🌐 The Industrial Transition, July 2024

Hi all, we have a packed edition this month; what Labour’s win means for UK industrial and tech policy, product releases from Palantir, Wayve, Helsing and Microsoft as well as progress in renewable pricing and new materials. Let’s get into it.

📢 PSAs

RealTech Conference:

We’re hosting the next RealTech Conference in London on September 20th. The conference connects leading technologists building in our most critical industries such as climate, supply chain and national security.

We have some awesome speakers lined up including Matt Clifford (co-founder of EF), Mike Butcher (editor at TechCrunch), Taavet (co-founder of Wise), Benedict Macon Cooney (Chief Strategist at the Tony Blair Institute) + others announced soon

If you’d like to join, please apply here.

🌹Labour’s UK win - 🇬🇧/acc: Whilst I try to keep this newsletter globally focused, given the UK’s outsized impact on European tech, a little commentary. The Labour Party led by Keir Starmer have formed a new UK government. Labour will grapple with thorny issues such as; a climate transition, increased geopolitical tension and sluggish productivity growth. Technological and industrial sovereignty look likely to be predominant issues of our time.

Whilst technology is created within an ecosystem of talent, capital and friendly policy frameworks - a vital ingredient is also a culture of optimism, something the UK has lacked of late. A new government not only brings renewed optimism but the potential for a new approach to tech and industrial policy. Labour has launched a ‘mission-led’ policy manifesto which harkens to much of Mariana Mazzucato’s policy work at UCL. Let’s have a look at what has been announced so far:

Tech policy: the new Chancellor of the Exchequer, Rachel Reeves, has shown strong engagement with technologists, entrepreneurs, and financiers over the past few years. Last year, Labour published ‘Start up, Scale Up’ policy proposals which, you, the RealTech community contributed to. Labour’s updated manifesto alludes to potential reform of R&D tax credits for startups, fixing university spin-out terms, increasing institutional capital for high-growth firms through pension fund reform and development banks, changes allowing regulators to keep pace with technology, the establishment of a National Wealth Fund to invest in innovation, enabling public procurement to engage with SMEs and much needed UK public market listings reform

Industrial policy: The four missions are: 1) delivering clean power by 2030, 2) harnessing data for the public good, 3) caring for the future, 4) building a more resilient economy. Whilst the last two are vague, the former focuses on investing heavily into renewable and clean energy (including nuclear), a focus on ethical AI development and datacentre build-outs as a core pillar of industrial strategy and strengthening supply chain and procurement resilience. One of the manifesto’s missions was to ‘Make Britain a clean energy superpower’ and the appointment of former party leader Ed Milliband is as a reflection of its importance.

Whilst policy pronouncements are one thing, enacting policy reform is another. There are some easy unlocks to get the UK growing again, namely better commercialisation of IP out of the UK’s world-class research institutes, increasing capital availability for mid-stage technology firms, busting rampant NIMBY-ism and making the London Stock Exchange a viable venue for IPOs post-Brexit. Starmer’s 100-day plan vows to change building planning regulations, lift the ban on onshore wind and ensure strong diplomatic relations with NATO.

RealTech community members may remember we co-hosted a RealTech Conference with the Tony Blair Institute (TBI) last year - a progressive policy think-tank that has actively engaged with UK technologists to shape the policy agenda. They have been at the forefront of pragmatic and sanguine policy proposals such as ‘Governing in the Age of AI’ and ‘Reimagining Defence and Security’, the latter I contributed to. Many of these proposals use talent, technology and sciences as the key vectors for growth. TBI’s political heritage will give them a central influence in UK tech and science policy. Tony Blair was recently interviewed by tech commentator Dwarkesh and reiterated technology’s central role in civil prosperity.

🌍 Climate Tech

Solugen secures ‘NOAK’ financing from US DOE - Solugen secured a $214 million loan guarantee from the Department of Energy (DOE) Loan Programs Office (LPO) to build their 2nd “Bioforge” plant in Minnesota. Solugen’s new 500,000-square-foot facility will produce bio-based chemical products which are carbon-negative. The DOE loan guarantee not only bridges the financing gap from first-of-a-kind (FOAK) to next-of-a-kind (NOAK) projects but also signifies a broader commitment to bolstering the US’ domestic green bio-economy. You can read an interview between Solugen CEO, Gaurab Chakrabarti and DOE director Jigar Shah here.

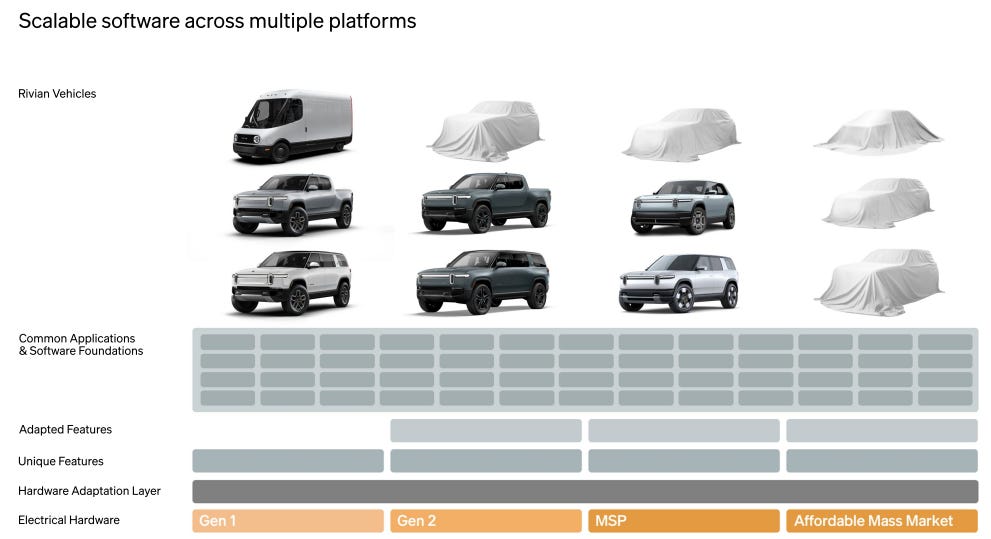

🚘 VW and Rivian partner on EV software architecture - Volkswagen (VW) will invest up to $5bn into Rivian for a software-architecture joint venture, with a $1bn initial equity investment. This is a big win for unprofitable EV maker Rivian, though arguably less so for VW as they continue to struggle to go from analog to software-defined. VW will use Rivian’s “zonal hardware design” and “next generation software-defined vehicle (SDV) architectures” for the foundation of future EVs. Rivian has benefitted from clean-sheet design and the ability to vertically integrate its software and hardware systems - providing better control of vehicle dynamics, battery and thermal management, body controls, autonomy, and digital experience.

The partnership signals VW and legacy automakers’ struggles to transition from ICE to ‘software-defined’ vehicles. VW had initially intended for Cariad, their software unit to merge their different EV platforms into the unified SSP platform and 2.0 E/E architecture. This has been shelved, with VW letting go of leadership and 2,000 employees at Cariad last year. VW recently struck a similar deal with Chinese EV maker XPENG, to provide software architecture for two EV models in China. All future vehicles will be software-defined, and outsourcing this core competency to competitors may be necessary but is unlikely to be a good strategy long-term. You can read Rivian’s partnership presentation here.

⚡️ AI-hungry Big Tech leads the way for novel renewables financing - AI is driving demand for data centre build-out, with an expected >$400bn per annum of data centre build-out over the next 5 years and electricity demand doubling by 2026. Chips are no longer the supply chain bottleneck. Big Tech needs the availability of clean, baseload power:

Last month, Google announced a partnership with NV Energy to launch a first-of-a-kind renewable energy payment model. The Clean Transition Tariff (CTT), allows firms to pay higher prices for clean power such as geothermal. The CTT is available to customers with over 5MW of monthly energy demand, allowing them to pay for clean energy capacity costs. Google’s rationale is that higher pricing will continue to bring onboard new renewable energy projects, at the development clearing price. The CTT brings Fervo Energy’s 115 MW enhanced geothermal power to the grid, powering two Nevada data centres. Similarly, Duke Energy recently joined Amazon, Google and Microsoft to accelerate emerging clean energy technologies through Accelerating Clean Energy (ACE) tariffs which also include a CTT. Salesforce announced several renewable deals. Notably, they joined Frontier, a Big Tech consortium providing Advance Market Commitments (AMC) of $1bn+ to carbon removal technologies (they just funded Stockholm’s Exergi with $48m of offtake agreements).

Whilst, AI (short-term) is not a boon for the environment, Google’s greenhouse gas emissions have increased 48% since 2019. It is forcing some of the most innovative companies to be unlikely innovators in renewable and clean energy pricing. Additionally, we continue to see renewables and the circumvention of a legacy electricity grid as vital to the transition.

📉 Lazard’s Levelised Cost Of Energy (LCOE) - a first-time increase in the cost of renewables. Lazard’s annual report provides normalised costs for energy generation across different technologies.

For the first time, the LCOE range tightened and the lower ends for wind ($24/MWh in ‘23 to $27/MWh in ‘24) and solar costs ($25/MWh in ‘23 to $29/MWh in ‘24) increased. Persistently higher interest rates and increasing needs for firm power driven by data centres, reindustrialisation and electrification, are driving costs up.

🔋Apple supplier battery TDK claims consumer electronics battery breakthrough - Their next-generation solid-state battery, CeraCharge, claims an energy density of 1,000 Wh/L, which is 2x greater than current lithium-ion batteries. This is comparable energy density to QuantumScape’s lithium-metal solid-state batteries, designed for EVs. Critically, TDK’s batteries are being built for consumer applications. Smaller, lighter, longer-lasting batteries will unlock a multitude of new hardware use cases.

♺ LLMatDesign, an open-source LLM for autonomous materials discovery - LLMatDesign is a language-based framework for materials design, powered by LLMs. It interprets human-provided instructions and design constraints, then uses computational tools for material evaluation, and uses existing chemical knowledge to function as an autonomous materials design agent. Unlike traditional methods dependent on explicit mathematical formulations and programmed solvers, LLMatDesign operates using natural language, allowing rapid iteration on various tasks, materials, and target properties through simple textual prompting.

Whilst impactful materials discovery has historically been sporadic (think semiconductors, photovoltaics and graphene), progress in Gen AI promises improved deep learning and exploration of chemical and physical space. New materials are crucial to the renewable transition, for better energy storage, conversion and transmission. We’ve seen a slew of new companies tackling these problems such as Orbital Materials, CuspAI, Polaron, Materials Nexus, Altrove, Dunia, among others.

🦾 Manufacturing and Robotics

🌊 Wayve releases PRISM-1 simulation model - a novel photorealistic 4D scene reconstruction model to scalably simulate, evaluate and train autonomous driving systems. PRISM-1 can self-supervise scene disentanglement and perform photorealistic 4D (3D in space + time) reconstruction of dynamic urban driving environments from 2D images without requiring explicit 3D video data. This allows scene construction of static (roads, traffic lights), and dynamic and deformable objects (pedestrians, cyclists). As part of this work, Wayve has open-sourced the WayveScenes dataset, 101 scenes from diverse driving environments in the UK and US.

Simulation is one of the biggest levers in making ‘hardware at software speed’. Replicating the physical world ‘in silico’ allows developers to dramatically reduce the training and iteration cycles of physical product development.

Open VLA, an open-source robotics foundation model - is a 7B parameter open-source Vision Language Action model and the first VLM-based robotic foundation model trained on large-scale real-world robot manipulation data. The model is pre-trained on 970,000 robot episodes from the Open X-Embodiment dataset. It outperforms state-of-the-art models such as Octo, RT-2-X on zero-shot evaluations.

Department of Big [Industrial] Tech

Palantir releases AIP, an industrial AI platform - AIP is short-hand for ‘Artificial Intelligence Platform’ and applies AI to unified shop-floor data from industrial firms. AIP integrates diverse data sources, creates a data ontology, and aims to provide AI-enabled insights to improve manufacturing processes. This builds on the Unified Namespace (UNS) concept, which employs a pub-sub model, data producers (like SCADA systems) publish data to the namespace, and data consumers (like analytics tools, dashboards, and other applications) subscribe to the data they need. The platform's architecture supports comprehensive data integration through various protocols and methods, including real-time streaming, batch processing, and virtualisation. The platform has three layers: 1) UNS to aggregate and normalise data 2) data ontology and process hub 3) workflow applications and automation (eg PLC exploration, anomaly detection, predictive maintenance, and remote operations).

This builds on a key trend of physical industries increasingly being ‘software-defined’ - in this case, applying AI to huge amounts of normalised sensor data to drive better industrial outcomes.

Microsoft just announced a cloud-based SCADA system - SCADA (Supervisory Control and Data Acquisition) systems are used to ingest and monitor distributed systems in IoT/Industry 4.0 and have largely been on-premise. Transitioning to the cloud will increase efficiency, lower costs and improve multi-site collaboration. We have been documenting Microsoft’s aggressive push into capturing the industrial sector’s transition from on-prem to cloud.

nTop v5 release - CAD’s most advanced design package? nTop is a CAD design package that uses data to automate the design and exploration of complex manufactured parts. They just released their latest update, 5, which features a new b-rep kernel and includes major third-party integrations including Materialise and Autodesk Fusion. The integrations allow for nTop interoperability in their software, allowing for improved design, workflows, simulation and downstream design-for-manufacture (DfM) processes.

🌐Tech Geopolitics

Airbus and Helsing collaborate on Manned-Unmanned military aircraft - under the agreement Helsing will provide AI-enabled sensor fusion and electronic warfare capabilities to Airbus’ new Wingman system. This unmanned fighter-type aircraft will operate with combat jets and receive their tasks from a pilot in a command aircraft such as the Eurofighter.

The US’ Ghost Robotics to be acquired by Korean defence firm LIG Nex1 - Ghost Robotics is a Penn spin-out and a leader in military quadruped robots (Q-UGVs). The dog-like robot is ideal for navigating complex and dangerous urban environments. LIG Nex 1 a leading Korean defence and aerospace firm, and is acquiring a 60% stake for $239m. The acquisition is under the US ITAR treaty with South Korea, a country that has increased strategic importance given its proximity to China. The US has one of the largest military presences outside of a warzone, with approximately 40,000 troops currently stationed in South Korea.

Auterion’s software allows drones to fly through jamming - the Swiss-US firm has developed, Skynode S, an autonomous terminal guidance system-on-chip which allows a drone to fly through a GPS-denied environment. The war in Ukraine has shifted the landscape of warfare to being increasingly asymmetric and drone-based, and we’ve seen Russia use GPS jamming as a defence. Skynode S has a single circuit board that runs the target-tracking algorithm and can also be linked to jamming-resistant GPS antennas, electromagnetic sensors that triangulate the drone’s position off radio beacons and computer vision algorithms that match the terrain below the drone against high-res satellite maps.

👭From the community

Reimagining Defence and Security: new capabilities for new challenges (The Tony Blair Institute)

Quantifying the career opportunities enabling the Industrial Evolution (Eclipse)

Industrial cyber firm Trout interview with David Ariens on OT cyber (Trout Software)

💰Notable Funding Rounds

Aira (€200m debt) is a European heat pump provider, spun out of Vargas Holdings. The company raised €200m of debt from BNP Paribas

Bright Machines ($126m Series C) provides modular micro-factories, the company raised $106M in equity from BlackRock, NVIDIA, Microsoft, Eclipse and $20M in debt from J.P. Morgan

VecnaRobotics ($100m Series C ext.) provide material handling robots. This is a $40m extension to their Series C, with participation from Tiger Global

Smart Energies (€95m) is a clean energy producer focused on small solar sites. They raised from Plenium and SWEN Capital

PreWave (€63m Series B) the supply chain risk management company raised from Hedosophia

GreyMatter ($45m Series B) is a robotics company automating finishing tasks, Wellington Management led the round

Sortera ($30.5m Series C) is a metal sorting company, RA Capital Management-Planetary Health led the round

CuspAI ($30m seed) is a UK-based startup building a foundational model for new materials, they raised from Hoxton Ventures, Basis Set and Lightspeed

Neural Concept ($27m Series B) is a Swiss startup focused on cutting EV design time to 18 months. They raised from Forestay Capital

Formic ($27m Series A) is bringing robotic automation to manufacturers, Blackhorn led the financing

Echion Technologies (£29m Series B) is a company focused on niobium based fast charging battery materials, they raised from Volta Energy

Kinetic ($21m Series B) have built robotics for automotive repair and maintenance, the round was led by Menlo Ventures

EthonAI ($16.5m Series A) is a Swiss manufacturing analytics startup. The round was led by Index Ventures, with participation from General Catalyst, Earlybird, and Founderful

ElectronX ($15m seed) is a new energy exchange. The company raised from Innovation Endeavors, DCVC, Amplo, BoxGroup, and Lightning Capital

Qargo ($14m Series A) is a cloud-based TMS for logistics companies. They raised from Balderton

Unigrid ($12m seed) has built drop-in manufacturing capabilities for sodium-ion batteries to use li-ion facilities, the funding was led by USV and Transition

Sift ($17m Series A) have built data review for hardware companies, the round was led by Google Ventures

ARX (€9m Seed) is a ground-based robotics startup for dual-use applications. The raised from NATO Innovation Fund, Discovery Ventures and Project A