RTN16: Materials, here, there but not everywhere

+ Humanoid robots, growth-stage VC, new Amazon tech

How are interest rates affecting early-stage company building?

There’s a lot of talk about interest rates. Though, I’ve been surprised at a lack of consensus view in tech on rates' effect on late-stage (Series B+) venture capital. This should have a clear strategic and financial impact on how companies are built today.

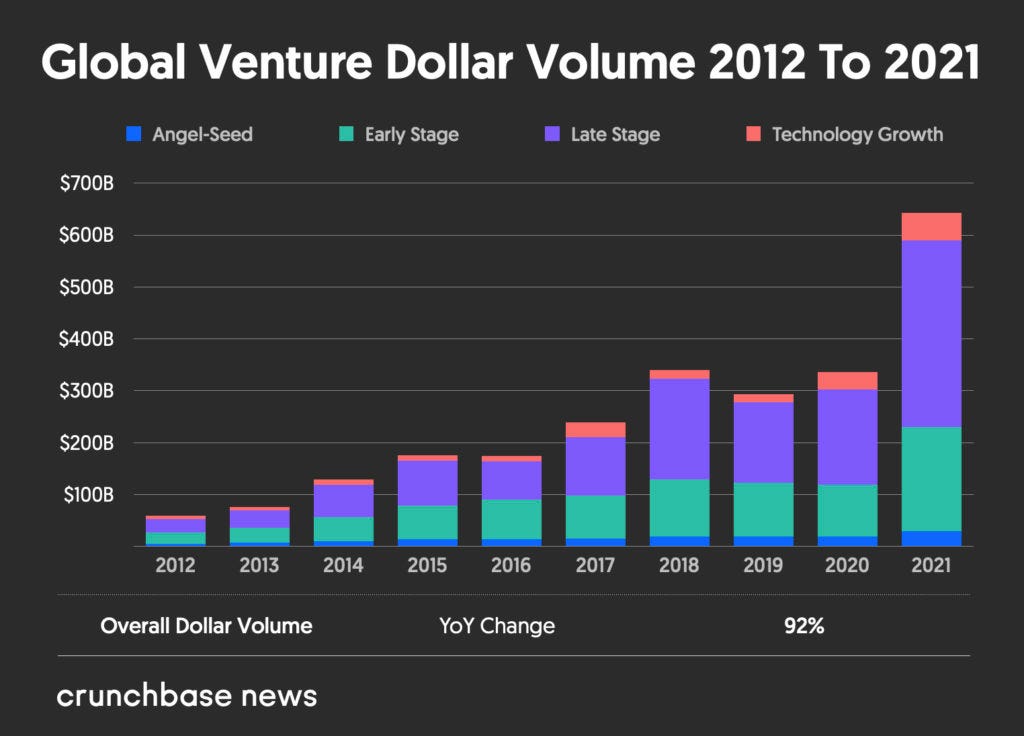

As a quick primer - 2015 to 2021 saw a huge influx of late-stage venture capital. This capital was largely driven by a “search for yield”, as interest rates at 0%. When rates are low, you need to allocate to equity risk (return on debt was low) and to get juicy 15%+ IRRs, you need to allocate to high-growth equity - eg technology.

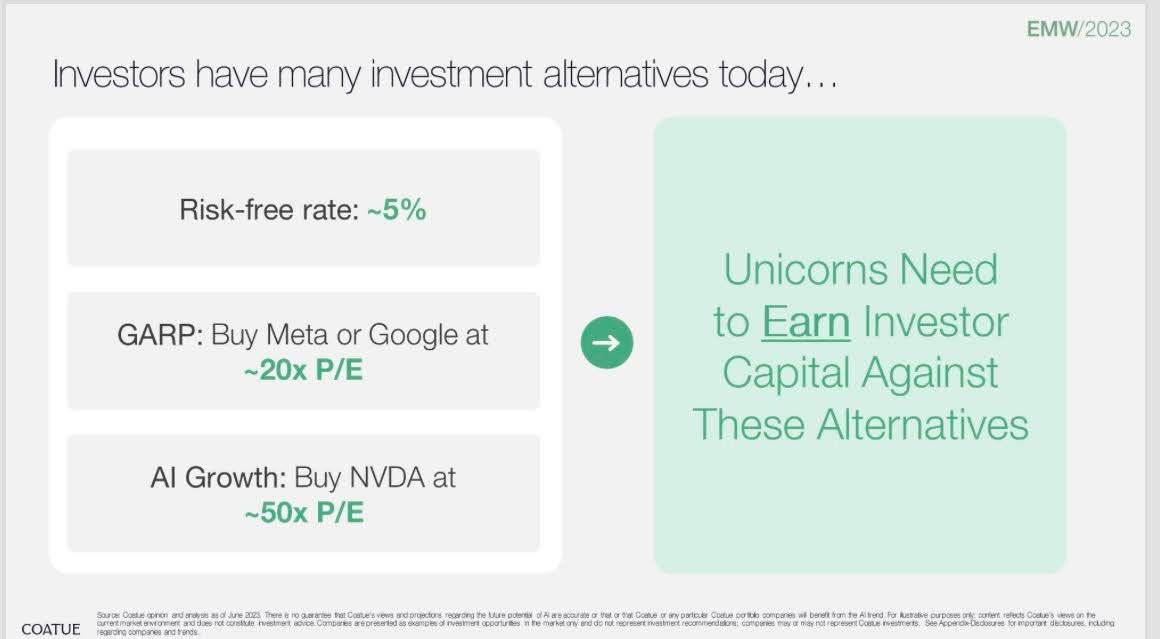

Now, interest rates in US/Europe are around 5.5%, with central banks guiding to terminal rates of 2%-3%. OK, and?

This means the current risk-free rate of return is 4%-5.5%. So if late-stage VC was targeting 15% IRRs, they now need 20% IRRs. On top of this, you need to factor in an illiquidity premium.

A key decision that asset allocators will have is whether they want;

10%-15% IRR in illiquid late-stage privates

5%-10% low-cost public equity

3%-5% in risk-free debt/bonds

Would you bet on there being a deep late-stage equity market? I wouldn’t. The late-stage market will not disappear but I expect it to be a quantum smaller than the last cycle.

Importantly, founders need to be building businesses today, that are not reliant on huge sums of late-stage capital. I fear, that this has still not permeated the thinking of most builders and early-stage VCs.

🌍 Policy and Geopolitics

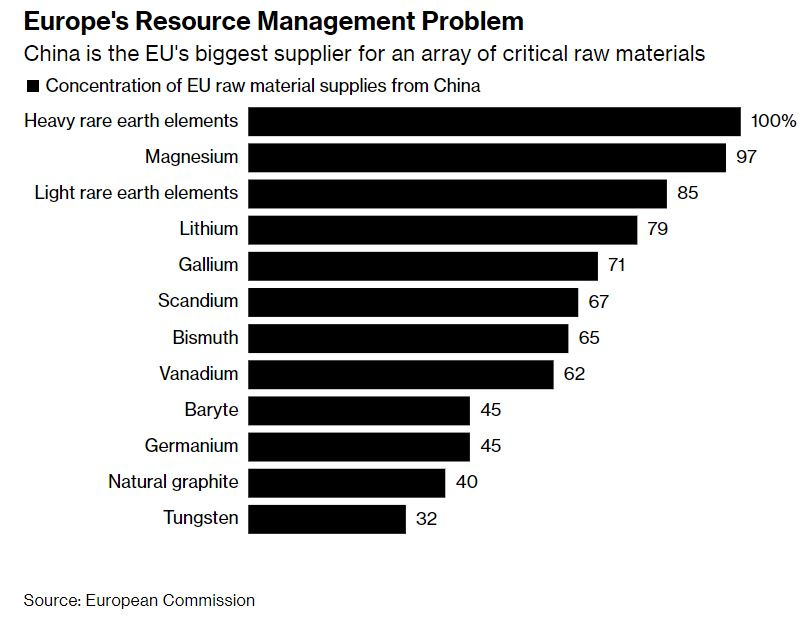

China restricts exports of key rare earths by WSJ

Why it matters: tech and resource export controls continue to intensify between 🇺🇸/🇪🇺 and 🇨🇳. China is retaliating at both a government and corporate level

The US and China, and to a lesser extent the EU have been in a tit-for-tat on export controls of key resources and technologies

In the latest bout, China has restricted exports of Gallium and Germanium. China accounts for 94% of the world's gallium production and largely controls the germanium supply chain which is a by-product of zinc extraction

These chemicals are key to the production of semiconductors, solar panels and fibre optics

This new ban means that companies will need permission from Beijing to purchase these minerals and their availability is a risk to 🇺🇸/🇪🇺 chances of achieving tech autonomy and net-zero

Similar mineral extraction processes are possible in other countries, though are capital-intensive, low-margin and generally not favoured by capital markets. Hence the outsourcing to China

China has also banned graphite exports to Sweden. Graphite is needed for lithium battery production. Sweden’s Northvolt, a large challenger to China’s dominance of battery production and CATL. China is protecting both its local industry and its defence supply chains

“Think about the $500bn of trade that goes from China to the US every year. More than 95 per cent of rare earth materials or metals come from, or are processed in, China. There is no alternative”

Resource discovery is largely an economic and technological problem

There are a multitude of new startups tackling this broader problem, from extraction → supply chain → recycling/circularity → novel composites, such as;

Earth AI (vertically integrated exploration)

Orbital Materials (Foundational models for materials)

Material Nexus (synthetic rare earths for net-zero)

Cyclic Materials (circular chain for rare earths)

Ascend (lithium-ion recycling)

Genomines (plant mining)

⚡️Energy, Materials and Climate

TU Delft spin-out VSParticle raises Series A

Why it matters: they are developing advanced 3D printers, which can print matter at the nanometer level. They are producing catalyst membranes for hydrogen electrolysers. Advanced material production remains critical to new technologies (eg silicon to semiconductors)

The VSP-P1 NanoPrinter developed by VSPARTICLE is an advanced 3D printer capable of depositing nanoparticles with exceptional precision.

It employs an electrostatic discharge process to generate nanoparticles, which are then transported and fused together to form nanoscale particles.

These particles, measuring between 0-20nm, can be composed of various materials, including both conductive and non-metallic compounds.

The printer offers the ability to mix and convert 62 basic elements, enabling the creation of a wide range of new materials, including nano-alloys, oxides, and hydrides

🦾 Manufacturing and Robotics

Humanoid Robots Principles and Guidelines: benchmarks, safety and ethics

Why it matters: humanoid robots are having a moment, with broader progress in AI being a main driver. There are many companies pursuing this goal, though the space lacks a common framework understanding for robot<>human interactions

Navigation in human-populated environments, known as social robot navigation, presents a significant challenge to widespread humanoid robot deployment

Evaluating algorithms for social navigation is complex due to dynamic human agents and their perceptions of robot behaviour.

Clear, repeatable, and accessible benchmarks have been instrumental in advancing computer vision, natural language processing, and traditional robot navigation fields.

Contributions of this paper include defining socially navigating robots, providing guidelines for metrics, scenarios, benchmarks, datasets, and simulators, and designing a metrics framework for comparing results across different platforms

The narrative around humanoid robots is similar to where we were in 2015/16 with drones. For a brief moment, everyone believed drones would be like mobile, we’d all have a personal one

There are a number of companies working on this including Tesla (supposedly), Figure, Prosper etc

Carl Pei, the founder of Nothing who just raised $96m gives an insight into how they manufacture their transparent earphones and phone handsets in India: