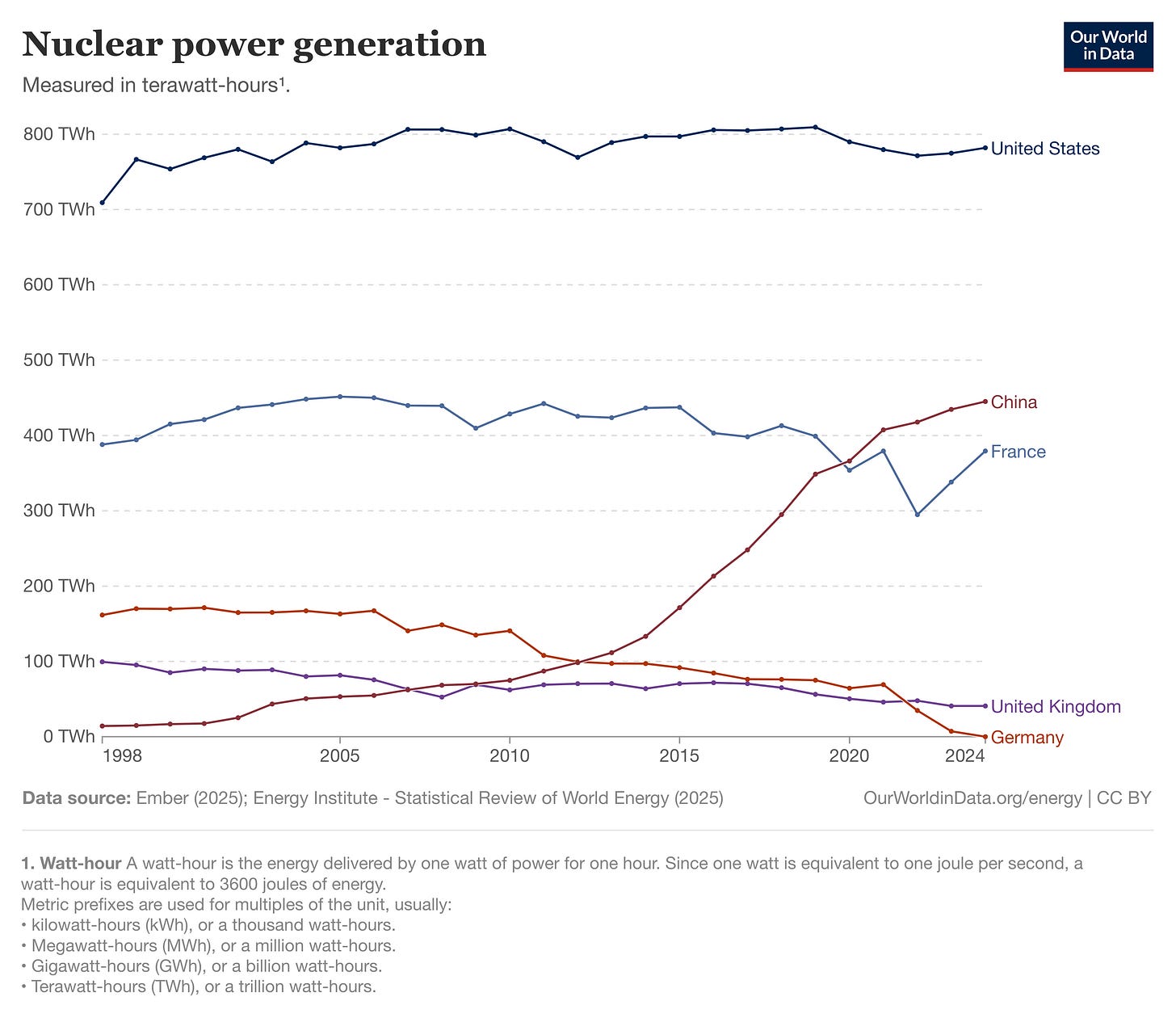

Nuclear energy in the West is undergoing a tentative resurgence. Governments are pressed by two structural drivers: the sharp uptick in energy demand from AI and hyperscale data centres, and the need to replace fossil baseload as renewables saturate. This has renewed interest in nuclear as firm, low-carbon generation. The US aims to quadruple nuclear capacity1, and the UK has set a target of 24 GW, both by 2050. Yet the track record is bleak: Western projects are mired in diseconomies of scale. The more you build, the higher the costs go.

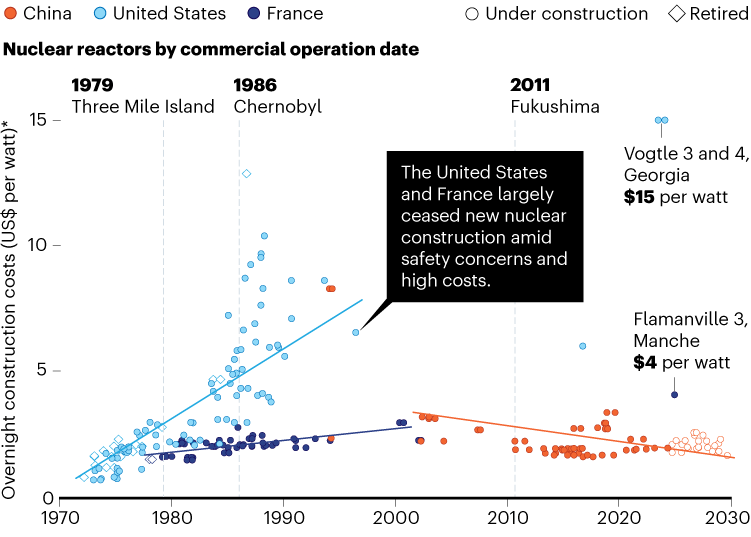

By contrast, China has created a predictable cadence and scale. With 56 reactors online, 27 under construction, and a goal of 150 new units between 2020 and 2035, it is on track to overtake the US in nuclear capacity by 2030. New builds are typically grid-connected within 5–7 years, versus 10–17 years in Europe. China’s overnight costs remain in the $2,500–3,000/kWe range; Flamanville-3 in France, by comparison, ballooned to over 4x that, at $9,800/kWe ex-financing, $14,100/kWe with financing.

Technology Core

Europe’s cost trajectory demonstrates what happens when standardisation is lost. France’s 1970s–90s fleet programme delivered steady cost declines, with unit savings of up to 23% per tranche as reactor designs were replicated2. But once the programme shifted to bespoke designs, costs reversed upwards. In the US, early demonstration reactors achieved an 81% overnight construction costs reduction (from $6,800/kWe in 1954 to $1,300/kWe by 1968) through scaling. However, after the Three Mile Island accident, regulatory barriers and one-off designs drove costs back up to $3,000–6,000/kWe, with some units exceeding $10,000/kWe.

China, by contrast, has taken a “whole-of-government” approach to nuclear. Replicating its strength in industrial manufacturing, embedding repeatability, localisation, and process control. Several drivers explain their marked efficiency:

Fleet builds and standardisation: Since 2022, China has approved ~10 new reactors annually. Units are built in series, often as multi-reactor sites, allowing construction teams to transfer experience directly and suppliers to achieve economies of scale. Standardised designs for pressurised water reactors such as Hualong One and CAP1400, now dominate the pipeline, freezing engineering design and reducing rework

Domestic supply chains: China localised core nuclear components from the mid-2000s onwards, starting with conventional parts and later moving to safety-critical systems. Today, many Chinese manufactured nuclear-grade components such as charging pumps or ring cranes, cost 50% less than imported equivalents and have shortened lead times

Stable regulatory environment: China's nuclear governance is centralised and programmatic, unlike the West’s ALARA/ALARP ratchet, which incentivises regulators to demand ever-smaller radiation reductions regardless of cost. The National Nuclear Safety Administration (NNSA) operates under the Ministry of Ecology and Environment (MEE) and is embedded in the state’s industrial planning. Approvals are coordinated nationally, standards are applied consistently across sites, and proven designs are reused without repeated licensing. This prevents in-flight redesigns that, in Europe, can add 3–5 years to schedules and billions in cost overruns. In 2013, the UK Office for Nuclear Regulation forced a redesign of a reactor, which took four and a half years and ultimately reduced the same amount of radiation as found in a banana (not actually a joke, see here)

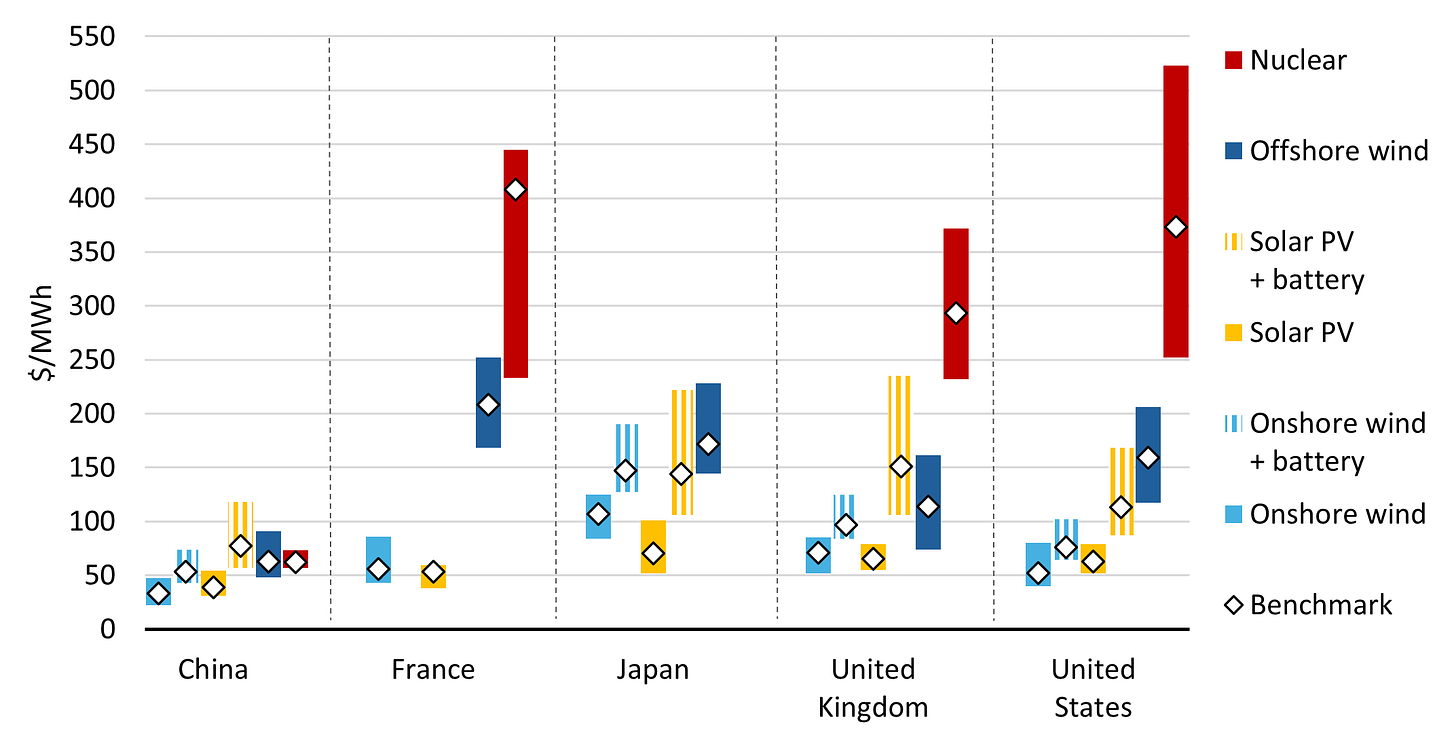

Financing discipline: Around 70% of project costs are financed by state-backed banks at interest rates as low as 1.4%, cutting the weighted average cost of capital far below the 8–10% typical in the West. This translates into a Chinese nuclear LCOE of $62/MWh, in the same band as onshore wind and solar, while Europe’s nuclear sits at $160/MWh. Nuclear is highly capital‑intensive (duh), where 70–80% of LCOE stems from fixed capital and financing costs. Even a modest cut in borrowing costs slashes electricity prices, reducing the cost of capital from 10% to 5% can lower LCOE by over 30%

Next-generation innovation. The Linglong One (ACP100) is the world’s first IAEA-approved SMR, designed for factory assembly and shortened build times. China is also trialling thorium-fuelled molten salt reactors in Gansu, a technology abandoned by the USA in the 1950s. The HTR-PM pebble-bed reactor is the world’s first fourth-generation reactor (Gen-IV) and began operation in 2021. However, these remain early demonstrations. Western analysts caution that neither SMRs nor advanced reactors have proven commercial at scale, with NuScale’s US SMR project cancelled in 2023 after costs more than doubled.

Density of talent and research: Concentrated centres of excellence underpin China’s nuclear ecosystem. Tsinghua’s INET developed the HTR-PM, the Shanghai Institute of Applied Physics leads thorium and molten salt work, and the Southwestern Institute of Physics in Chengdu runs the EAST fusion reactor. State-owned operators CNNC and CGN provide the industrial backbone. Additionally, Chinese R&D intensity is high: Chinese firms spend ~4–5% of revenue on R&D3, outpacing EDF and most Western peers, and China now leads global nuclear research publications by H-index, a commonly used metric measuring the impact of research journal publications.

Fuel security is also being industrialised: China produces ~30% of its uranium domestically (Xinjiang, Inner Mongolia), with the rest secured via equity stakes in Kazakhstan and Namibia. By contrast, the US imports ~90% of its uranium, and Europe remains partially reliant on Russian enrichment capacity.

China’s nuclear strategy is built on industrial discipline, fleet deployment, frozen designs, strong supply chains, and deep R&D investment. It isn’t choosing between fusion or renewables but pursuing them in concert, leveraging a national innovation intensity that includes SMRs, thorium reactors, and advanced research hubs. Nuclear, like semiconductors, is an industry where control of design rules, cadence, and finance determines competitiveness. China is already acting as if this is the case.

Possible Future(s)

Energy independence: The net impact of China’s approach is an increasingly sovereign energy backbone. Nuclear is becoming a strategic pillar alongside renewables, underpinning energy security and decarbonisation, and positioning China for export markets under the Belt and Road. Here, nuclear is as much geopolitical instrument as energy source: turnkey packages combine financing, technology, training, and waste handling. Unless Western nations form consortia with Japan, Korea, and France, they risk ceding the Global South nuclear market entirely to Chinese (and residual Russian) suppliers by the 2030s.

West to fast follow? For the West, the lessons are concrete. Commit to fleets, not one-offs. Freeze designs before Final Investment Decision (FID). Harmonise regulation and accept allied approvals. Restore proportionality to ALARA. Rebuild supply chains and skills with predictable demand. Invest and finance next-generation modalities, SMRs, molten salt, thorium, not as research projects but as industrial products.

Limits of nuclear: Critics argue nuclear is too slow for the 2030 climate window. Even in China, 5–7 years from FID to grid connection means projects deliver after 2030, helping long-term net zero but not near-term peaking. Renewables plus storage will still dominate the 2020s buildout. Yet nuclear firm output remains unmatched for baseload demand such as AI and energy-intensive industrials.

❤️ If you enjoyed this piece, please share it with your smartest friend

Additional reading

Historical construction costs of global nuclear power reactors (Science Direct)