🌐 The Industrial Transition: March 2024

👂🏼 Hi all, after listening to your feedback (thanks to those who completed the survey!) I’m switching the cadence of this newsletter to monthly and concentrating on analysis of news items that matter. Hope you enjoy!

I will be attending both Start Summit in St Gallen, Switzerland and Hello Tomorrow in Paris. 🙏🏼 HMU if you’re around!

🦾 Robotics & Manufacturing

Big dollars, for small parts. Hadrian and Daedalus, who automate precision part manufacturing, both announced large funding rounds, $117m and $21m respectively. Whilst one is US-based and the latter in Germany, the thesis is the same. Precision parts manufacturing is a large, legacy industry with a long tail of producers that lack (software) automation and are beholden to a specialised, manual and ageing workforce. Hadrian and Daedalus automate the laborious processes that start from when a customer places an order for a part until it is dispatched. This not only involves programming CNC cutting and inspection machinery but also encompasses factory operations such as scheduling, task management, and documentation. A good short on Hadrian below:

Recent breakthroughs in Transformer architecture and convolutional neural nets (CNNs), continue to provide a rich seam for multi-modal robotics research. There’s a multitude of new research integrating and building on vision-language models (VLMs) specifically. Much of this work is focused on solving the limitations of VLMs’ lack of 3D spatial understanding, particularly in recognizing quantitative relationships of physical objects, such as distances or size differences.

Dream2Real (Imperial College’s Robot Learning Lab)- integrates VLMs trained on 2D data into a 3D object rearrangement pipeline. The model imagines multiple object-oriented scenes using a NeRF and then uses a VLM to evaluate each arrangement. The scene which best satisfies the user's instruction is selected and the action is undertaken in the real world (as per below). This allows language-conditioned rearrangement to be performed zero-shot, without needing to collect a training dataset of example arrangements.

Spatial VLM (DeepMind, Stanford and MIT) - researchers introduced a system that leverages Internet-scale spatial reasoning data to train VLMs. They develop an automatic 3D spatial Visual Question Answering (VQA) data generation framework. The key contribution of this work is the creation of the first Internet-scale 3D spatial reasoning dataset in metric space. By co-training a VLM on this dataset, the researchers significantly enhance its ability to perform qualitative and quantitative spatial tasks.

Better training and datasets for generalisable robotics - Scaling quality real-world data is crucial to robotics generalisation, though difficult to capture.

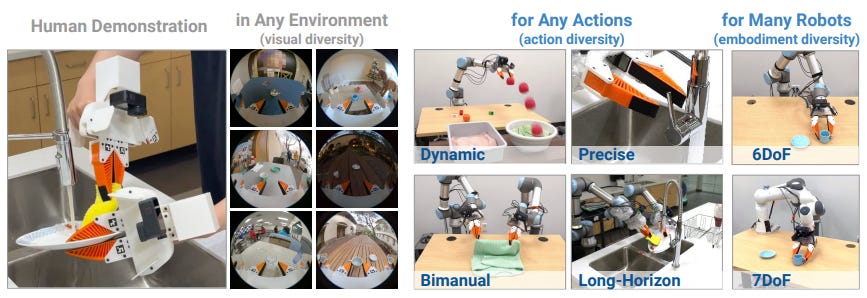

Universal Manipulation Interface (UMI) Gripper (Stanford). UMI is a new framework designed for low-cost data collection and policy learning, enabling seamless skill transfer from human demonstrations to robot policies. It’s a $400 setup which negates the need for tele-operation.

It is joined by a similar line of work in tele-operation-centric ALOHA-2 (Google DeepMind). ALOHA-2 is an open-source, low-cost hardware device for bimanual teleoperation in robots. The new version of ALOHA has greater performance and robustness compared to the original design.

Nvidia launches, GEAR, a new embodied AI research lab. Their express mission is to “Build[ing] Generally Capable Agents in Many Worlds, Virtual and Real”. The lab is led by Dr Jim Fan and Dr Yuke Zhu, their work will focus on multi-modal models, general-purpose robots and simulation / synthetic data. This builds on some impressive recent research such as Eureka and MimicPlay

AutoStore release in-store robotic storage solution - AutoStore, a leader in automated storage and retrieval systems (AS/RS) have launched PickUpPort. It allows customers to pick up items in stores that have adjoined warehouse storage. The initial product launched with outdoor shop, Thansen, it features 14 robots and over 18,000 bins, optimizing storage space for more than 32,000 of Thansen's 200,000 items.

Anybotics goes AnyMal mode. Swiss robotics company, Anybotics, who produce a robotic quadruped, AnyMal, for hazardous industrial inspection have announced series production in partnership with manufacturer, Zollner. Labour shortages within industrial facilities continue to pull demand for automated solutions. Zollner will manufacturer the PCBs and assemble the 400 or so components on-site

ASML launches its latest chip-making machine - the High-NA EUV lithography platform, known as EXE, costs $380m and weighs 150 tons. The machine offers chipmakers a critical dimension of 8nm. They can print transistors 1.7x smaller – and achieve transistor densities 2.9x higher. Notably, the technology will not be sold to China due to export restrictions.

Metal 3D printing - MIT researchers have developed a new liquid metal printing (LMP) technique which is 10x faster than wire arc additive manufacturing (WAAM)or Powder Bed Fusion (PBF) approaches, though with lower print resolution. This is likely to find applications in architecture and industrial design.

Nuclear welding. Sheffield Forgemasters have created a new way of doing large-scale steel welding, using electron beams. The firm, that builds Nuclear reactors, believes this will massively reduce the cost of Small Modular Reactors (SMRs), with lead times for reactor welding going from 150 days to hours.

🌍 Climate Tech

EU’s response to the Inflation Reduction Act - The European Union’s Net Zero Industry Act (NZIA) which was conceived in March ‘23, has been provisionally approved. Surprisingly, the bill will not include any monetary subsidies, unlike its US counterpart. The NZIA is aimed at strengthening Europe's net-zero technology manufacturing capabilities. The NZIA seeks to simplify permit-granting procedures, support strategic projects, enhance workforce skills, and promote innovation through regulatory sandboxes.

Chinese batteries, coming to a power source near you soon. CATL and BYD, the largest producers of battery cells with 37% and 15% market share respectively, are slashing prices by 50% for LFP (lithium phosphate) batteries. They expect costs to be below $50 per KwH, which would have widespread implications for low-cost EVs, as well as solar battery storage. BYD is now the largest global EV producer. Their vertical integrated approach continues to pay dividends, as seen by their new low-cost ($15k) EV, they even build their own ships to deliver vehicles 🤯.

Light at the end of the solar tunnel? The EU is mulling whether to provide European solar manufacturers with a financial rescue package. European solar cell producers are being outcompeted on price by Chinese producers. This is frankly, a waste of taxpayer money. Whilst China is subsiding the solar industry to drive costs lower, the sheer scale of their domestic market makes competition futile. We previously covered China’s dominance of the hardware needed to transition to Net Zero.

EU regulates carbon removals. The EU parliament has passed the Carbon Removal Ceritifcation Framework (CRCF) a first EU-level certification framework for for permanent carbon removals, carbon farming and carbon storage. The regulation comes after a few tough years for Voluntary Carbon Markets, which have been plagued by claims of greenwashing and bad accounting.

Avalanche Fusion released information on their fusion microreactor. The Orbitron is a compact plasma device that confines high-energy ions electrostatically in orbits around a cathode. Current attempts at Fusion rely on warehoused-sized reactors, which are large and expensive to build. Avalanche is betting on reactors that can fit on a trailer bed, comparatively inexpensive and fast to build.

Fervo Energy has reduced costs of drilling costs by 70% year over year. The US-based Enhanced Geothermal System (EGS) company who produce abundant heat energy from the earth’s crust, last year announced promising results from their initial drill site in Utah. Since then, Fervo has been focused on lowering costs to drill, bringing learning curves down. This has promising implications for this technology at scale. Fervo just raised a $244m funding round.

Tech Geopolitics and Defence

Heavy metals. Magrethea Metals a nascent company with interesting, carbon-neutral magnesium extraction technology, has just received a $28m grant from the US Department of Defense, to build a production plant. Magnesium is needed in the making of steel and aluminium alloys. Rare earths are increasingly becoming a point of National Security, as recently seen with the EU’s Critical Minerals Act (CRMA). Similarly, Kobold Metals just discovered a large copper deposit in Zambia. Kobold use AI to discover mineral and metal deposits, creating the “Google Maps of the earth’s crust”.

The EU has seemingly woken up to the fact there’s been a war happening in Europe since 2022. Ursula von der Leyen is calling on the EU to subsidise defence production. Thierry Breton is pushing for a €100bn ‘European Defense Fund’, the European Defence Investment Program (EDIP), a fund aimed at boosting joint weapons procurement and putting the EU on more of a war footing by ramping up domestic production. Breton also announced a €175m fund to bolster growth-stage defence tech firms across Europe. This is a good start but a drop in the ocean in terms of what these companies need, namely support building manufacturing facilities for volume production and buyer-of-first-resort agreements from governments.

Munich Security Conference - The annual security conference was marked by concerns about the United States' reliability in addressing the Ukraine conflict, with calls for urgent military support to Ukraine. Amidst fears of a Europe caught between an assertive Russia and uncertain US leadership, the focus turned towards strengthening the "European pillar" within NATO, underscoring the need for increased defence spending and enhanced military capabilities.

UK to co-lead ‘Drones for Ukraine’ coalition with Latvia - the UK announced it will be working to co-lead an international Western coalition, to provide ‘first person view’ (FPV) drones to Ukraine. This is the first program, from Rishi Sunak’s recently announced £2.5bn aid increase to Ukraine, of which £200m is earmarked for drones. British defence prime, BAE Systems just acquired heavy payload drone maker Malloy Aeronautics for an undisclosed sum.

Semi-autonomous drone swarms. Oregon State University research shows one person can supervise over 100 semi-autonomous ground and aerial robots efficiently. This breakthrough enables diverse applications like firefighting and disaster response. The study, part of the DARPA’s OFFSET program, deployed swarms of up to 250 vehicles in urban settings. We previously covered the US DoDs Replicator program, which looks to support innovation in low-cost, autonomous robotic swarms. The US Navy just announced the potential use of 1000s of surface and aerial drones to protect Taiwan.

🫂From the community

‘Funding RealTech’ on the challenges of funding deeptech by Steve Crossnan

‘Differential programming in engineering’ focuses on using differential design and simulation for complex hardware design by Nick McCleary

‘The defence exit problem’ (in Europe) by AI-focused Air Street Capital

‘The future of European defence and security’ by McKinsey

‘Heat batteries in 2024: nothing is hotter than heat’ by John O’Donnell

💵 Notable Funding Rounds

Figure ($675m Series B) is an emerging leader in humanoid robots. The company has raised from Jeff Bezos, Nvidia, Samsung, Amazon and Intel. They also teased their latest humanoid release, which undertakes pick and place at 16% the speed of a human.

Ascend Elements ($162m Series D extension) produced sustainable materials for batteries. Participants in the round extension include Just Climate, Clearvision Ventures, and Irongrey

Lilac Solutions ($145m Series C), who use a novel method to extract Lithium from brines, the round was led by Mercuria, Lowercarbon Capital, and Breakthrough Energy Ventures

Antora Energy ($150m Series B) produce thermal batteries for industrial sites, their round was led by Decarbonization Partners

Intenseye ($64m Series B) a Turkish company that uses computer vision to improve workplace safety on industrial sites, they raised from Lightspeed

Hadrian ($117m Series B) is a US-based automated precision parts manufacturer. The round was led by Andreessen Horowitz

Daedalus ($21m Series A) is a German automated precision parts manufacturer. The funding was led by NGP Capital

Robco ($42m Series B) is a robotics systems integrator, their round was led by Lightspeed

Orbital Materials ($16m Series A)use generative AI to new materials for carbon removal and the energy transition. The round was led by Radical Ventures

Jua ($16m seed) a foundational model for weather prediction, they raised from 468 Capital and the Green Generation Fund

Monumental ($25m Series A), build robots that build buildings, raised from Plural

Sage Geosystems ($17m Series A) is a commercial geopressured geothermal system (GGS), they raised from Chesapeake Energy

Quilter ($10m seed) - uses AI to create circuit board designs have raised a $10m round from Benchmark