🌐 The Industrial Transition, October 2024

Hi all, I hope the back-to-school period has been fruitful. I’ve been catching up on a bunch of work and reading after the REALTECH Conference. Thankfully for you, this edition is packed with goodness.

In today’s edition:

Amazon acquires a robotics company and continues to skirt anti-competition regulation

Wayve and Uber partner as the ride-hailing company jumps back into autonomy

An open-source materials simulation model and the actual bottleneck in creating new materials

Meta makes AR glasses cool and may have finally made an AR device with widespread appeal

A defence tech acquisition in Europe and prognosis on an evolving market

PSA

🔬Next week, we’re releasing a research report on European REALTECH, co-authored with Dealroom. The report, previewed at the REALTECH Conference, focuses on talent, funding and company trends in European deep tech. Keep an eye out 👁️

🦾 Manufacturing and Robotics

Amazon “hires-then acquires” the Covariant team. Covariant, the warehouse automation company, has been “acquired” by Amazon. Notably, this points to two things: Big Tech continues to skirt anti-competition regulations with creative acquisition sleight-of-hand, and it exemplifies the difficulties in implementing robotic subsystems in real-world environments.

Covariant was founded in 2017 and spun out of OpenAI’s original robotics team. It has been focused on using Transformer architecture for warehouse automation, specifically pick-and-place. The company raised over $200m from legit investors such as Index. This year, they released the RFM-1 foundation model, a multi-modal model that allows robotic arms to "see, reason, act” in dynamic real-world environments.

Mo money mo problems. Big Tech’s ability to acquire companies remains hamstrung by Lina Khan’s anti-monopolistic Federal Trade Commission (FTC). This is the latest of a string of AI companies to be “hired-then acquired” by Big Tech. We’ve seen this with Microsoft and Inflection, as well as Amazon and Adept. This current acquisition playbook aims to shift the mechanics of the acquisition optically and legally by not acquiring the target company outright. They lure the company’s talent with substantial pay packages, the founders and some part of the workforce, and license its technology. Importantly, the licensing terms likely clear Covariant’s investors' liquidation preference, making them whole and giving the board grounds to sign off on the acquisition. An acquisition in everything but the name.

Your new Big Tech daddy. Approximately 25% of Covariant’s employees, including founders Pieter Abbeel, Peter Chen, and Rocky Duan, are joining Amazon’s Fulfillment Technologies & Robotics division. Covariant will continue to operate independently under a new CEO, the non-exclusive nature of the license allows Amazon to leverage Covariant’s technology and AI chops without fully absorbing the startup. Whilst this new means of acquisition is above board, they will certainly not be well received by the FTC, which is currently awaiting the results of a close US presidential election. A Trump nomination would likely trigger substantial deregulation across industries.

Uber makes moves in autonomous vehicles (again) - Uber’s latest partnership with Wayve and Cruise shows its renewed interest in applying autonomy to ride-hailing. Their initial foray into autonomy was through Uber’s Advanced Technologies Group (ATG) subsidiary. Uber CEO Dara Khosrowshahi kitchen-sinked the company’s loss-making entities pre-IPO, selling ATG to Aurora in 2020. Uber is enjoying its first full year of profitability and free cash flow generation, allowing Dara to adopt new strategic imperatives. Rather than building this technology in-house, they are now partnering with Wayve and Cruise to integrate self-driving capabilities.

Uber's promise of autonomy is to replace the core cost of any ride, the driver. How they will deploy autonomy is less clear. Uber is a marketplace that connects riders with ‘driver partners’—independent contractors who drive on the Uber platform. Uber will be keen to maintain this ‘asset-light’ model, taking a tax on rides whilst not managing operationally complex vehicles.

Whether Uber will deploy their own fleets remains to be seen, though their partnership and investment in Wayve might suggest this. I would expect Uber to use their scale advantage to enable AV companies such as Cruise to deploy its own Chevy Bolt vehicles on the Uber platform.

😎 Meta’s augmented reality glasses, Orion - Meta announced their impressive augmented reality glasses, Orion. Zuck, who has been looking for a hardware platform to call his own, has packed an insane amount of technology into seemingly normal-looking glasses. Whilst Orion won’t be available for general release for some time, they do point to a new potential paradigm in computing. Overlaying technology on the view of the real-world. I’m here for that. Here’s a detailed breakdown of the tech here by Axel Wong.

🌍 Climate Tech

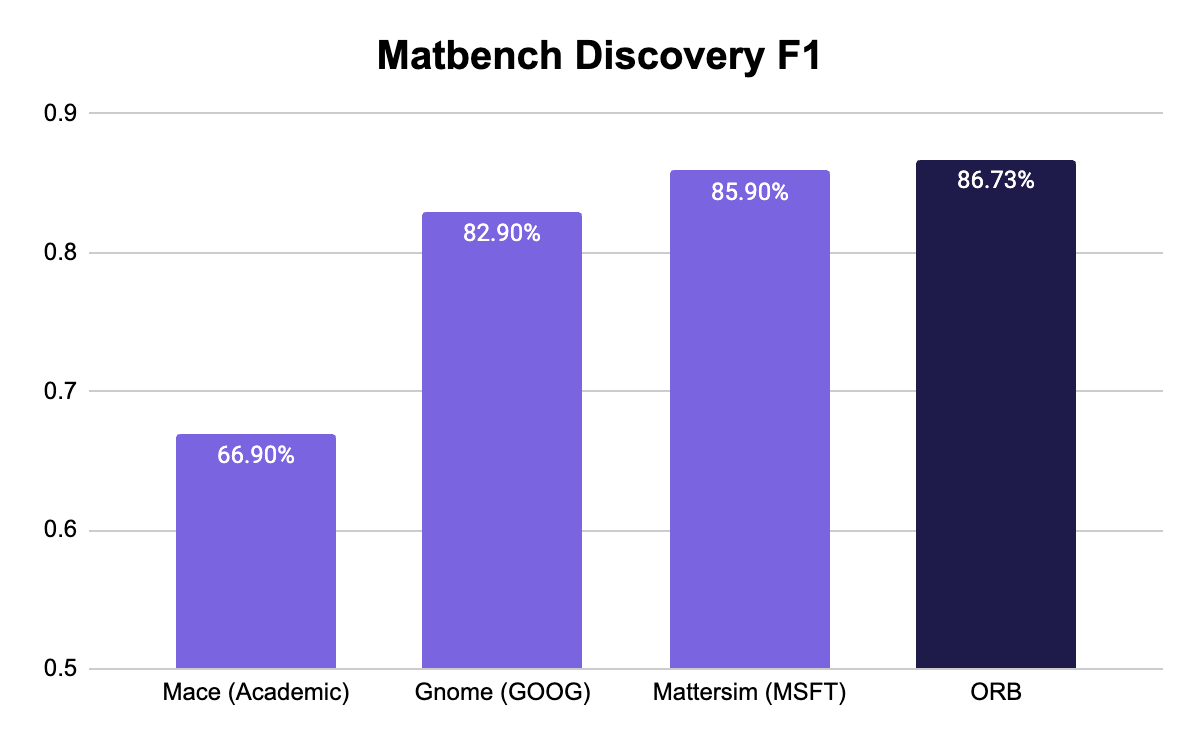

🧑🏼🔬 Orbital Materials open-sources materials discovery and evolving issues in materials discovery - Orbital Materials, an AI materials discovery startup founded by an ex-DeepMind researcher, has open-sourced their materials simulation model, Orb. The model is pushing the state-of-the-art for material simulation by offering unprecedented speed and accuracy in simulating interatomic potential and helping create novel advanced materials. The model is 3x smaller than MatterSim and 5x more scalable than MACE:

Orb is a fine-tuned version of Orbital’s internal foundation model, ‘LINUS,’ which they trained from scratch. The model enables researchers to explore material properties in semiconductors, batteries, and climate technologies much faster than traditional methods.

🌳 Gingko Bioworks’ biology models are now available via API. Similarly, Gingko has opened access to their in-house biological models - enabling biologists to protein and sequence analysis. Ginkgo’s model, AA-0, is trained on over 2 billion proprietary protein sequences - they aim to accelerate progress in drug discovery, synthetic biology, and genomics.

The falling complexity of material simulation. As we covered a few months back, we’ve seen a notable increase in materials discovery startups, with multiple new startups in the space. Progress in AI architecture has reduced search complexity in non-deterministic fields such as biology and chemistry. Discovery has gone from hand-crafted by technicians over multiple years to in-silico, fast, and at scale.

The new chasm - from in-silico to real world. Model output results must be validated in a lab through synthesis —turning AI-designed molecules into real-world materials. Small molecules are complex. Many reaction pathways don’t exist and software approaches to retrosynthesis can be limited. Each molecule requires a custom synthesis process, often involving dozens of steps and experimental tweaking in a lab. At this stage, model output replicability can fall short. As Deepmind found out with their GnoMe model. The synthesis bottleneck severely limits the scalability and practical application of AI-generated materials. We’re seeing more attempts at resolving this with startups building autonomous self-driving labs, such as Dunia, Twig Bio and Chemify.

🌐Tech Geopolitics

Safran acquires French AI company Preligens - French aerospace and defence prime Safran has acquired Preligens for €220m. Preligens is a geospatial company that uses AI to detect threats from satellite imagery. Preligens had approximately $30m in revenue and traded hands at a respectable 7.3x EV/revenue.

Whilst we’re in the early innings of the defencetech wave, large-scale outcomes remain a rarity. With Anduril in the US and Helsing in Europe, as categorical exceptions. In Europe, the market continues to evolve to enable continent-wide multi-national defence tech firms to scale, and exit. The recent IPO of Exosens, which went public at €1bn market cap, exemplifies the current complexities. in 2021, the company had an acquisition offer from a US suitor blocked by the French government, requiring a sale of French PE firm HLD, who have benefited massively from the company’s eventual listing.

☢️ Macron cucks the UK by poaching Nuclear firm - Newcleo, a nuclear technology startup focused on developing small modular reactors (SMRs), has decided to move its headquarters from London to Paris. The company cited the broader access to European funding and better support for its projects in France as key reasons for the move. This, and the US Inflation Reduction Act, continue to magnify the UK’s lack of implementation of new Industrial policy. France is Europe’s predominant user of nuclear energy, generating >70% of power from nuclear energy. Their government led by Macron has been pushing to place France as a hub for nuclear development and energy-hungry datacenters.

🤓 Other stories worth reading

AI is hungry for power; Microsoft and Blackrock announce $100bn for data centre build-out

Cruise autonomous vehicles return to the Bay Area after a year on the bench

Heart Aerospace premiered its full-scale electric passenger plane

The UK has a bought a semiconductor fab to strengthen its defence supply chain

💰Notable Funding Rounds

Twelve ($645M Series C) raised funding to transform CO2 into sustainable jet fuel and chemicals, led by TPG

ZeroAvia ($150M Series C) secured funding to scale its hydrogen-electric aviation technology for zero-emission aircraft from American Airlines

Distribusion (€80m Series C) the B2B ground transport marketplace raised from TQ Ventures

Dexory ($80m Series B) the London-based warehouse data intelligence company raised from DTCP and Latitude

Forterra ($75M Series B) a defence-focused autonomous ground robotics company raised from Moore Strategic Ventures, XYZ Venture Capital, and Hedosophia

Cyclic Materials ($53M Series B) the advance rare-earth recycling infrastructure company raised from ArcTern Ventures

Spare ($42M Series B) raised funding to grow its on-demand transit software platform

Pyka ($42m Series B), the autonomous electric plane manufacturer raised from Obvious Ventures

vSim ($21.5M Series A) raised funds to develop its robotics simulation technology, they raised from EQT Ventures

Bot Auto ($20M Pre-A) secured funding to deploy its autonomous trucking fleet commercially

Abolis Biotechnologies (€35M Series A) raised funding to develop sustainable microbial ingredients

Phlair (€14.5M Series A) is a hydrolyzer-based DAC technology company

Fuse (€10.7M Seed) raised funding to put it’s renewable energy network on the Solana blockchain

Findable ($10M Series A) raised from Point Nine to streamline property transactions.

Reshape Automation ($5M Seed) raised funding to develop automation solutions for the robotics sector, they raised from Ironspring and Haystack