🌐 REALTECH News, June 2025

Your monthly technology guide on software defined physical industries

If there was a tech geopolitics version of vibe coding [vibe researching?], then this month’s newsletter would be it. Every month seems to be more important than the totality of what has happened before it, so I won’t bore you with a pithy intro. This edition is rammed with Trump tariffs, European re-armament latest, US defence firms moving in to the UK, European players fighting back, UK Strategic Defence review and AI trials, Nuclear mishaps, AI sovereignty, the Middle East and what conflict in Pakistan means for Western tech. Read below

📣 PSAs

I’m trying to grow this newsletter, so if you enjoyed this - please forward this to your smartest friend

I wrote a piece on how to ensure Europe’s Industrial prosperity. Read it in case you haven’t already

🧑🏼🔬 Research: Alongside Dealroom, we have compiled 40+ pages of in-depth analysis on trends in REALTECH. We analysed 15k companies, 11k investors over 10 years - read it here

Top Stories

Has Liberation day turned into de-dollarisation year?

Trump’s global tariff chaos was abated by a Trump capitulation, rolling back tariffs on China and a host of other major nations.

Public markets have rebounded to pre-liberation day levels. Though, the US was stripped of it’s AAA credit rating by Moody’s, the ratings agency, citing a projected deficit of 9% of GDP by 2035. Trump’s rollback of tariffs may be aimed at appeasing inflation concerns and investor nerves, but doesn’t address the structural deficit issues that led to the credit rating downgrade. Persistently higher bond yields and lower investor confidence for the US, would signal the end of zero-interest policies.

The damage of tariffs is likely to be on the dollars historical status as the global currency. A status which has afforded it the ability to sell debt to foreign nations, in order to fuel consumption.

Dead cat bounce? To date, this has not materially affected the US VC market. Some delayed IPOs, such as eToro, have since gone out with strong early demand. Late-stage AI rounds continue apace. Early-stage valuations in certain themes remain frothy. Other Trump policies may have a more detrimental effect. The pipeline of world-leading academic R&D combined with early-stage risk capital has been a key driver of US economic prosperity over the last 50 years. Though Trump looks to be disrupting this with his attack of academia:

The broader question remains: if not the US, then where? Other continents, Europe included, are watching carefully as the US Presidential administration fumble.

Big money in Europe, re-armament narrative and policy upheavals

The ‘rearmament’ narrative comes at an opportune time for European leaders looking to loosen fiscal constraints, and reinject growth into the continent. Three years into Russia’s invasion of Ukraine, Europe’s political class has finally found alignment on the need to rearm.

Mo’ money, mo’ armaments. Last month, the EU launched a €150B SAFE instrument, debt for defence procurement. Long-maturity EU loans for joint procurement of priority defence equipment, and even open to non-EU members Ukraine and the UK. SAFE also introduces a clear industrial strategy. It focuses procurement on EU-made defence capabilities across two categories, from artillery and cyber to AI-enabled air defence. Yet this is still a demand-side tool, funnelling cash via national plans, with disbursement contingent on joint procurement across two or more member states.

Brussels is even bending fiscal rules, governments can breach the Stability and Growth Pact by up to 1.5% of GDP through 2028 to accommodate defence spending. This could total up to €800bn of new spend. But there’s still a lack of industrial realism. Brussels remains ideologically attached to regulatory levers, assuming prosperity flows from values, not capabilities.

Germany tries to deliver the Zeitenwende. Germany’s new chancellor Friedrich Merz is pledging to build “the strongest army in Europe”. But unforced errors persist. Much of the plan still relies on power from imported gas, though there has been a small concession. Germany has pledged to not block France’s wish to treat Nuclear energy on a par with renewables at an EU level. Additionall, it was reported that the data of up 1m German reservists was lost, due to GDPR regulations! Doh.

🇪🇺🇬🇧 On the UK front, the EU-UK defence pact offers an overdue realignment. Under the new framework, the UK joins joint training, classified info-sharing, and even PESCO’s Military Mobility project. This is Brussels and London cooperating not just to support Ukraine, but to rebuild a pan-European deterrence architecture. This is actually a much bigger deal for the UK. Which risked being out in the cold and in close proximity to a much enlarged and dangerous European military force, with a distant and preoccupied US as its main ally.

The UK released its Strategic Defence Review (SDR), the largest review of the UK’s defence apparatus since World War 2. Key changes include the formation of UK Defence Innovation (UKDI) with a ring-fenced £400M budget, a mandated 10% allocation of the equipment budget to emerging capabilities, and the launch of a sovereign munitions strategy—targeting six new energetics plants and stockpiles of 7,000 long-range missiles. A new Cyber and Electromagnetic Command fuses cyber ops and spectrum dominance. The review introduces a permanent Recce-Strike force, embeds uncrewed systems into force design, and commits to contract awards for novel capabilities within 3 months. Export controls return to MoD oversight, and clearance reform is promised to reduce SME / startup friction.

The British Army also released its 20-40-40 doctrine, with autonomy replacing mass. The doctrine is the Army’s operational pivot to drone-first warfare: 20% traditional heavy platforms; 40% single-use loitering munitions and kamikaze drones for rapid, targeted strikes; and 40% reusable, high-end drones for intelligence, surveillance, reconnaissance (ISR), and precision strikes. The British military completed AI trials. Both the Royal Navy and Royal Air Force undertook cross-domain AI trials, designed as a show of force and to optimise AI algorithms and data validation.

Has Europe really woken up?

EU leaders claimed to have “woken up”, after the longest lie-in in recent foreign policy history. If this is Europe’s great awakening, then it’s one that needs a second engine, real industrial capacity, not just pooled procurement. European Union leaders are moving but very slowly, the institutional inertia of the European Union is not designed for agility and is likely due significant reform.

Expect to see EU leaders push for increased centralisation of power, less democracy and federalisation across the continent. Unfortunately for Ukraine, European leaders are aligned in prolonging this narrative and potentially this war.

US defence firms moving into the capability gap in Europe

US defence firms, god bless them, have smelt opportunity to rearm Europe and are moving in decisively. Saronic, the maritime autonomy company has just expanded to the UK, hiring Anduril’s ex Head of Europe, Paul Hollingshead to lead efforts in Europe.

Similarly, Applied Intuition have also landed in the UK. The autonomous car company, got into defence via their acquisition of EpiSci in February 2025. Their UK presence will be focused on selling defence-focused product lines, Axion and Acuity, to bring autonomy and vehicle intelligence to airborne capabilities. Anduril and Archer Aviation partnered with UK based SkyPorts, to test dual-use eVTOLs in the UK. Saildrone, the autonomous ISR surface vessels, raised $60m from Danish EIFO in order to enter the UK market.

New defence firms in Europe are accelerating, and the UK Government is all-in on autonomy

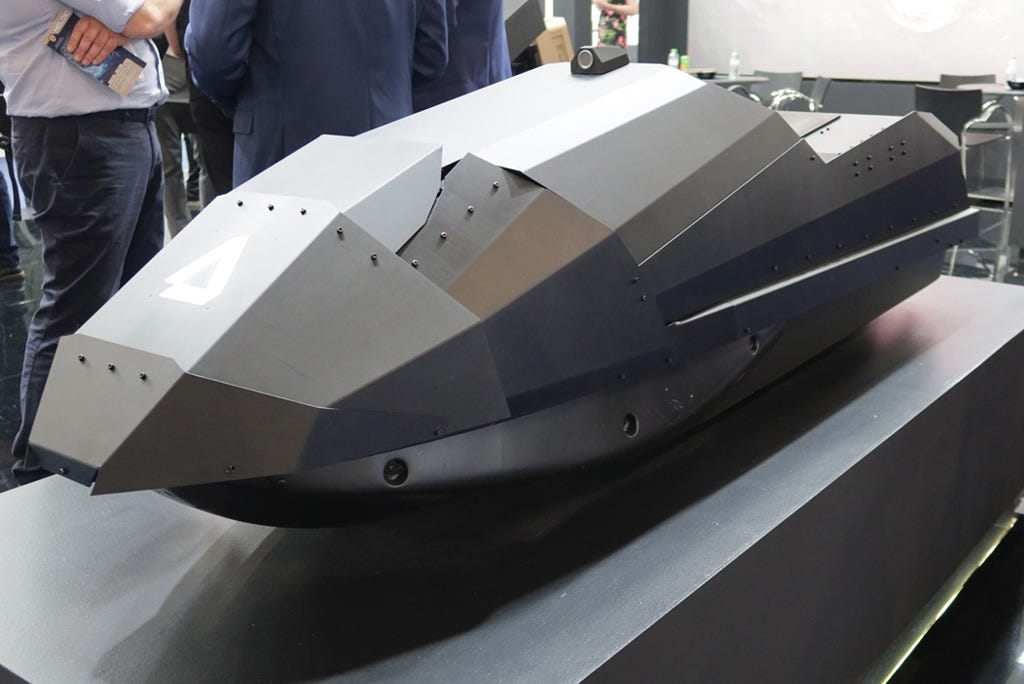

Not to be outdone. European startups released a host of new products. Delian, released a slew of new products: Interceptigon is a new family of autonomous, attritable one-way effectors (OWEs) built for asymmetric A2/AD missions. The series includes Interceptigon-A (A fixed-wing UAV designed for swarm attacks from concealed ground positions) and Interceptigon-N (A seabed-concealed unmanned surface vehicle - see image above).

Helsing revealed their autonomous subsea capabilities, with their Lura and SG-1 Fathom products, which encompass AI capabilties and an underwater glider respectively. Munich-based Alpine Eagle previewed Sentinel, the world’s first air-to-air counter drone (cUAS) system.

The Pakistan-India conflict gave us a look at Chinese military technology, and its bad news for the West

The India<>Pakistan skirmish offered a rare, glimpse into the viability of Chinese military hardware in the field. Reports suggest a Chinese J-10C fighter equipped with AESA radar and a PL-15E beyond-visual-range (BVR) missile downed an Indian flown Rafale jet, a flagship of Western military aircraft. This marks the first time Chinese BVR tech bested Western platforms in active combat. The implications ripple far beyond South Asia. A live missile lock and hit from over 100km away would be an astonishing proof point for China’s defence-industrial base, which for decades lagged in real-world validation. It also sharpens the debate around whether manned fighter jets are increasingly outclassed by long-range sensors, networked targeting, and autonomous kill chains

Trump goes power crazy, Middle East and Nuclear edition

Donald Trump has made clear he sees AI as both a geopolitical asset and an infrastructural imperative. Last month, he unveiled a Middle East tech blitz worth over $2 trillion, including a landmark deal with Abu Dhabi’s G42: a guaranteed import quota of 500,000 Nvidia GPUs annually, and a 5GW AI datacenter campus, with the first 1GW phase already underway. In parallel, Saudi Arabia’s $600B deal includes $80B+ in inbound US tech capital, and HUMAIN, a new AI firm set to deploy 1GW of compute (split between Nvidia and AMD chips) by 2026.

The Nuclear option. To ensure domestic infrastructure can keep pace, Trump issued an Executive Order to accelerate advanced nuclear deployment, the order:

Mandates the Army to build and operate a nuclear reactor at a military base within 3 years

Designates AI datacenters at Department of Energy (DOE) sites as critical defence infrastructure

Europe is taking note too. Italy, Spain, Denmark, and even Germany are revisiting nuclear bans in light of rising renewables volatility. In the age of AI, reliable baseload power is no longer optional.

🤓 Stories you need to know

🇬🇧 Three (UK) technologies that can change the world (Ilan Gur, ARIA): Ilan is CEO of the UK’s Advanced Research and Invention Agency (ARIA), a government funded research organisation. Ilan discloses three hugely impactful technologies that the UK could become a global leader in

NVIDIA’s GEAR Lab releases DreamGen (NVIDIA, various universities): is a fine tuned world model, trained to generate realistic robot videos from image-and-text prompts, enabling large-scale synthetic data generation

🟠 What does Trump’s crackdown on research and science mean in a geopolitical context? (Danny Crichton, Lux Capital): an interesting look at Trump’s axing of academia, and where do scientists go if not the US? Europe? China?

🏦 A new institutional logic, in a connected world (Jonno Evans): A great piece by Jonno, an ex-politician, now VC and REALTECH reader! He posits that the post-war centralised institutional order is being reshaped: “It is transforming from one based on state-centric, rules-based systems to a distributed order shaped by platforms, protocols, and technological leverage”. Great read.

⚡️The decentralised energy grid, are we building an internet for energy? (Contrary Research): interesting research piece, that looks at the history of the US grid, how we got to its current state and why a decentralised energy grid looks to be unavoidable future

☢️ The bad science behind expensive nuclear (Works in Progress): REALTECH reader, Alex Chalmers, published a great long read on the historical distortion of nuclear regulation.

⛏️ The 2025 critical minerals outlook is out (IEA): critical minerals are ever more important today. The report finds that Lithium demand rose by nearly 30% YoY. Demand for nickel, cobalt, graphite and rare earths increased by 6‑8% in 2024 too!

🚀 First flight of Hermeus Mach 5 aeroplane (DefenseNews): The aircraft, dubbed Mk 1, is the second iteration of the Quarterhorse high-speed test platform and the first to take flight. Its flight test brings Hermeus closer to its goal of flying the autonomous, reusable vehicle at Mach 5 speeds by 2026

FutureHouse released the first open source AI scientist (Sam Rodrigues): a multi-agent framework which can undertake a variety of scientific tasks better than humans. This is an interesting emerging space, as we’ve previously covered with Google’s AI Co-Scientist

🔬Research

Surface to Seafloor: A Generative AI Framework for Decoding the Ocean Interior State: Researchers introduce a probabilistic framework utilising score-based diffusion models to reconstruct 3D subsurface ocean dynamics from surface observations. This approach enables the inference of velocity and buoyancy fields, including energetic ocean eddies, providing physically meaningful uncertainty estimates

OneTwoVLA: A Unified Vision-Language-Action Model with Adaptive Reasoning: OneTwoVLA is a unified model integrating vision, language, and action with adaptive reasoning capabilities. Unlike dual-system approaches, OneTwoVLA seamlessly switches between reasoning and acting modes, enhancing performance in tasks like long-horizon planning and error recovery. This research builds on ‘thinking fast, and slow’ VLAs from Physical Intelligence and FigureAI we covered in April’s edition

Dynam3D: Dynamic Layered 3D Tokens Empower VLM for Vision-and-Language Navigation: Dynam3D introduces a dynamic layered 3D representation model that enhances vision-and-language navigation by leveraging language-aligned, hierarchical 3D representations. By projecting 2D features into 3D space and constructing multi-level representations, the model improves geometric and semantic understanding, enabling better navigation in dynamic environments. It sets new benchmarks on VLN tasks under monocular settings

PARC: Physics-based Augmentation with Reinforcement Learning for Character Controllers: The PARC framework combines physics-based simulation with reinforcement learning to augment motion datasets for character controllers. Starting with a small dataset, it iteratively generates and refines synthetic motions, enhancing the capabilities of terrain traversal controllers. This approach addresses the scarcity of motion capture data for agile movements, facilitating the development of versatile character controllers

Panda: A Pretrained Forecast Model for Universal Representation of Chaotic Dynamics: Patched Attention for Nonlinear Dynamics (Panda), is a pre-trained model trained on a synthetic dataset of chaotic systems. It exhibits zero-shot forecasting capabilities on unseen real-world chaotic systems and demonstrates emergent properties like nonlinear resonance patterns. Despite training solely on low-dimensional systems, Panda can predict partial differential equations without retraining, highlighting its potential in modeling complex dynamics

Aurora: A Foundation Model for Earth System Forecasting: Aurora is a 1.3-billion-parameter AI foundation model trained on over a million hours of geophysical data, delivering high-resolution forecasts across air quality, ocean waves, tropical cyclones, and weather. It surpasses traditional numerical models in accuracy while operating at a fraction of the computational cost, and can be fine-tuned for diverse applications with minimal data

💰Notable Funding Rounds

Radiant Nuclear ($165m Series C) is a portable nuclear reactor designed to replace diesel generators

Chaos Industries ($145m Series B) the defense technology company, raised funding led by Accel

Quantum Systems (€160m Series C) the Munich-based ISR drone company raised from Balderton

Mach Industries ($100m Series A) the FPV drone company is raising from Khosla and Bedrock

The Nuclear Company ($51m Series A) the nuclear infrastructure developer, raised funding led by Eclipse

EnduroSat (€43m Series B) the satellite-as-a-service provider, raised funding led by Founders Fund

remberg (€15m Series A) the manufacturing maintenance platform, raised funding led by Acton Capital and Oxx

SpAItial ($13m seed) the world model startup founded by a Synthesia co-founder, raised funding led by Earlybird

CX2 ($31m Series A) the electronic warfare systems startup, raised funding led by Point72 Ventures

Orasio (€16m seed) the security software company started by the co-founder of Payfit, launched with funding led by Singular

Rivan (£10m seed) the London-based synthetic fuel company raised from Plural

Aris Machina (€6m seed) is a Sweden based manufacturing software platform spun-out of Northvolt