This week:

Nvidia is launching a language model

A PE roll-up opportunity in manual industries?

Nuclear, and why founders, investors and the US government are bullish

The 10 most important developments in solar this year

⚡️Energy and Climate

Goldman releases ‘Carbonomics’ - the economics of Net Zero

Cost curves continue to fall in a number of key technologies - it's generally getting cheaper, year over year, to decarbonise

This has been accelerated as fossil fuel prices have increased recently

Stationary technologies such as renewables, hydrogen, biogas have seen the steepest cost declines

Technologies substituting oil like EVs and biofuels have become more expensive, leading to a higher price to abate carbon from some types of transport

Bank of America report: The Nuclear necessity by BofA

Bank of America believe a third bull market in nuclear has begun and will be fueled by

1) resource nationalism and global demands for energy security

2) structural supply shortages

3) decarbonization commitments that would require a doubling of world nuclear output

"After a decade of underinvestment, a shortage is visible; our strategists forecast 20-40% upside. Global demand is also rising, with 60 new reactors being built & 100 more approved. Resource nationalism, energy security, war and inflation echo the nuclear build-out of the 1970s/80s"

A 60-minute video on the historical context for why Nuclear is not more widespread and what the future holds for this technology in the US

The video features numerous nuclear energy advocates and operators, including Mark Nelson (Radiant Energy), Emmet Penny (Grid Brief) Rod Adams (Atomic Insights), and VCs Albert Wenger and Josh Wolfe

Just this week, the US has pushed to ensure “Nuclear is not forgotten” in COP pledges

New direct lithium extraction (DLE) technologies by IEEE Spectrum

There is rapidly growing demand for lithium due to electric vehicles and energy storage, but current lithium extraction methods are slow, wasteful, and environmentally harmful

Direct lithium extraction (DLE) technologies are emerging as a faster, more efficient, and more sustainable way to increase lithium supply.

DLE technologies take hours rather than months to extract lithium, reducing land and water use. They work by filtering out lithium from brine and reinjecting the brine underground rather than evaporating the brine in ponds.

The main DLE technologies are adsorption, ion exchange and nanotechnology membranes

Pilot plants and demonstrations are underway by startups like Summit Nanotech, Lilac Solutions, Volt Lithium, and EnergyX, as well as major producers like Albemarle and SQM. Carmakers like GM, BMW, and Tesla are investing

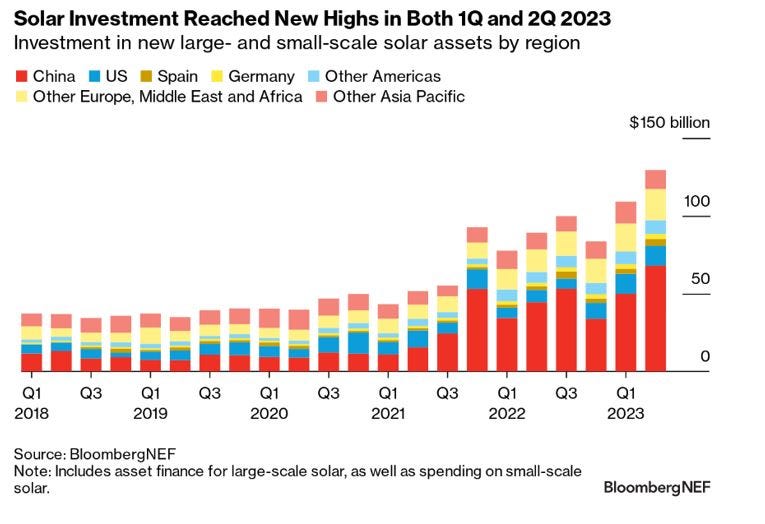

Great Twitter thread on solar by BNEF’s Jenny Chase

The thread is a treasure trove of insights on solar’s progressing in 2023. Some key takeaways:

PV panel cost declines/pricing and financing are no longer an issue for solar deployment

Grid access, permitting and labour are current bottlenecks

Solar's midday peak production doesn't match grid demand well. Utilities should use time-of-use tariffs to help address this issue

Localised deployment of solar is effectively cannibalizing their potential revenues, as pricing nears zero.

Many countries will have spot power pricing of zero for solar during the day, consumers will encouraged to shift usage by using EVs, batteries, precooling, preheating

Residential batteries now economically "kinda work" with subsidies, though the grid is still important

Utility-scale batteries and small-scale residential batteries have grown faster than expected

The latter has attachment rates – the proportion of residential PV buyers who get a battery too – at >70% in Germany and Italy, >50% in Switzerland, >30% in the UK

Daily intermittency is less of an issue than seasonal intermittency (summer v winter), concluding we should build more wind capacity given you generate at night and in winter

Her team significantly increased their 2030 solar build forecast to 707 GW, reflecting growing confidence in transformative growth

The deployment of solar has been accelerating and reached a record this year;

Top Stories

VW to slash 2,000 jobs in their software division, Cariad (InsideEVs)

Defense startup, Shield AI, raises $200m from USIT (Shield AI)

Goldman launches the ‘Global Institute’ advisory, to help clients navigate geopolitics, technology and markets (GS)

The US economy shook off the ‘tech bust’ (Noahpinion)

The trillion dollar quest for green steel (Canary Media)

Chinese robot maker, Unitree, releases new, larger robotic dog (Twitter)

Nvidia is piloting its own internal GenAI model (IEEE Spectrum)

US factory orders are highest since 2021 (Morning Star)

BlackRock warns investors that disdain for mining is threatening the transition (paywall, FT)

🌍 Policy and Geopolitics

The Top 100 Defense Contractors (pdf)

A reminder of the scale in which Defense Prime contractors generate revenue from the US’ DoD

🦾 Manufacturing and Robotics

Vertically integrating robotics via roll-up acquisitions? by Robot Report

A consistent problem I see amongst companies deploying robotics/hardware or software in legacy physical industries is very long sales cycles. The author of this article suggests a possible solution

Acquiring legacy businesses, applying new technology, in this case robotics, to automate manual processes and expand margins

Traditional robotics business models like RaaS force software expectations on hardware products, burning cash. Acquiring service companies and using profits to fund R&D is an alternative

Playbook:

Acquire profitable service businesses in industries ripe for automation, using debt financing, e.g lawnmowing, agriculture, manual inspection

Acquire service businesses with revenue and profits to fund growth. Focus on culture fit, tech-savviness, and commitment to enable automation.

View robots as strategic tools to improve margins, not just products to sell. Focus on usefulness, not features. Deploy imperfect robots to iterate

Consolidate and dominate an industry to capture full value. Build towards a massive data and distribution moat

Many roll-ups succeed by acquiring many similar businesses, driving operating efficiencies, creating multiple expansion

I’m really interested in this thought experiment, if you are too please email me!

RE Electric Sheep, Slow Ventures have an interesting thesis they call vertical saas buyout. Basic premise is (a) software now exists in most verticals but just isn't adopted (mainly distribution bottleneck) and (b) software (or robotics) can positively transform an operating company. IF your technology works then rather than selling benefits to all competitors at once, you can buy operating companies to capture 100% of upside, concentrate the gains and own a premium tech-enabled service. E.g. Metropolis

The franchise model can be an interesting way to do this as tends to have higher attachment rates and can require adoption as part of ops package or push strongly. Also debate as to if its better to roll-up operating co's or create de novo. Latter hard to do simultaneously, but happening a fair bit in healthcare services like tech-enabled dentistry, vets, primary care plays

Not a classic venture model (not a bad thing tho IMO), but argument that by capturing 100% upside of operating companies it provides scope for venture scale outcomes in verticals that VCs would previously dismiss