🌐 REALTECH News, April 2025

Your monthly technology guide on software defined physical industries

“This could be Heaven or this could be Hell” from Hotel California, could be describing today’s venture markets. We’re witnessing the relentless acceleration of breakthrough technologies, set against a macro backdrop that’s increasingly chaotic.

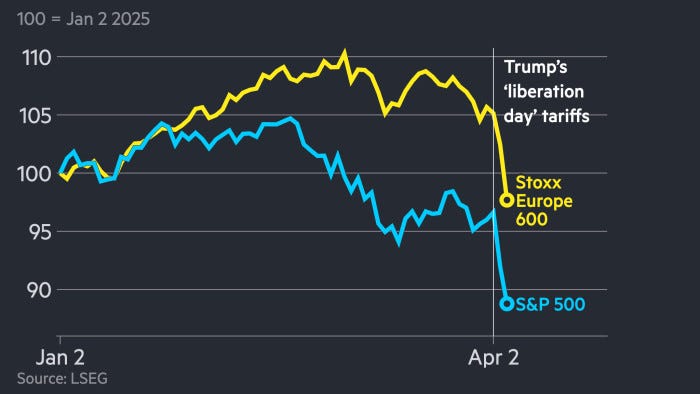

This week, Trump unveiled sweeping 10% tariffs on all global imports with the US, with 34% tariffs imposed on China, which retaliated with tariffs and export sanctions. Public markets got hammered. Though, through the lens that we’ve previously covered, Trump is accelerating the transition to a new unipolar order, this move isn’t surprising. It’s the end of the post-WWII Bretton Woods consensus and a bold attempt by Trump to renegotiate global trade under his terms.

There is a Brexit-y vibe to this, a wave of national-first ideology that is increasingly decoupled from economic reality. The ambition to “bring back” manufacturing jobs is politically resonant but flawed. It’s a badly executed version of China’s military-civil fusion, forcing the growth of home-grown technological capacity. The US economy has spent decades optimising for globalisation and outsourcing cheap labour. Large, new capital expenditure needs investment, which in turn needs positive market sentiment.

China’s retaliation came fast: new export restrictions on rare earth metals critical to everything from EV motors to jet fighters to AI data centers and chip fabs. Notably, the US tariffs failed to carve out exemptions for AI datacenter supplies (servers, storage systems and networking switches), endangering the US’s current lead in AI. Increasing complexity, especially for many late-stage US deeptech companies.

For venture markets, it paints a mixed picture. IPO pipelines that had finally reopened are now freezing again, M&A had been un-Lina Khan’ed by Trump. Security startup Wiz, was just acquired by Google for a healthy 47x EV/revenue multiple.

Now, numerous companies, including Klarna, have paused their IPOs. Secondary transactions and M&A remain the only paths to venture liquidity today, with the latter likely slowing. This will create downward pricing pressure on venture funding rounds, creating interesting opportunities for early-stage investors. I think this is likely a net positive for a venture market that has been irrationally overheated due to AI fervor.

Long Europe?

For Europe, this chaos presents opportunity. With the US increasingly seen as unreliable, the continent can re-architect its economic posture: deepen ties with China and pursue a more independent industrial strategy. Both paths offer a chance to absorb commercial opportunities in AI, climate tech, and advanced manufacturing, especially where American uncertainty has left gaps. Onward.

In today’s edition:

Humanoids are now thinking, fast and slow- new inference architectures from Physical Intelligence and Figure

Everything that happened at NVIDIA GTC in physical AI

The US DoDs race to 2027, software acquisition and the impact on Europe

Insights into China’s robotics market from the Unitree CEO

📣 PSAs

I wrote a piece on how to ensure Europe’s Industrial prosperity. Read it in case you haven’t already

🧑🏼🔬 Research: Alongside Dealroom, we have compiled 40+ pages of in-depth analysis on trends in REALTECH. We analysed 15k companies, 11k investors over 10 years - read it here

Top Stories

Humanoid robots: thinking, fast and slow

Robots are starting to reason like humans, or at least like humans in Daniel Kahneman’s famed book Thinking, Fast and Slow. Physical Intelligence and Figure released models which split robotic control into two tiers: a fast, reactive “System 1” and a slower, deliberative “System 2.” The idea is simple, use fast inference for routine actions and invoke higher-order reasoning for more cognitively heavy actions.

System 1 is typically a Vision Language Action (VLA) model—streamlined, low-latency, and optimised for real-time robotic control. It executes learned behaviors like grasping or moving objects with precision and speed. System 2, by contrast, is a Vision Language Model (VLM) that interprets goals, parses ambiguous instructions, and sequences tasks. Physical Intelligence’s, Hierarchical Interactive Robot (Hi Robot) and Figure’s Helix models exemplify this: the VLA handles practiced motions, while the VLM breaks down complex prompts into stepwise instructions—literally “whispering” commands back to the VLA. This hierarchy lets robots generalize better, react intelligently to real-time feedback, and—crucially—start to “think” before they act.

NVIDIA GTC: Everything that mattered in Physical AI

NVIDIA’s GTC was, unsurprisingly, a flex. While headlines focused on the Blackwell platform and its successor Rubin, architected to drastically reduce inference costs and unlock rack-scale AI, the real shift was strategic: from training-time horsepower to test-time compute and post-training orchestration. NVIDIA is positioning itself to dominate runtime intelligence as models become reasoning-heavy, tool-using agents. All this lands against a shakier macro backdrop: semis are cyclical, and even before the tariffs Microsoft was rumoured to be scaling back its datacenter build-out—a potential signal that hyperscaler capex has peaked.

Beyond the hyperscale cloud layer, the interesting stuff was at the edge: the Drive Thor SoC, NVIDIA’s in-vehicle chip, has been re-architected for transformer workloads, enabling multi-modal inference for everything from cockpit UX to autonomous driving. Cosmos, is a new system for training world foundation models (WFMs) for physical AI. It ties directly into an updated Omniverse, the platform now underpins simulations for Foxconn, Mercedes, and Hyundai—each testing multi-robot orchestration, synthetic data pipelines and AI-enabled layouts. NVIDIA didn’t stop there. They also launched the Newton physics engine - which they are building with Disney Research and DeepMind. Newton is an open-source, extensible physics engine built on NVIDIA Warp that enables robots to learn how to handle complex tasks with greater precision. Last but not least, an updated GR00T N1 robotics model, NVIDIA is assembling a vertically integrated stack for robotics and autonomy. It’s not just building chips; it’s building the runtime substrate for a physical AI future.

The DoDs race to 2027, software and reforming procurement

Washington is locked onto 2027 — the year the Pentagon believes China could move on Taiwan. However, the US military’s traditional procurement cycles are too slow for the US to be ready to counter:

“New warships are not coming. New aircraft are not coming in that timeline. But software is” Navy CTO Lt. Artem Sherbinin

In response, SecDef Pete Hegseth has ordered all DoD components to adopt the Software Acquisition Pathway, using OTA and CSO mechanisms to rapidly onboard commercial tech. The new mandate is to ship operational software within 12 months of funding, with frequent updates.

This pivot is reshaping the defense-industrial landscape. Just last month, Scale AI’s Thunderforge integrated AI into command workflows at INDOPACOM; DARPA is funding provably secure code for legacy systems. And at the a16z American Dynamism summit, VP JD Vance’s speech called globalisation a “drug” that hollowed out America’s industrial base, urging a return to domestic manufacturing and investment in software and technology:

“We got lazy, we over-regulated, and made it too hard to build in America.”

The European Union, meanwhile, is targeting 2030 readiness but remains years behind in procurement speed and software adoption. To remain a credible partner and deter near-term threats, the EU would do well to replicate the US model — fast, digital-first, and commercially integrated.

🔬Research

SAM2Act: Enhancing Robotic Manipulation with Visual Foundation Models (Univ of Washington, Nvidia): Researchers have introduced SAM2Act, a multi-view robotic transformer-based policy that integrates visual representations from large-scale foundation models with a memory architecture. This approach achieved an 86.8% success rate across 18 tasks in the RLBench benchmark, demonstrating robust generalization under diverse environmental perturbations

Scaling Pre-training to 100Bn for Vision-Language Models (Xiao Wang et al., Google DeepMind): This study pushes vision-language pretraining to 100Bn image-text pairs—10× larger than previous datasets. While traditional benchmarks plateau, the gains are clear in cultural diversity, low-resource languages, and fairness metrics. The work also highlights a core limitation of current VLMs: pre-trained language models tend to over-rely on linguistic priors, often ignoring visual input, limiting grounding and robustness across tasks

All-atom Diffusion Transformers: Unified generative modelling of molecules and materials (Meta FAIR, University of Cambridge, MIT): A step toward foundation models for chemistry and materials. ADiT uses a single transformer-based architecture to generate both molecules and crystals—something that separate models typically handle. It’s fast, scalable, and beats domain-specific approaches on key benchmarks

MuJoCo Warp physics simulator (DeepMind and NVIDIA): MuJoCo Warp (MJWarp) is a GPU-optimized version of the MuJoCo physics engine tailored for NVIDIA hardware. MJWarp achieves over 100x speed improvements in complex simulations, enhancing the efficiency of robotic manipulation tasks

NeuralCFD: Deep Learning on High-Fidelity Automotive Aerodynamics Simulations (Emmi AI): The NeuralCFD framework introduces deep learning to automotive aerodynamics simulations. Utilising Geometry-Preserving Universal Physics Transformer (GP-UPT), it addresses scalability and training efficiency challenges

🤓 Stories you need to know

Unitree’s CEO on China’s robotics scene (China Talk): Wang Xingxing discusses an imminent general purpose AI model for robotics, the limitations of LLMs and China’s dominance in hardware. Great read

New Joule Order, a report looking at energy security (Carlyle): a report on energy which normalises sources by unit and focuses on security- what’s striking is that renewables are less present in conversations about energy resilience

Figure AI unveiled BotQ, their humanoid manufacturing facility (Figure AI)- the plant is reportedly capable of assembling 12,000 humanoids a year. Weirdly, the shop floor doesn’t seem to have any humanoids operating on it 🤔. Figure also released a preview video of their humanoid working at a BMW factory

China designs the world’s first silicon-free transistor (Nature): necessity is the mother of all invention. Technology sanctions are forcing China to find workarounds - in this case, with sanctions on lithography machines for traditional leading edge chips production, China has created a silicon-free gate-all-around 2D transistor

1X’s approach to home robots (Eric Jang): A great thread on X which covers 1X’s technical approach and why home robots are the “Final Boss” of robotics

Helsing’s Torsten Reil has Lunch with the FT (Financial Times): an interview with the European defence company’s CEO on a European resurgence, AI’s role in combat and the continent’s Trump shock

NASA prepares for Trump-induced workforce reductions (Space News): the US national space agency is considering cutting 2,500 jobs and closing down 3 R&D centres

Onshoring UK manufacturing (The Times): UK firms are set to invest up to $650bn in reshoring manufacturing capabilities, driven by geopolitical volatility and global tariffs

💰Notable Funding Rounds

Flock Safety ($275m Series E) the surveillance infrastructure company, raised at a $7.5B valuation, the round was led by Bedrock

Epirus ($250m Series D) the directed-energy defense startup, raised a round led by 8VC

Shield AI ($240m Series F-1) the aircraft autonomy company, raised a new round with participation from L3 Harris

ALSO ($105m, spinout from Rivian) Rivian spun out ALSO, a new micromobility company, they raised from Eclipse

Lumafield ($75m Series C) the industrial CT scanning platform for manufacturers, raised a round led by IVP

Apptronik ($53m Series A ext) the humanoid robotics company behind Apollo, secured further Series A funding led by B Capital and Capital Factory

Evroc ($55m Series A) the European sovereign cloud infrastructure startup raised a round from EQT Ventures, Blisce and Giant

Marvel Fusion (€50m Series B extension) – Munich-based laser fusion company raised new capital led by EQT and Siemens Energy

CaDDi ($38m Series C extension) the Tokyo-based manufacturing procurement platform raised from Atomico

Infinite Uptime ($35m Series B) – the predictive maintenance and analytics firm helping industrial customers optimize uptime, raised a round led by Avatar Ventures

Manna ($30m funding) – the autonomous drone delivery startup raised a new round led by Molten and Tapestry VC

Viam ($30m Series C) – the cloud-based robotics development platform raised capital led by Union Square Ventures and Neurone

Rerun ($17m seed) the open-source observability platform for real-world AI (robots, drones, AVs), raised a seed round Point Nine