🔥RTN: trouble for Germany's automakers?

+ a new tech city for billionaires, Anduril release, UFO sightings

China coughs and Germany catches a cold?

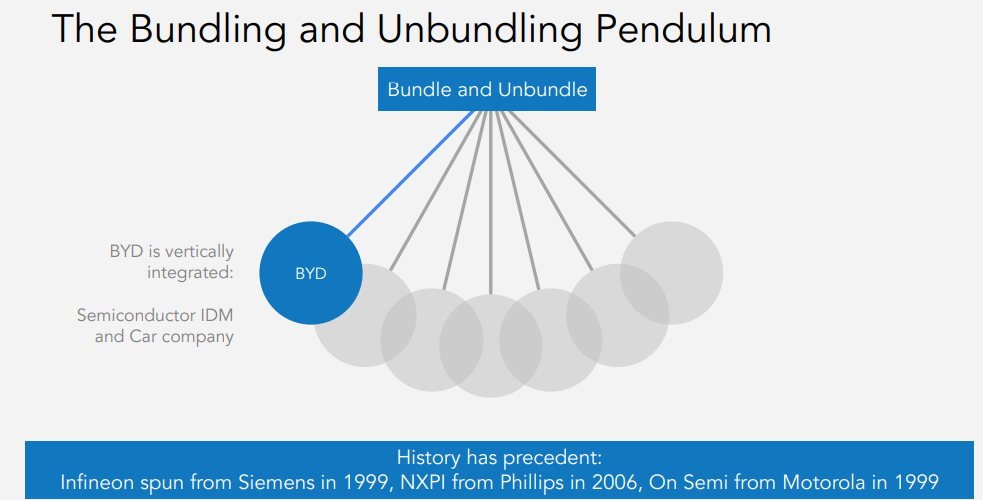

This week, the Munich Auto Show has been dominated by Chinese EV makers like BYD, SAIC and XPeng. This is no mistake, China has been strategic in how they’ve built vertically integrated companies, with manufacturing capabilities in both EVs and Semiconductors.

Germany is Europe’s Industrial heartland. It’s home to the largest players in Automotive (VW, Audi, Daimler) and its Mittlestand constitutes 200,000 industrial companies, accounting for > 50% of GDP.

As of today, Germany finds itself in a tricky spot due to; an energy crisis (reliance on Russian gas), skewed energy politics (rollback of Nuclear) and unclear controls regarding China exports (prev covered here). This has wreaked havoc on industrial companies. Legacy automakers in particular are struggling.

German Automakers (OEMs) largely outsource the production of parts, and undertake design, assembly and delivery. Leaving them with less control and expertise, unlike vertically integrated Tesla or BYD:

These legacy companies, have competencies in Mechanical Engineering, not in software and electrical engineering required for EVs. They do not have this expertise in-house and are structurally unlikely to develop them.

Today, the German automotive sector is increasingly dependent on China. VW and Audi have recently partnered with XPeng and SAIC for battery and ADAS technology (covered here), partly shifting core competencies and profit pools to their Chinese counterparts. Whilst still maintaining a dose of cognitive dissonance:

China has benefitted massively. They have strategically integrated many of their core competencies, cheap manufacturing, assembly, lithium batteries and even lagging-edge semiconductors. BYD is both a semiconductor manufacturer and an automaker. The number of EV imports from China to Germany, trebled in Q1 (28.2% vs. 7.8% last year).

China has a capacity for 40m EVs a year compared to a domestic market of just 25m vehicles. No doubt, they want to try and pursue export-driven growth to Europe especially, even if that means heavily discounting vehicle ASP. They are also likely to dominate low-cost lagging-edge semis needed for EVs, dogfooding their own production and likely using this to enact geopolitical leverage.

This week’s auto show is largely symbolic. We’re likely years away from impact, but as it stands European Autos are in for a rough ride.

Top Stories

Flexport CEO resigns after just a year, due to “change of strategy” (Twitter)

Industrial automation startup, Mujin, raises $85m Series C (TechCrunch)

The UK rejoins the EU’s Horizon science funding program (Politico)

Anduril released a Mach 0.9 unmanned autonomous air vehicle (AAV) (Anduril)

Palmer Luckey on Anduril’s future growth plans and IPO (Breaking Defense)

AI silicon firm, d-Matrix raises $110m (Reuters)

An empirical analysis of decoupling of energy usage and GDP (Lancet)

US lithium battery company, Ascend Elements, raises $542m (PRN)

Are biofuels a good use of land (v solar)? (Hannah Ritchie)

The hidden costs of reshoring (Lyn Alden)

Good listen on Nvidia, with a particular focus on AI:

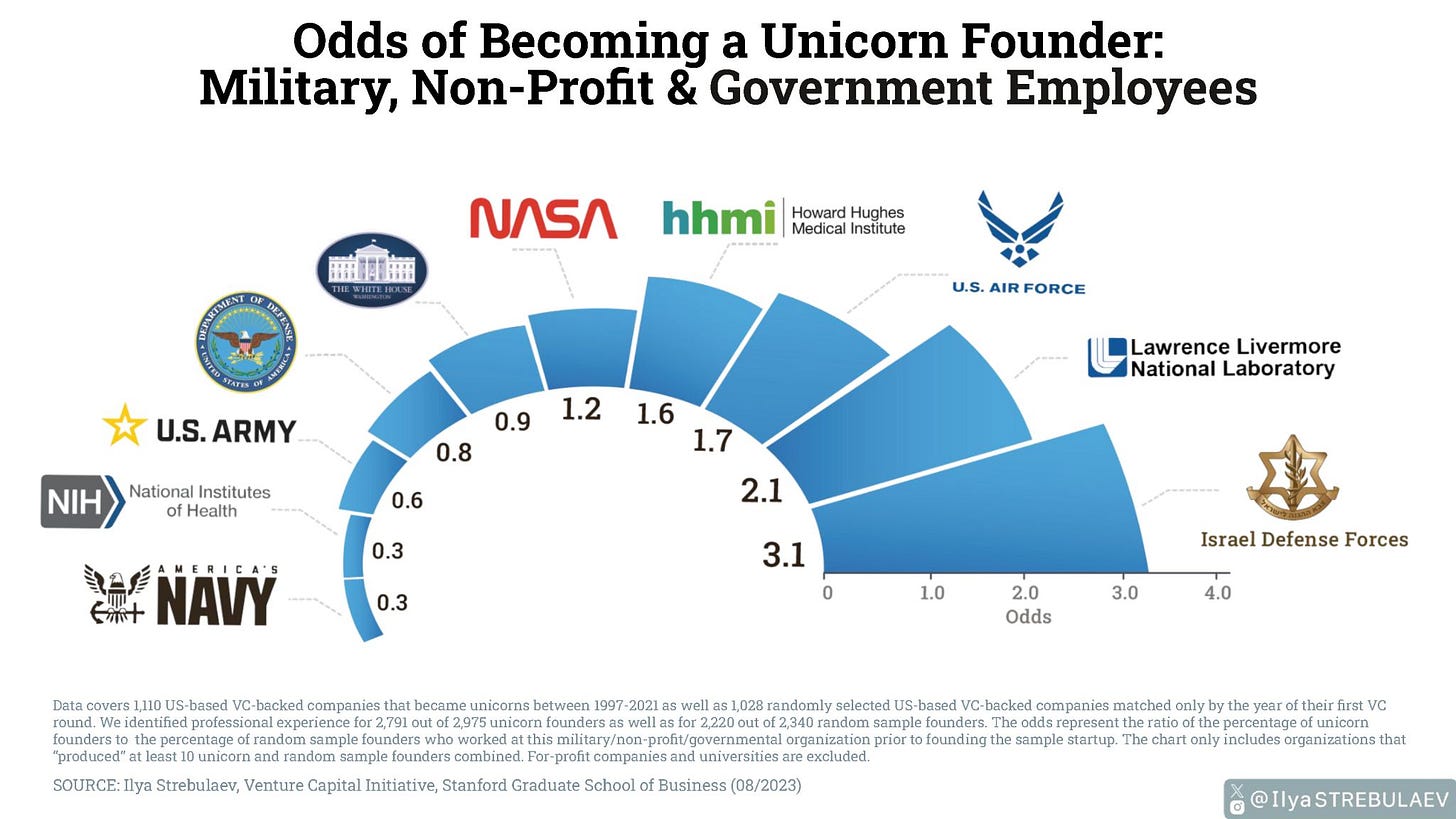

Maybe unsurprisingly, Israel’s IDF is adept at churning out unicorn founders:

FCC commissioner uses Hacker News to propose IoT regulations:

🦾 Manufacturing and Robotics

Great behind-the-scenes on Flow Engineering, a London-based hardware requirements SaaS startup by Jason Carman

China’s integrated manufacturing capabilities across semiconductors and EVs by Fabricated Knowledge

China is focused on developing its lagging-edge semiconductor (nodes like 28nm) manufacturing capabilities to support growth in EVs and advanced driver assistance systems (ADAS)

China has been prevented from attaining leading edge semiconductor manufacturing capabilities due to export controls, but has still managed to achieve 7nm with SMIC

China is rapidly expanding lagging edge semiconductor fab capacity, accounting for much of the global capacity additions in 2022

China's electric vehicle industry is growing rapidly and is expected to drive semiconductor content growth. China accounts for 60% of global EV sales and 65-80% of lithium battery production.

China has cost advantages in EV production that allow models priced under $15,000 compared to over $20,000 minimum in the US and Europe.

Vertical integration in China's auto industry (ex. BYD) will enable semiconductor price dumping that Western automakers likely cannot compete with. Diverging supply chains between China and the West in automotive semiconductors will disadvantage Western automakers.

🌇 Built Environment

Tech moguls want their own city, and so do a lot of other folks it seems

In a tale as old as time itself - an elite group is creating a separate living community

This time, it’s a group of elite SF entrepreneurs including the Collison brothers, Reid Hoffman, Nat Friedman, Marc Andreessen, and led by ex-trader Jan Sramek

They have spent some $800m on 50,000 acres in Solano County, an area North East of San Francisco. Their intention is:

“to build homes of different sizes and price points integrated in the same walkable neighborhoods, with homes, shopping, dining, and schools all within walking distance”

What is more interesting about this is that it’s far from the only recent project to build towns, cities and even new countries

Peter Thiel has a seasteading obsession, Google did Sidewalk Labs, YC even had a crack, and more recently Praxis are trying to build a new city

The most progressed effort has been Ryan Johnson’s (ex Opendoor) Cul de Sac, a completely car-free neighbourhood in Tempe, Arizona

This speaks to a few things; 1) a new generation’s dismay with modern cities 2) post-Covid, remote work has eroded the importance of proximity to work 3) people want to align with like-minded folk 4) this is a kind of Silicon Valley wrapper on real estate development