🔥RTN22: the battle for battery standards

+ humanoid robots, SPACs, industrial policy and new Nvidia partnership

This week:

a new humanoid robot

Robot delivery SPAC

VinFast IPO is 🤯

New Industrial Policy and its implication for companies

⚡️Energy, Materials and Climate

The competing race for battery chemistries, and the West’s dilemma from the FT

Lithium-ion (Li-ion) batteries have dominated the EV market, but face challenges like rapid degradation, thermal runaway risks, and lithium availability constraints. New battery chemistries and architectures are emerging to address these:

Li-ion variations like lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) offer higher energy density and faster charging than Li-ion, with improved safety. But the lithium supply issue remains.

Sodium-ion batteries (SIBs) substitute abundant sodium for scarce lithium. Lower energy density than Li-ion but faster charging. China leads in SIB production today.

Solid-state batteries replace the liquid electrolyte with a solid, enabling higher energy density and safety. But manufacturability at scale remains unproven. Most companies are multiple years from production

As we’ve previously covered China is the current leader in the production of SIB and LFP batteries, with >30% and 99% of cell production volume respectively. They’re also investing heavily in solid-state

Automakers and battery firms are building massive Li-ion factories to meet EV demand. But 60%+ of the manufacturing lines will need retooling for newer chemistries like solid-state, presenting a challenging transition (from Porsche: The Race for Solid State batteries)

Chinese CATL, BYD and LG, collectively dominate production in lithium-ion, with a number of the solid-state players in the US like QuantumScape

China is increasingly deploying solid-state batteries, Nio announced the use of solid-state in their upcoming EV and Gangfeng claims to be mass producing these batteries

Western countries face a similar dilemma - rely on cheap, proven tech from China (German automakers are choosing this option) or invest to develop their own capabilities and reduce dependence

🌍 Policy and Geopolitics

The New Era of Industrial Policy is here by HBS

“increasingly intervening in the private sector through industrial policies designed to help domestic sectors [..]. As a result, companies in targeted sectors—such as automakers, energy companies, and semiconductor manufacturers—may experience dramatic changes in their operating environments” Prof Willy Shib of HBS

Deglobalisation and reshuffling of the industrial deck is a theme we have covered extensively here at RTN

Governments globally are increasingly using industrial policies to achieve strategic goals like growing domestic industries, maintaining tech sovereignty, and competing geopolitically. This represents a shift away from purely market-driven approaches

Governments are using a combination of supply-side tools like subsidies and tax incentives as well as demand-side tools like procurement and subsidies to consumers

This allows the targeting of specific sectors, technologies or companies that are key to advanced compute, supply chain and manufacturing and tech sovereignty

Major new industrial policies include the EU's Green Deal and IPCEI program, the U.S.'s CHIPS Act, China's Belt and Road Initiative, and "friend-shoring" alliances between countries

Whilst these policies seem novel, they have a long history of success;

🦾 Manufacturing and Robotics

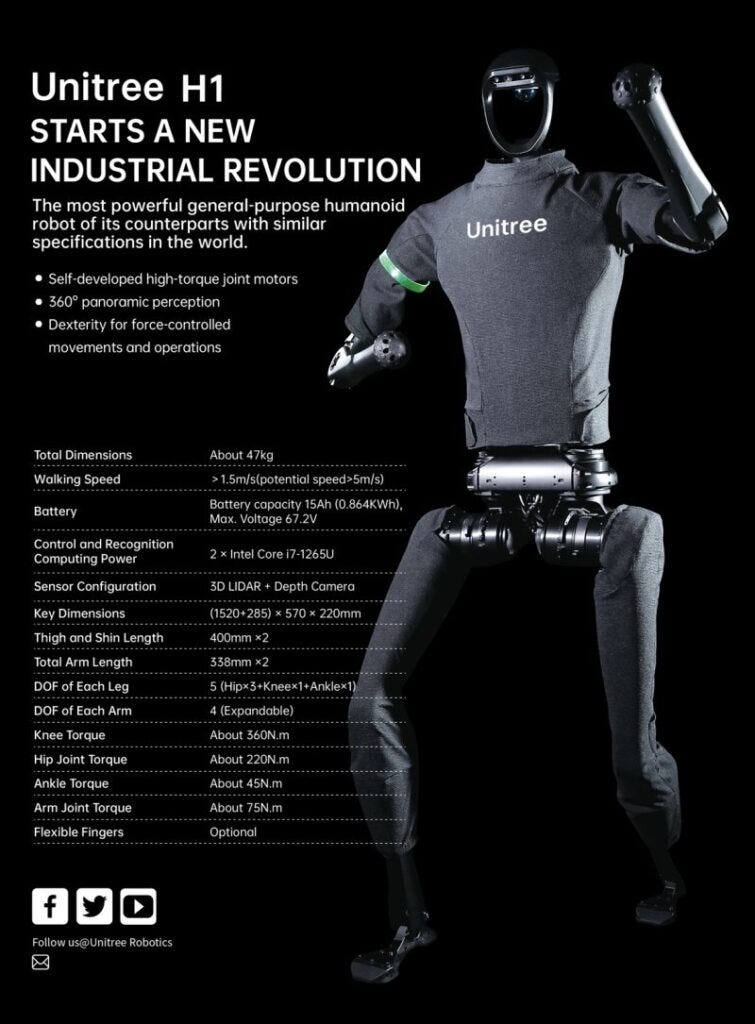

Unitree release teaser of $90k Humanoid robot

China’s Unitree released footage of their humanoid robot, building on their experience of quadrupled Go2 robot dog (see RTN17)

They have repurposed much of the Go2 tech - such as the LiDAR and cameras, and the perception and locomotion algorithms

The robot features a high-torque joint motor and gear train developed internally at Unitree. The leg joints are 5 degrees of freedom (DOF) and the arms are 4 DOF

The robot is being touted for release in 3 - 10 years

In a week, when Skydio stopped selling consumer drones (due to DJI) - this continues to show China’s abilities across robotics and low-cost manufacturing

We previously covered humanoid robots, which have seen a marked increase in progress recently (see RTN10)

The ambition for these robots is to replace a segment of manual human labour. Early use cases include domestic chores and warehouse automation

Interesting companies: Tesla Bot (supposedly), Figure, Prosper, 1X, Agility, Sanctuary, Boston Dynamics

the LK99 excitement is over, as the experiment failed to replicate :(

Ben reminds us how long new material discoveries take to incorporate into supply chains and products

🚖 Moving things

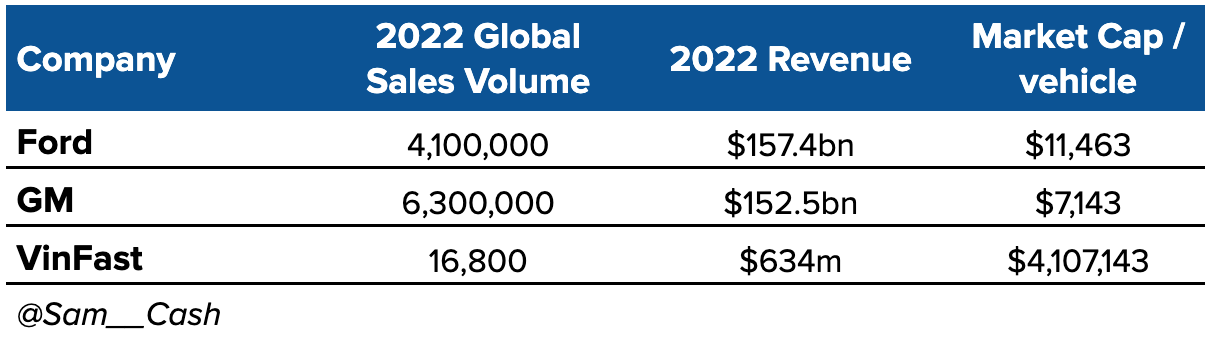

EV maker VinFast goes public via SPAC

Vietnamese EV maker VinFast, went public this week via a SPAC merger

VinFast started as an e-scooter manufacturer in 2018, expanded to EV cars in 2019 and e-buses in 2020

82% of their 2022 revenues came from EV sales of VF8 and VF9 SUV models

VinFast has an automated manufacturing facility in Vietnam with a capacity to produce up to 300,000 EVs per year. It plans to open a factory in North Carolina in 2024 with an initial capacity of 150,000 vehicles per year

Key financials:

$634m of revenue in 2022, down 6% YoY

82% of revenues came from EV sales

EV Gross margins are -98%, down from -67% in 2021

As of time of writing, the company is valued at nearly $70bn 🤯, more than either GM or Ford

Robot deliveries and yet another SPAC

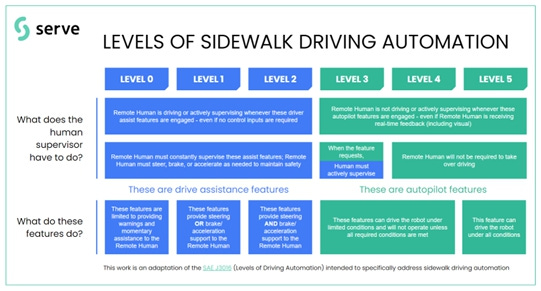

Serve Robotics, a last-mile delivery robotics company announced its going public via a SPAC merger

Serve spun-off from Postmates in 2021, post being acquired by Uber

Serve's robots claim to operate at Level 4 autonomy and use LiDAR and AI for perception and navigation

The company has 100 robots in service, integrations with Uber Eats, 7 Eleven and Delivery Hero. Serve is due to deploy 2,000 robots across the US in the coming years

Alarmingly unit economics are nowhere to be seen in the 8K filing, though we did grok this: Cost per delivery can be divided into labour costs (remote supervision, field operations, hardware operations) and robot costs (software, data, lease). With the utilisation rate of the robot the key metric

This continues a trend of early technologies companies, going public without sustainable economics. This may be good for early shareholders but is mid to long-term value destructive (see RTN11)

The growth-stage VC market has dried up significantly + there are a large number of SPAC sponsors yet to find targets, we may actually see more of these types of deals