🌐 REALTECH News, May 2025

Your monthly technology guide on software defined physical industries

“When the music changes, so does the dance.” African proverb

The global order is changing. Whilst, the S&P500 has rebounded to a similar level today to pre-’Liberation Day’, Trump’s global tariffs salvo. Volatility remains high as investor sentiment toward a Trump-led US sours. Confidence is eroding in an administration seen as unpredictable and a threat to the global growth engine that once made the US so dominant. A key question for many allocators remains: where is better for long-term investment than the US?

Did VC get the memo? Meanwhile, liquidity remains constrained to secondaries in VC - Hunter Walk posted a good write-up on this new reality. Still, ‘animal spirits’ persist in late-stage enterprise AI, where, from what I’m seeing, valuations and diligence processes feel more detached than even in 2021. Enterprise aside, European governments are becoming critical buyers of technology. It’s a long-dated trend we’ve tracked, but it’s accelerated sharply post-JD Vance and Trump’s unravelling of Transatlantic security ties.

Long UK? This last month, the UK’s MoD is cutting procurement times for SMEs by two thirds, the Navy launched the Disruptive Capabilities and Technologies Office and Labour sees National Security entrepreneurship as a pillar of economic renewal. The UK currently sits in an interesting position, friendly with the US and the EU and able to move decisively without undue bureaucracy. Whilst the EU claims to have ‘woken up’, it’s still lumbering through its morass of competing interests. On the ground, mission-led founders are heeding the call to restore Europe’s tech sovereignty, which is no small task but an exciting one to be part of.

In today’s edition:

Where is China technologically, and where does that leave Europe?

Data-constrained robot learning, exploring new techniques

What happened when Silicon Valley met the Trump administration

📣 PSAs

I wrote a piece on how to ensure Europe’s Industrial prosperity. Read it in case you haven’t already

Travel: I will be in Paris May 6th to 8th, Marrakech May 12th to 16th, Berlin May 19th to 21st and Munich May 21st to 23rd! HMU if you’re around

🧑🏼🔬 Research: Alongside Dealroom, we have compiled 40+ pages of in-depth analysis on trends in REALTECH. We analysed 15k companies, 11k investors over 10 years - read it here

Top Stories

An assessment of China, chips and energy

I’ve been covering progress in Chinese technology for some time, much to the dismay of my US-pilled readers. This past month saw a cluster of under-documented yet significant technology releases from China. I still hear vast amounts of cope from economists and technologists about China’s supposed technological inferiority. The prevailing narrative remains that China copies rather than innovates, that its economic malaise precludes strategic advances, and that US companies’ market cap and profitability automatically equate to technological supremacy.

But what if the narrative is wrong? And what does that mean for Europe?

The last few weeks we’ve had some notable technologies released, across nuclear, chips and datacenters - which you could think of as ‘new industrials’:

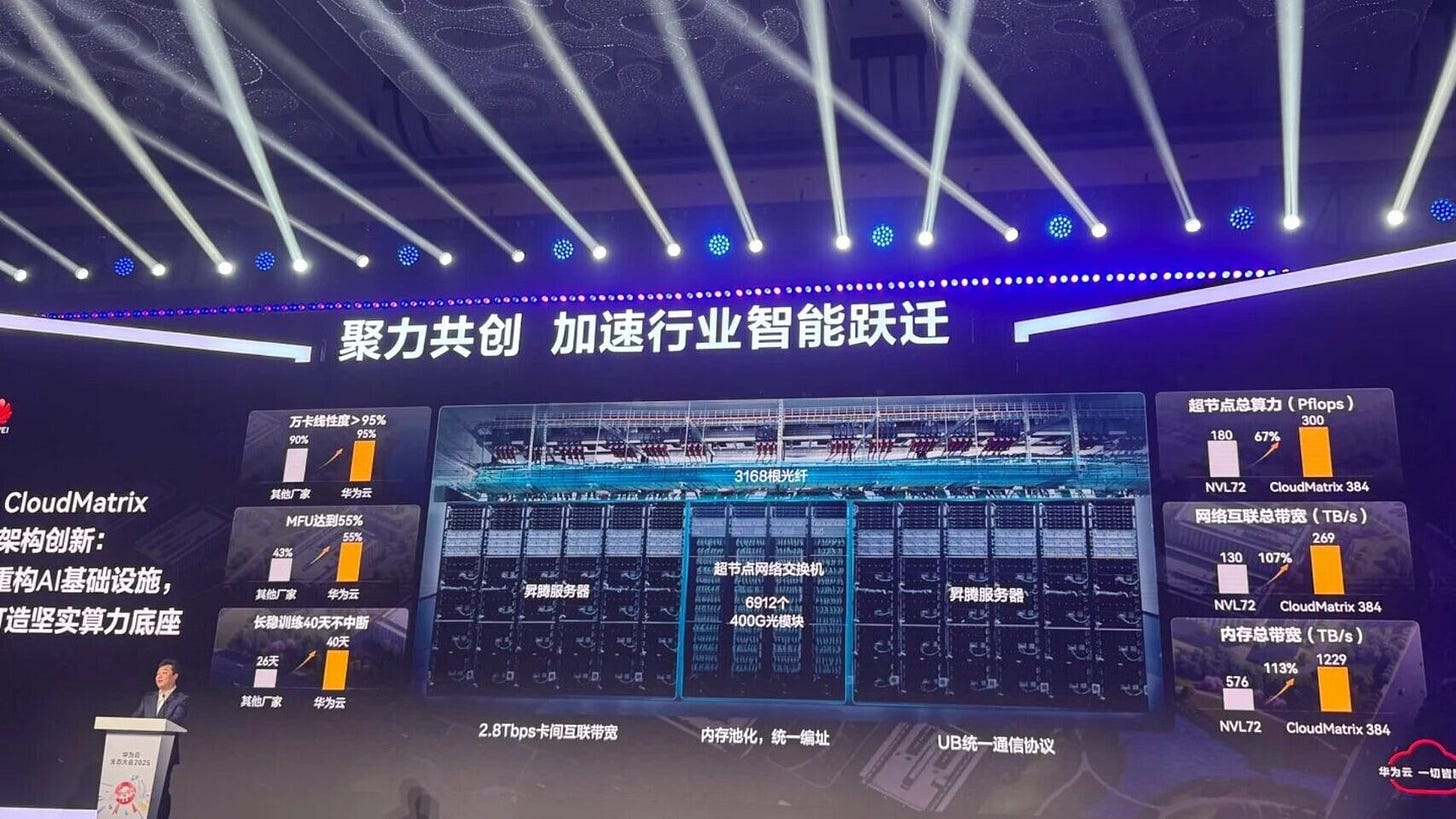

Huawei launched the Ascend 910C and its CloudMatrix CM384 system, a 16-rack AI cluster built around 384 chips. Despite relying on 7nm dies (sourced mainly from TSMC through export-control breaches), this system reportedly outperforms Nvidia’s GB200 in aggregate memory, bandwidth, and floating point compute (side by side table below). The system trades efficiency for raw scale, 4x more power, 2/3x more performance, and leans on China’s large and growing power infrastructure. Huawei’s software stack is impressive. It supports PyTorch, JAX, and VLMs natively, and they’ve built out a vertically integrated supply chain including networking, optics, and packaging.

Fudan University unveiled PoX, a nonvolatile memory claimed to be 10,000x faster than NAND flash. While not replacing HBM (used in parallel with AI accelerators), PoX addresses performance bottlenecks, especially in AI-adjacent storage and edge workloads. China is broadening its architecture toolkit as the US clamps down on HBM exports.

China just activated a GenIV SMR thorium reactor, built on US research from the 1950s. Thorium is 60,000 times more abundant than uranium and has no meltdown risk. China plans to build 150 nuclear reactors over the coming 15 years, providing critical baseload power needed to power AI

China continues to expand its AI clusters using homegrown alternatives at a time when US export controls remain. The numbers are staggering: 13x America’s steel production, 200x its shipbuilding capacity, 3x its car output — a scale that translates directly into embedded knowledge, manufacturing edge, and strategic optionality.

“The common refrain in the West is that AI is power-limited, but in China, this is the opposite. The West has spent the last decade shifting a primarily coal-based power infrastructure to greener natural gas and renewable power generation paired with more efficient energy usage on a per capita basis. This is the opposite in China, where rising lifestyles and continued heavy investment mean massive power generation demand.” SemiAnalysis

China is 3-4 years behind on cutting-edge logic chips and at near parity on AI models. Its already ahead in batteries, solar, electric vehicles, and nearly all core materials supply chains. Europe and the US had one major card left to play, collective scale. But that advantage looks shakier with Trump tariffs and fragmentation across key alliances. As the brilliant Rush Doshi notes in this fantastic interview, previous powers, from imperial Britain to prewar Germany, failed not due to lack of ingenuity, but because they couldn’t translate size into scale as their technologies proliferated internationally. The same risk looms now. The West must rethink industrial strategy around domestic demand and aligned production ecosystems. Scale still exists, it just won’t be gifted.

Roboticists, from GPU-poor to data-poor

Last month, the release of No-data Imitation Learning (“NIL”, Max Planck Institute, ETH Zurich) was a turning point in how we think about scaling robot learning. Rather than relying on costly, hard-to-collect demonstrations, NIL uses pre-trained video diffusion models to generate reference videos from a single frame and a text prompt. A vision transformer compares these synthetic sequences to simulated robot behaviour, providing a learning signal with minimal data. This shift reflects a broader trend. Robotics has long faced a data bottleneck — high-quality, diverse datasets for manipulation and general-purpose skills are rare and expensive. World model approaches like Wayve’s GAIA-1 and NVIDIA’s COSMOS offer partial workarounds by predicting future frames to learn environment dynamics, but they remain limited to data-rich domains like driving. In manipulation tasks, the gap between ambition and available data is still huge. Though efforts like the Open-X Embodiment dataset are trying to resolve that.

New methods are changing that. RoboEngine, for example, takes a few real demonstrations, segments the robot and scene, and uses a fine-tuned diffusion model to generate high-diversity synthetic data. This data augmentation pipeline boosts performance dramatically, turning 50 demos into decent skill generalisation. NIL takes it further, discarding real data altogether. The implication is clear: we may no longer need more demonstrations to scale robotics. Instead, we need better generative priors and smart architectures to extract signal from simulated experience. For roboticists, this means rethinking the learning stack. The next breakthrough will not come from the lab floor, but from models that can imagine, not just observe, the physical world.

🤓 Stories you need to know

👮🏼♂️Will we enter an era of agentic warfare? (War on the Rocks): AI agents will likely become a powerful, automated force from military planning to the battlefield. In true EU style, they have just banned agents from joining meetings at the Commission 🤦🏽

🎈Ukraine is using technology from the 18th century in its fight against Russia (IEEE Spectrum): the airship resurgence continues as the value of persistent reconnaissance and domain awareness increases

🇺🇸A round-up of ‘The Hill and Valley Forum’ (Tectonic): a gathering of Silicon Valley Defense investors and the Trump administration gathered at the US Capitol. Hill and Valley was founded by Jacob Helberg (Palantir), Christian Garrett (137 Ventures), and Delian Asparahouv (Founders Fund) in 2023

🇬🇧The Centre for British Progress launches: a spin-off from UKDayOne by Julia Garayo Willemyns, a speaker at last year’s REALTECH Conference. The centre is focused on influencing technology and pro-progress policies in the UK

✈️ Boeing sold its software division to Thoma Bravo for $10bn (Financial Times): the beleaguered aircraft manufacturer is offloading non-core assets in a bid to get fit

🤗 Hugging Face gets into selling robots (Hugging Face): the LLM repo’s move into robotics gathers pace with the acquisition of Pollen, a French open-source humanoid company. They are also hosting a global hackathon

⚡️Anatomy of an error, on Spain and Portugal’s blackout (Luis Garicano): “It is interesting to consider how we reached a point where discussing basic engineering realities became taboo” A great review of what happened this week and what role Europe’s energy policies played in the blackout

🔬Research

OceanSim: A GPU-Accelerated Underwater Robot Perception Simulation Framework (Stanford): OceanSim is a GPU-accelerated underwater simulation framework that dramatically improves the realism and speed of sensor modeling for underwater robots. By enabling real-time rendering of imaging sonar and advanced physics-based environments, it reduces the sim-2-real gap and supports synthetic data generation. This makes OceanSim a critical tool for advancing autonomous underwater systems in exploration

TesserAct: Learning 4D Embodied World Models (UMASS Amherst, HKUST, Harvard) : is a 4D generative world model that helps robots understand and plan actions by simulating how 3D environments change over time. It uses RGB, depth, and surface normal video data to create detailed, time-consistent scene reconstructions from images and text instructions. By combining geometry-aware video generation with smart optimization techniques, TesserAct delivers more accurate scene understanding and better performance on robotic tasks than previous video or 3D models—marking a key step toward general-purpose simulation for embodied AI.

💰Notable Funding Rounds

Nuro ($106m series E) the autonomous delivery company, raised funding led by T. Rowe Price at a $6bn valuation

CMR Surgical ($200m) the surgical robotics company behind Versius, raised a round led by Trinity Ventures

Base Power ($200m series B), the residential battery and virtual power plant startup, raised a round led by a16z

BRINC ($75m Series C) the emergency-response drone company, raised a round led by existing investor Index Ventures

Amca ($76m seed) the aerospace components startup, launched with funding led by Founders Fund

Parallel Systems ($38m Series B) the autonomous battery-electric rail startup, raised a round led by Anthos Capital

ARX Robotics (€31m Series A) the autonomous ground vehicle company, raised a round led by HV Capital

P1 AI ($23m seed) is an engineering AI for physical systems, led by a very experienced team, the round was led by Radical Ventures