🔥RTN17: China marches ahead on key technologies

+ Germany's China policy, robot dogs, new EV batteries

“Transmission moves power through space (technically null space, at the speed of light) and batteries move power through time”

A tech defrosting?

The US Fed announced better than expected inflation numbers this week (3% v 3.1%). The Fed is expected to hike rates in July for a final time in 2023. The picture is less rosy in the UK (⬆️7.9%) and Eurozone (⬇️5.5%) however. Whilst the US looks like it’s dodging a “hard landing”, Europe looks like it could have a bumpier economic ride.

Importantly, it seems like the early-stage venture market in Europe is defrosting. Builders are building, investors are investing. Decent Series A rounds are being done, occasional growth rounds, new companies are being started, the tech opportunity landscape looks bountiful and talent is comparatively cheaper.

I sense, this “defrosting” has come not due to a markedly better economic background, but more comfort with the new normal. 2022 was characterised by a sharp correction, wide-scale repositioning and a “wait and see” mentality.

They waited, and now its clear that the early stage market is normalising. We might have a few more shoes to drop - working through some of the capital overhang of 2021 and recycling more liquidity through the system via exits. Overall company building landscape feels consistent and rationalised.

🦾 Manufacturing and Robotics

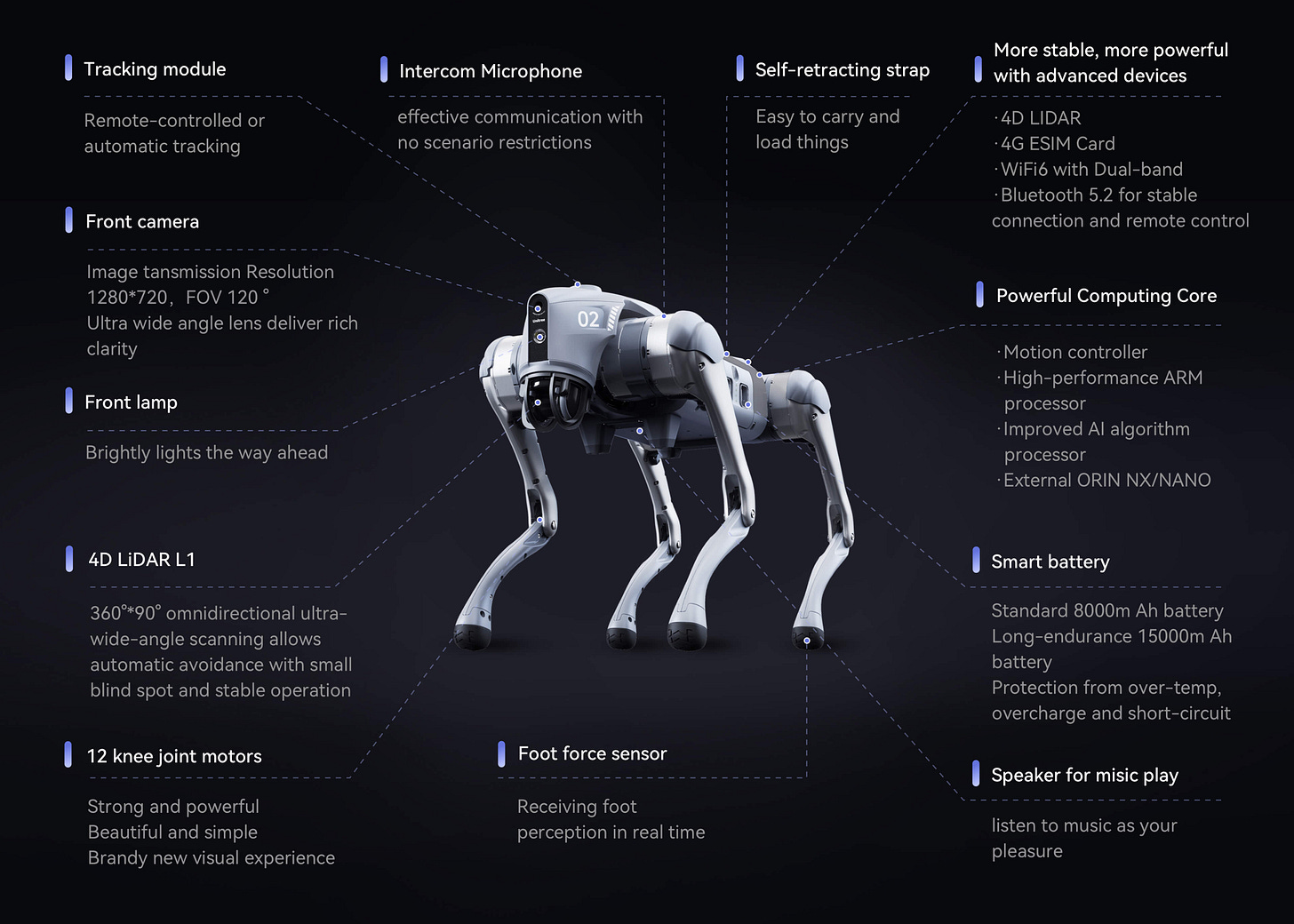

Unitree launches Robot Dog for $1600

Why it matters: China continues to flex its muscles in low cost hardware manufacturing and advanced robotics. Whilst this robo-dog is a toy, it’s low price point and technologies are likely to have a broader impact and applications

Chinese Unitree just announced the launch of a $1,600 robot dog, a quadrupedal locomotion system. Video here

Whilst I’ve yet to figure out a single practical application of having this robot other than scaring your grandparents

Its packing a decent amount of tech, from ultra-wide LiDAR, connectivity (4G, Wifi, BLE) and ARM SoC powering the control system, kinematics and dynamic stability

It’s price point is indicative that many of the technologies such as advanced perception, wayfinding and human-to-robot interactions are at a point on their cost curve where we might widespread adoption of adjacent applications

⚡️Energy, Materials and Climate

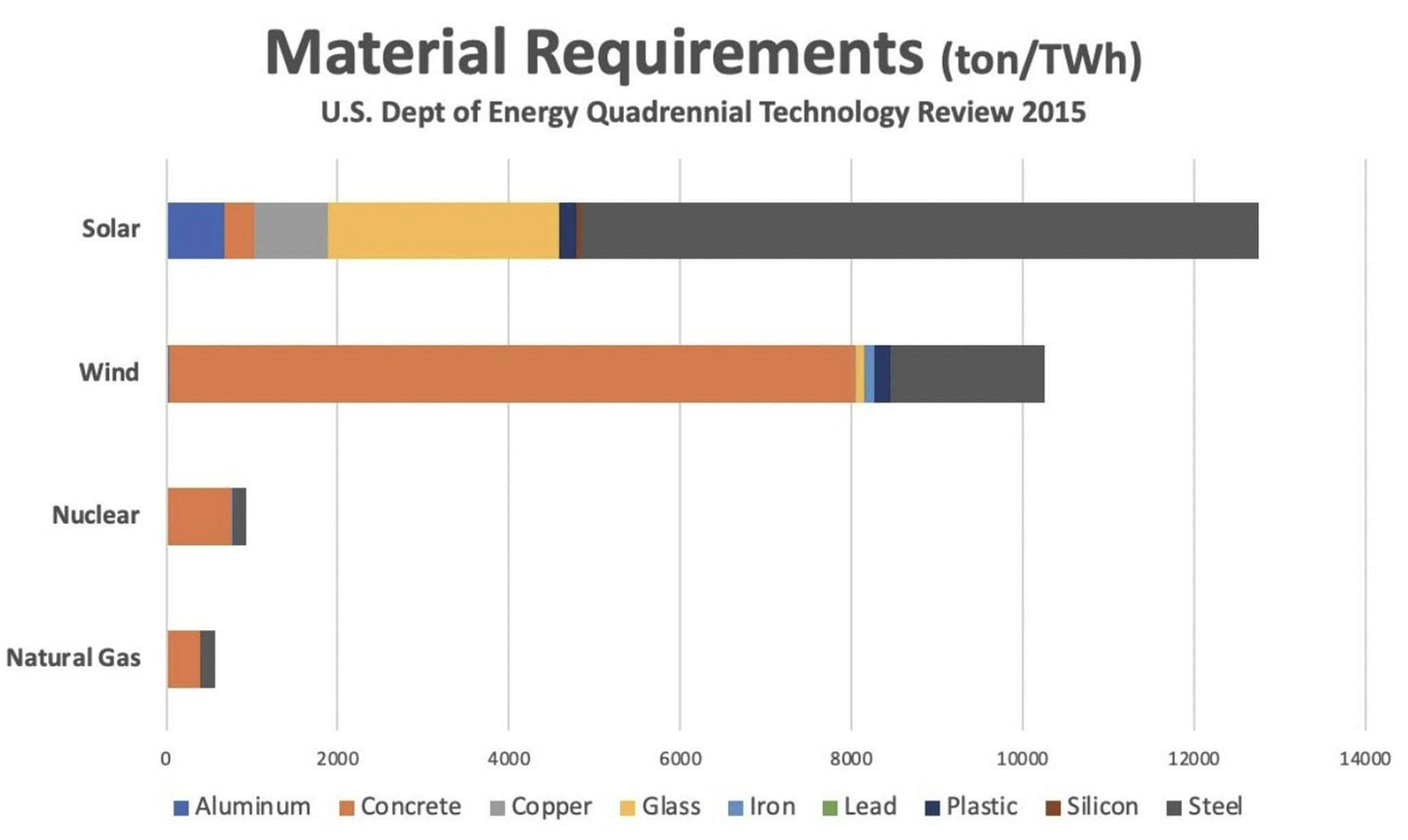

Last week we covered our insatiable need for earth materials, this chart helps visualise the importance to the net zero transition:

Batteries are competing with new power transmission by Casey Handmer

Why it matters: there are many energy analysts that believe in plugging new power generation (renewables, nuclear, even fusion) into the grid is the best fix to the energy transition. However, this neglects a) the difficulty in building more transmission capacity b) the cost of doing so. This is why I’m so bullish on decentralised power, localised generation and consumption

Many still believe that building more power transmission capacity is the solution to future energy needs, they face obstacles such as per permitting, land acquisition, NIMBYism and an inability to find sufficient skilled labour to build it

Wind, solar, and battery technologies have been experiencing significant growth, with battery investment and manufacturing increasing by approximately 250% annually and costs decreasing

Batteries and transmission compete directly as they both enable electricity arbitrage, batteries have a fixed cost per MWh delivered, while transmission lines become more expensive as they get longer

Spatial correlation in energy demand favours batteries over transmission, as there is more consistency in power usage across large areas compared to temporal variations throughout the day

Quantitative analysis based on historical data suggests that adding more storage is more beneficial than adding transmission for reliable, low carbon electricity supply.

The addition of 12 hours of storage to the entire US grid could cost around $500 billion and pay for itself within a few years, while upgrading the US transmission grid could cost $7 trillion over 20 years

The future of energy is likely to involve local generation and storage rather than extensive transmission infrastructure, as it provides better reliability and profitability

🚖 Moving things

Chinese EV maker, Nio, announces EV with solid-state battery

Why it matters: China is perpetually ahead of the West on battery technology and continues to cement this lead through battery makers like CATL, BYD, WeLion etc. Solid state batteries represent a step change improvement v liquid-state on a number of parameters

Battery progress to date has largely been within cathodes, we’re now seeing a number of next-gen anodes such as solid-state batteries (and sodium-ion)

They have higher energy density versus their liquid state counterparts

They provide increased range (≅ 600 miles / 960 km), faster charge times (< 30mins), lighter thus improving power-to-weight (kWh/Kg) ratio, have less thermal runaway, higher cycles and a 39% smaller environmental footprint

Traditional liquid-state, lithium-ion batteries are susceptible to catching fire due to flammable liquid electrolytes

Other auto makers such as Toyota, Subaru and Mazda are working on incorporating these batteries also

Whilst solid state batteries are holistically superior, there are challenges, namely their integration with existing battery management systems (BMS) and difficulties recycling key materials in closed loops such as graphite and lithium

Assuming cost curves come down for solid-state, these packs will be impactful across electric vehicles and energy storage systems

eBike company VanMoof enters Chapter 11

Why it matters: light electric vehicles remain one of the most viable options in reducing emission from the 60% of all passenger trips are under 7 kilometres. However, continued adoption of LEVs is being held back by challenging the economics of these units and businesses

This week, rumours of VanMoofs demise were confirmed. The company was “the most funded eBike company in the world”

Failure has largely been economic, with unrealistic repair warranties and theft insurance. Additionally, the company had a high number of custom components

The complexity included lock and unlock mechanisms, maintenance and anti-theft insurance packages, custom parts, an advanced app, GPS tracking, automatic gear shifting, integrated battery, and over-the-air updates

VanMoof's anti-theft insurance package provided bike replacement in case of theft at a lower cost compared to commercial insurance, and likely had negative unit economics. The package relied on bike tracking and "Bike Hunters" to recover stolen bikes

🌍 Policy and Geopolitics

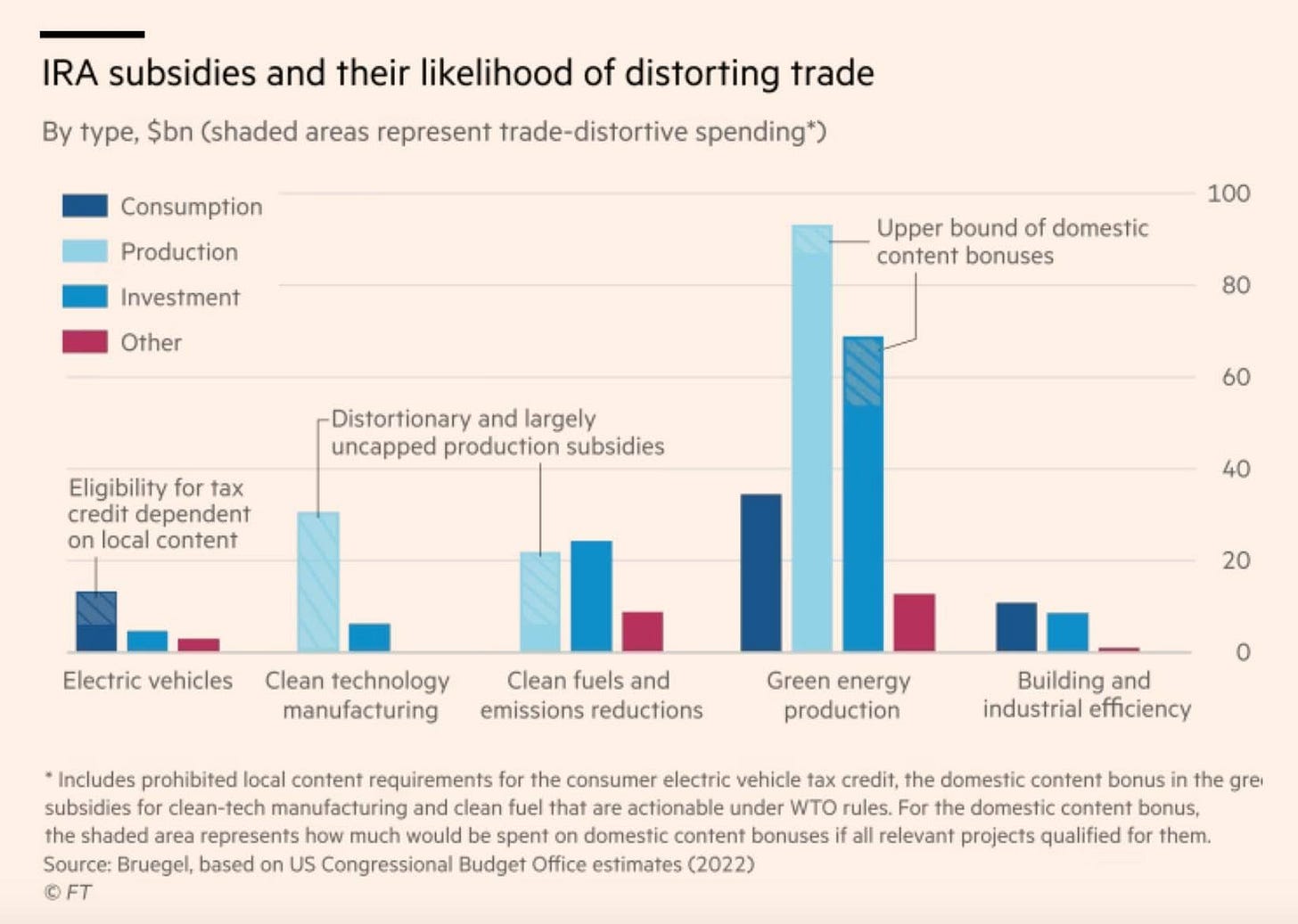

uncapped IRA subsidies are unsurprisingly likely distorting trade

Germany unveils its China strategy, the coldest of cold wars

Germany just published its first “China strategy”. An absolute snooze fest of a document, with vague pronouncements and largely characterised by a key trichotomy:

Cutting critical supply chain reliance on China, especially in areas of NatSec +

Outwardly signal a harder stance on China to the German electorate +

Maintain strong ties to China as a key export partner, especially for German automakers and Mittlestand

This characterises a tension for many Eurozone members, balancing economic interests with weakening national security through trade over reliance

[it did] “not address how Germany can participate in China’s economic growth and innovation capacity to strengthen its economy, without becoming overly dependent [on it].”

Best of the rest

Noah Smith interviews Chip War author Chris Miller (who presented at our Q1 conference)

Coincidentally, I noticed in my weekly digest that China is also flexing its ability to innovate in production capabilities for many primary components underlying durable goods.

https://open.substack.com/pub/doclrogers/p/manufactured-in-china-innovation

VanMoof link which expired: https://www.bike-eu.com/45739/vanmoof-enters-chapter-11-status-after-months-of-rumors