🌐The Industrial Transition, May 2024

Hi all, welcome back.

📢 A few PSAs;

The Defence Tech Hackathon which my firm co-sponsored was a huge success. It was truly inspiring to see so many young engineers passionate about solving problems of significance. Great coverage from TechCrunch here and an event summary video;

We had 345 attendees, predominantly engineers who came from leading universities in the UK, France, Germany, Ireland

The hackers were set to work on problem sets directly from Ukraine and from Lambda Automata

The final presentations were impressive, from pulse-jet engines, drone interceptors to localisation in GPS-denied environments. Full breakdown of the final projects here

✈️Travel: I will be in Milan on May 14th-17th and Berlin on June 2nd -4th - HMU if you’re around

🦾Manufacturing & Robotics

Wayve announced LINGO-2, the first vision language action model (VLA) to power a car autonomously end-to-end. The system provides a natural language interface for simple human<>machine understanding and displays an impressive understanding of contextual semantics. This builds on Wayve’s prior work with LINGO-1 and their world model GAIA-1

Using language for "chain of thought" helps the car break down a complex scenario, reason with rules and counterfactuals, and provides further explainability of complex AI systems. It is not an exaggeration to say that Wayve’s end-to-end learning approach has changed autonomous vehicles.

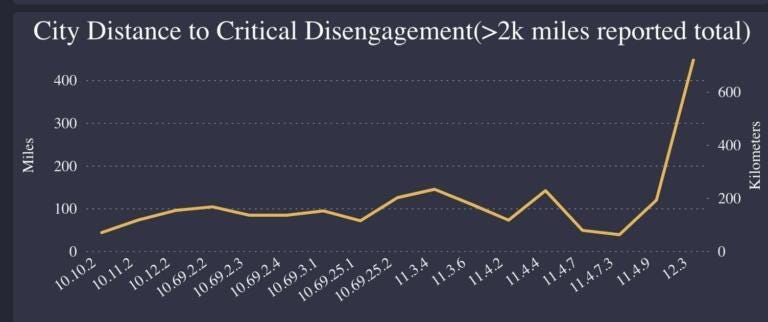

Tesla’s releases new Full Self Driving (FSD). Tesla just released ‘FSD 12 Beta’, their first FSD release with new end-to-end learning architecture. Tesla changed their autonomy approach for FSD in 2023, away from ‘hand coded’ to end-to-end learning. Early data suggest it’s an order of magnitude better than prior releases. Evidenced by the number of miles driven before a disengagement (a driver intervention):

These improvements can be attributed to a few things; namely the use of neural nets for end-to-end learning and the build out of custom Dojo chips for training. Importantly, Tesla has a huge data pipeline, with their (6m FSD enabled) vehicles feeding visual training data from real world scenarios and edge cases into their system. Full autonomy, would allow Tesla to launch finally launch ride-hailing robotaxis (“cyber cabs”), which featured prominently in their recent earnings call. Whilst merely a hypothesis, I would bet that Tesla FSD v13 will build on this, and will be “grokking” language tokens from X AI’s Grok 1.5v vision-language model.

Xiaomi, the Chinese consumer electronics company launched its first EV, to much fanfare. Their initial vehicle the SU7, is comparable to the Tesla Model 3 though it's $4k cheaper and claims to beat 90% of its specs. Xiaomi is producing around 8,000 vehicles per month, and expects to ramp up to 300k vehicles per annum by 2026.

This is notable, as a) Xiaomi is known as a smartphone manufacturer and the ultimate manifestation of the thesis that EVs are just “smartphones on wheels” b) they have implemented advanced manufacturing processes, like Tesla. They are using an IDRA Group gigapress to assemble large single metal underbodies. Xiaomi’s manufacturing process is highly advanced, with the use of automated robotics and AMRs across, metal forming, body work, assembly and inspection (cool video below):

This has resurfaced an old argument; that Tesla was lured to China in order for local EV players to adopt and adapt their vehicle IP and manufacturing processes. Whilst mere speculation, what is evident is China’s impressive mass production of lower-cost EVs. China is moving from being a producer of low-value goods to high-value goods. Tesla sells about 600,000 vehicles per annum in China and competition from Xiaomi and lower cost players like BYD continues to threaten that position;

🤖 Department of humanoids - Boston Dynamics released their New Atlas humanoid. Not to be outdone by younger upstarts, the OG humanoid company released a robot with impressive high-powered electric actuators, moving away from hydraulic in their prior humanoid. This allows the robot to perform 360 degree turns and displays impressive range of motion. Sanctuary AI also released an update to their humanoid, the Phoenix Gen 7.

Tau Robotics released a cool demo video of their AI systems doing pick and place with low-cost robotic hardware, which costs $1400. It points to an emerging trend: > generalisable AI software capable of coordinating various tasks in dynamic environments + cheap commodity hardware.

🌍Climate Tech

Solugen’s use of AI for chemical discovery. Solugen, the vertically integrated sustainable chemicals startup share their use of AI to produce new chemicals in their biomanufacturing process. They use Bayesian optimisation to drastically expedite protein design, reducing the time for enzyme development from over a year to under three months, cutting process costs by 60% and improving product conversion rates. Solugen’s vertically integrated approach, from chemical creation to production and delivery, places them in a unique position to rapidly commercialise AI’s breakthroughs.

💨Terraform Industries claims to have converted fossil-free electricity and air into pipeline-grade green hydrogen, using a proprietary and complex system of solar, hydrogen electrolysis, direct air capture (DAC), and methanation. Whilst there is high likelihood their process works, some of the stated and unverified economics are an order of magnitude better than current levelised costs: electrolyser capex of $100 KW, electricity at $20/MWh and DAC for $250/ton. Converting air into hydrogen is not complicated, its just quite expensive currently. Their enigmatic CEO, Casey Handmer was recently featured in an episode of S3:

The US Department of Energy (DOE) released a blueprint on decarbonising US buildings. Buildings account for roughly 17% of global greenhouse gas emissions, and 75% of electricity use in the US. The Blueprint aims to reduce greenhouse gas emissions from buildings 65% by 2035 and 90% by 2050. Decarbonising buildings is still an underappreciated investment opportunity with a large footprint of potential innovation across white goods, HVAC, materials, and embodied carbon construction.

🏭Big money for heavy industry. The Biden’s administration’s Industrial Demonstrations Program, is directing $6bn in subsidies towards decarbonising heavy industries which account for 25% of GHGs.

CATL announces a battery with a 1.5 million km warranty over 15 years. The lithium iron phosphate (LFP) battery is designed for heavy usage buses and trucks. LFP batteries are capable of thousands of cycles before seeing battery performance degradation, making them a good choice for home, off-grid and heavy transportation. CATL and China’s huge scale is pushing production prices down of LFP to near parity with Li-Ion.

CATL has introduced 'Tener', a battery energy storage system (BESS), with a capacity of 6.25MWh per 20-foot container and claims of no battery degradation for the first five years. Companies such as Sungrow, Trina Storage and Hithium have 20-foot products with 5MWh per unit, with Tesla’s megapack packs a mere 3.5MWh.

🌐Tech Geopolitics and Defence

Anduril has had a flurry of product releases of late and major contracting wins with the DoD:

Anduril’s Ghost Shark just debuted, its an extra-large autonomous undersea vehicle (XL-AUV) which is being co-built with the Royal Australian Navy (RAN). The Ghost Shark is an uncrewed, multi-purpose vessel that is likely semi-autonomous. This builds on Anduril’s prior, smaller unmanned sub, the DIVE-LD which was capable of 10 day operations at a depth of 1800 meters.

We are seeing strengthening of the AUKUS alliance as the US looks to strengthen its naval capabilities in the South China Sea. Recently, a $5bn defence bill was passed by the Senate and the likelihood of an ITAR exemption for the UK and Australia to “to enhance technological innovation among the three countries and support the goals of the AUKUS Trilateral Security Partnership”

Anduril is a prime now. Anduril and General Atomics beat out giants Lockheed Martin, Northrop Grumman and Boeing for the development-for-production phase of the collaborative combat aircraft (CCA) drone program. As part of the Next-Generation Air Dominance (NGAD) family of systems, the drones are intended to fly alongside the service’s fighter jets and platforms to augment its manned aircraft fleet. The drones are unmanned fighter jets, which will cost $30m a piece and the DoD may purchase up to 2,000 units by 2030.

More unmanned surface vessels. Palantir has partnered with South Korea’s Hyundai Heavy Industries Group to bring Palantir Foundry to it’s shipbuilding operations and to it’s planned unmanned surface reconnaissance vessels. US-based Saronic, demonstrated its autonomous surface vessels (ASVs), the Cutlass and Spyglass - they serves multiple roles, including deploying payloads and effectors, enhancing communication networks, tracking maritime targets and domain awareness. Both vessels feature a modular open software architecture (MOSA) compatible with common command and control (C2) systems, and have integrated with Anduril’s Lattice software

Lambda Automata, the European AI-first defence company has acquired its first company. The acquisition of Smart Flying Machines (SFM), a manufacturer of autonomous aerial vehicles. This gives Lambda’s autonomy products multi-domain (land, air) coverage. (disclaimer: I’m an investor)

The European Investment Bank (EIB) has loosened the definition of dual-use, in order for more capital to flow into European defence and security companies. Dual-use companies, no longer have to derive 50% of their revenue from civilian use cases. This comes as more European Defence Ministers call to broaden the ESG definitions - a set of subjective investment reporting guidelines which stem the flow of capital to national security endeavours.

👭From the community

Annual battery report (Volta Foundation)

Can the UK become a leader in Frontier Technology (UKOnward)

💰Notable Funding Rounds

Platform Science ($125m Series D) is a telematics and fleet management tool for trucking

Skyports ($110m Series C) London-based drone port operator raised from IRIDIUM

Cobot ($100m Series B) is a collaborative robot company, the round was led by General Catalyst

Mosa Meat ($85m Series B) is a Netherlands based synthetic meat company, the round was led by Lowercarbon Capital

Matterport (acquired by CoStar for $2.1bn) is a leader in digital twins for real estate

Nominal ($20m Series A) the company who provide “faster, more reliable way to review test data and validate mission-critical systems” emerged from stealth with a $7m seed and a $20m A round from investors such as Lux, Founders Fund, Haystack and General Catalyst

Proxima Fusion ($20m seed) is a Munich based fusion energy company, the round was led by Redalpine

Turbine One ($15m Series A) is a military intelligence platform who are modernising frontline perception with AI and ML

Meetee Robotics ($17m Series A) is a dexterous humanoid robot company, Ahren Innovation led the round

Archetype AI ($13m seed) are building a foundational model for robotics. The round was led by Venrock

Circular ($10m seed) is a sustainable sourcing platform, the round was led by Eclipse