🔥RTN: capital markets for Industrials are broken

+ CAD product launches, video on the LA manufacturing scene, next RealTech event, White House mulls AI sovereignty, Mobileye takes on Tesla,

PSA 📣: we’re hosting the next RealTech Conference this November in London. As a reminder, our mission is to showcase leading frontier tech startups and provide connection amongst founders, operators and VCs.

If there are any founders you’d like to see present their startup, let me know and we’ll try to make it happen. You can see some of the prior speakers here (full list):

If you’d like to attend and have yet to sign up to one of the events, please register using this form 🙏🏻

The capital stack across Industrials is currently dislocated

We are on the one hand seeing large-scale market consolidation (Rockwell acq Clearpath Robotics, Ocado acq 6 River) rationalisation of balance sheets (Toshiba was just delisted) and spinning off non-core or cash generative assets (Intel IPO’ing its FPGA unit, Softbank’s ARM IPO, Blackberry IPO’ing its IoT unit)

At the early stages, the venture market is down 27% YoY. Financings, broadly, are taking longer, the threshold for companies getting funded is much higher and much of the current dry powder is allocated to propping up VCs’ existing portfolio companies.

Most HardTech raises are still proving mind-blowingly hard. An interesting long tweet, that provides an ‘inside baseball’ into raising a successful Series A round in HardTech in 2023;

On the other hand, we’re seeing healthy valuations in key segments (AI obviously), such as US defence and certain software-based climate companies. This week, Mach Industries announced their Series A at a $335m valuation 🤯. South Korea’s Doosan Robotics, just went public and closed its first day 98% higher, Rainbow Robotics stock is up over 300% YTD.

🔮 The market is rationalising and currently volatile, it’s not fully rational yet though it feels like we’re getting close. Typically, where there is market volatility, there is opportunity 👀

Request: Help us grow our readership by sharing this newsletter with a friend or colleague

🌍 Policy and Geopolitics

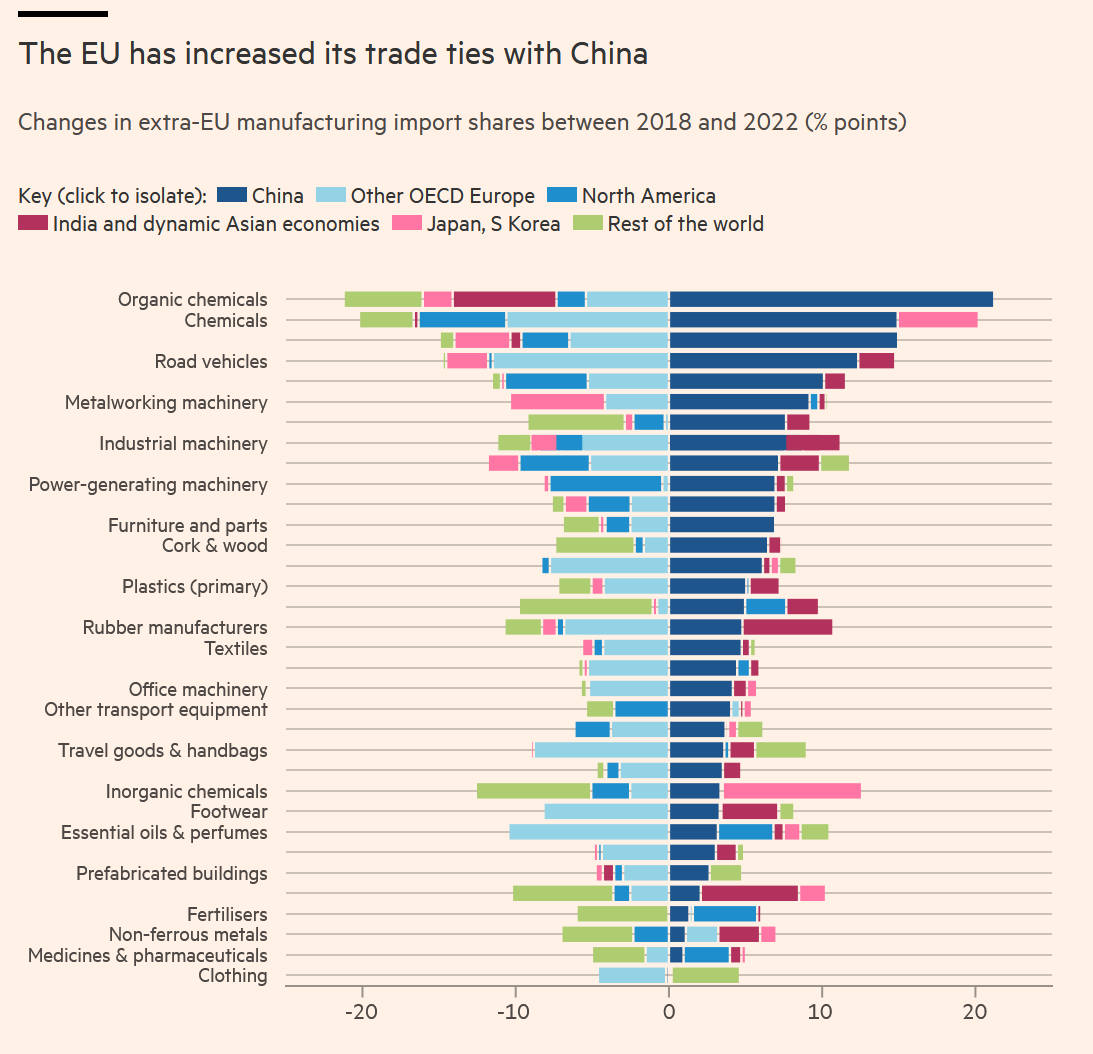

A startling graph shows that the marginal import in Europe from 2018 onwards has been satisfied by China

Europe now has the tough job of replacing low-cost Chinese imports, with homegrown industrial capacity

🇺🇸 White House could force cloud vendors to disclose AI customers

Technological sovereignty continues to be a key national focus for Western governments, as they look to protect key technologies from non-sovereign states

It’s been reported that the US government might impose KYC requirements on AI cloud vendors such as Google, Microsoft, OpenAI and Amazon

The move is designed to prevent certain states from accessing advanced compute from the US. Namely, China, which has been downwind of export restrictions on key semiconductor technologies

🦾 Manufacturing and Robotics

Ashlee Vance takes a look at Los Angeles’ manufacturing revival, with a focus on some of the newer companies building new technologies in the city

LA has long been the US’ aerospace home, with a number of large companies such as Northrup Grumman, Boeing and Raytheon, providing talent, expertise and knowledge density

More recently, SpaceX has been the notable new local incumbent and has spawned a number of new startups out of its ecosystem

One of the companies featured, Machina Labs, just announced their Series B funding this week

Dirac launches BuildOS, their automated CAD assembly instructions product

Top Stories

How Western Digital uses Digital Twins to control factories 8,000 miles away (Western Digital)

Financial Times Video: race for semiconductor supremacy (Financial Times)

John Kerry: energy transition is new ‘Industrial Revolution’ (Financial Times)

China’s military can build 200 times more naval warships than the US (The Drive)

Robots can now bag groceries, kinda (Arvix/Google)

German Parliament release guidance on Fusion energy strategy (Fusion Assoc.)

The traditional auto industry is doomed (Noahpinion)

World’s first artificial energy island just got the go-ahead (Electrek)

Robotaxi startup, Glydways, raises $56m Series B (The Information)

KittyCAD open sourced their visual and code CAD designer (KittyCAD)

Vayu Robotics emerges from stealth with $12m seed (RobotReport)

Jetson is a personal eVTOL company that just raised $15m (VentureBeat)

Wayve releases an update to their GAIA-1 foundational model (Arxiv paper)

Back in June, we covered Wayve’s initial release of GAIA-1, a foundational that generates synthetic training data by taking video, text and action inputs to model urban driving. This unlocks unlimited, photorealistic scenes to augment real-world driving data

Wayve has improved GAIA-1, a 9 billion parameter generative AI model trained on 4,700 hours of driving data to simulate complex urban driving scenarios. This massive model size enables high-fidelity simulation of diverse environments

The model recombines edge cases seen during training to form new corner case simulations. This long-tail approach improves robustness and guards against unexpected scenarios

Cruise releases study on autonomous vehicle safety

A 2-year study by GM, Virginia Tech and Michigan University analyzed 5.6 million miles of human ride hail driving data in San Francisco to establish a safety benchmark for autonomous vehicles

Human ride hail drivers had a total crash rate of 64.9 crashes per million miles driven, while Cruise AVs had a significantly lower overall crash rate of 30 crashes per million miles

For severe crashes with injury risk (Level 2+), human drivers crashed at a rate of 11.76 per million miles compared to Cruise AVs which had zero severe crashes over 1 million miles driven

Cruise has been under fire from SF locals after a number of accidents. Whilst AVs might safer than human-driven vehicles, it shows a different standard being applied for machines v humans

Tesla FSD v Mobileye’s SuperVision

To date, Intel-owned Mobileye has been a notable success in self-driving technology

However, Tesla’s Full Self Driving system (FSD) might collide with Mobileye;

“But we are very open to licensing our FSD software and hardware to other car companies. And we are already in early discussions with a major OEM” Musk

There is some precedent to this, Tesla just standardised electric charger standards across the industry, indicating a new strategic direction to monetise internal IP

Musk stated they have over 300 million miles of FSD data collected and this will grow exponentially to billions and tens of billions as more Teslas are on the road.

Mobileye's Amnon Shashua said their SuperVision system is comparable or superior to Tesla FSD and costs much less at around $2,500. They already have 120,000 vehicles with SuperVision

Widespread adoption of a lower-cost competing system could cannibalize Tesla's FSD business

“I would say that we have lots of respect to what Tesla has accomplished with FSD. In fact, [..] it pushes the market to move faster to implement advanced solutions like SuperVision” Amnon Shashua

⚡️Energy and Climate

Texas is looking to plug modular Nuclear into its grid

Texas is one of the most interesting case studies in the renewable transmission

They have deployed 40Gw of wind, and 19Gw of solar - which has been facilitated by Competitive Renewable Energy Zones (CREZ) and the ability to plug new capacity into the grid easily

Under the CREZ program, Texas invested $7 billion building 3,600 miles of high-voltage transmission lines in 2013

Now, Texas are turning to Nuclear and SMRs (covered last week) specifically, to help bolster local industrial businesses with steady low-carbon baseload power;

“nuclear reactors in the state are great for the power business, they’re also good or better for the industrial business, for the supply chain, for the long-term economic growth of this state,”