Hi all, another packed month of news.

Robotics check-in: latest on AV deployment and robotics state of play

What persistent tensions in the Middle East mean for technology, elected politicians and markets.

Did the 12-day war in Iran prove that multipolarity has already happened?

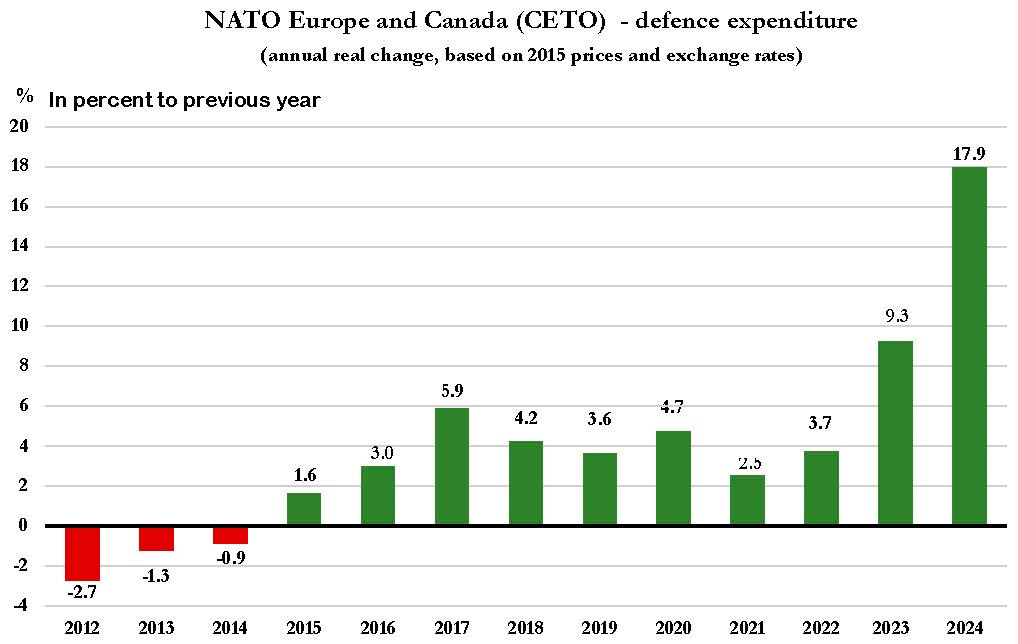

European leaders double-down on the ‘re-armament narrative’ with promises they’re unlikely to keep

📣 Public Service Announcements

REALTECH Conference - preparations are underway to host the next instalment later this year. For the 3rd year running, we’ll put the most ambitious builders in critical industries in one room, for just one day. If you’d like a chance to attend, sign up here, and check out last year’s event if you still need convincing

🧑🏼🔬 Research: Alongside Dealroom, we have compiled 40+ pages of in-depth analysis on trends in REALTECH. We analysed 15k companies, 11k investors over 10 years - read it here

I wrote a piece on how to ensure Europe’s Industrial prosperity. Read it in case you haven’t already

Robotics check-in: on the up or (gradient) descent?

Two major trends are shaping robotics today. First, autonomous vehicles (AVs) have finally reached commercial scale. Second, robotics is rapidly converging around a standardised architecture, large-scale multimodal transformer-diffusion policies, trained via sim-to-real. Recent advances from AV players offer a blueprint for scaling deep-learning robotics more broadly. More below.

Gradually, then all at once

Wayve just announced it’s rolling out fully autonomous ride-hailing in London this year, through the Uber app. Tesla has just launched its robotaxi pilot in Austin, to much fanfare and attracting regulatory scrutiny from NHTSA, spotlighting the practical hurdles still inherent in deploying autonomy at scale. Meanwhile, Waymo quitely crossed 10 million rides, accumulating over 500,000 hours of driving logs. Waymo’s latest data shows something remarkable; trajectory-prediction errors decline smoothly as a clean power-law of training compute. A similar scaling curve we’ve seen in LLMs:

Transformers and diffusion across robotics 🦾

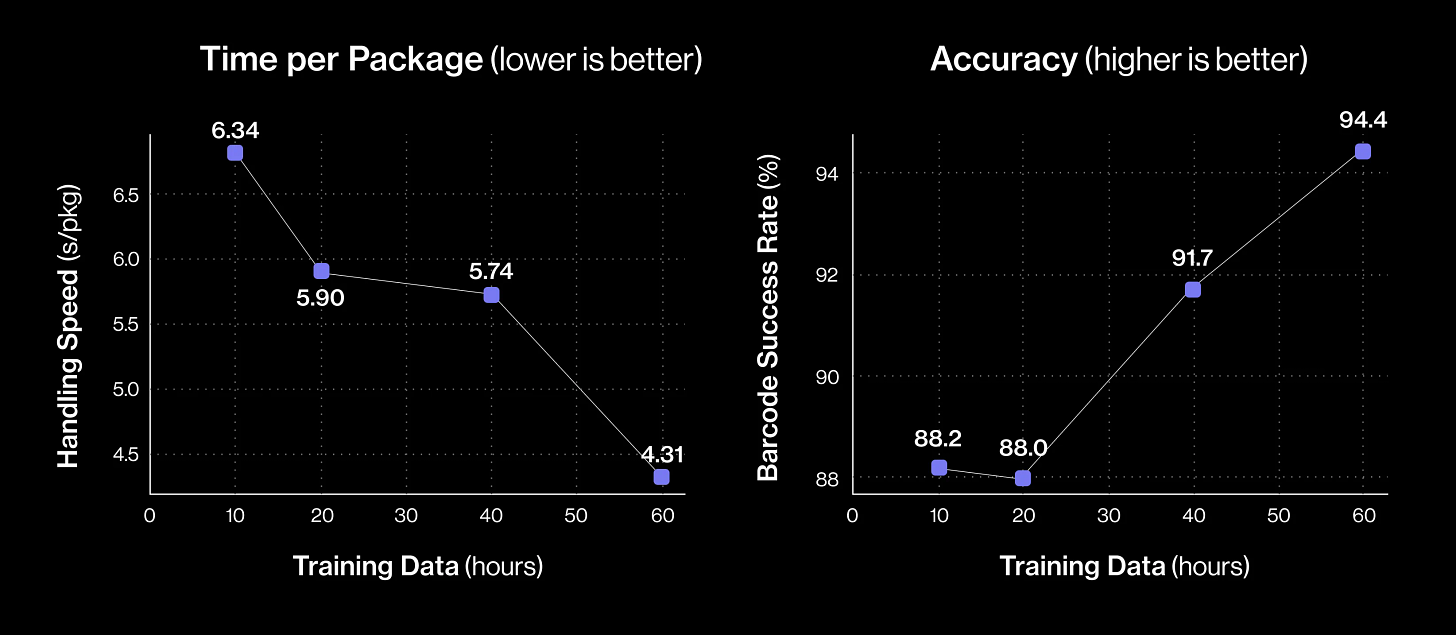

Last month saw a slew of robotic model releases. DeepMind launched Gemini Robotics On-Device, compressing a powerful 2B-parameter Vision-Language-Action (VLA) model onto a single Nvidia Orin, enabling on-device reasoning. Meanwhile, 1X introduced "World Model," a generative video system designed for humanoids capable of predicting future robot states and task-level outcomes. Figure shared promising results from their enhanced Helix model, which rapidly improved manipulation skills via architectural upgrades (temporal visual memory, proprioceptive state history, and force feedback). Helix now handles diverse packages faster (4.05 seconds/item) and more accurately (~95% barcode orientation success). Critically, performance accelerated as demonstration data scaled from 10 to 60 hours, echoing the AV and LLM scaling trajectory:

Even academia is aligning with this trajectory. At this year’s ICRA 2025 conference, the winning paper, Robo-DM, addressed data management infrastructure explicitly designed to handle vast, multimodal robotics datasets. Simultaneously, submissions concentrated around soft robotics and bio-inspired systems, suggesting future robot capability will hinge on hardware and materials choices as much as model capabilities.

Robotaxis represent arguably the first robots running autonomously at consumer scale, providing a concrete roadmap for scaling embodied AI: massive, diverse datasets, GPU-driven simulations, big compute budgets as the primary throttle for performance and management that can tough out multi-year deployments. For robotics startups, performance becomes a function of compute spend, suddenly an existential budget question rather than just a technical puzzle. If you’re not capital-efficient in how you generate and consume data, you’re not gonna make it.

Tech Geopolitics

Isreal-Iran-US, the 12-day war and what tech isolationism looks like

Israel's strike on Iran occurred strategically just days before critical US-Iran nuclear talks, amplifying geopolitical tensions. The strike came at a remarkable time. Rafael Grossi, head of the International Atomic Energy Agency (IAEA), had just toured the Iranian facilities that found themselves in Trump’s crosshairs. Grossi described his visit in a Lunch with the FT interview (dated June 6th, 2025):

“Iran doesn’t have a nuclear weapon at this moment, but it has the material….The most sensitive things are half a mile underground — I have been there many times, To get there you take a spiral tunnel down, down, down.” Rafael Grossi

Technological leapfrogging

The conflict showcased major technological leaps: Iran bypassed Israel’s Iron Dome using Fattah-1 hypersonic missiles and Shahed-136 drones. Israel deployed precision drones to disable Iranian air defences, gaining air dominance. Trump’s dramatic US intervention with ageing B-2 stealth bombers, although impactful, only temporarily hindered Iran's uranium enrichment, by “a few months”.

Lessons in tech isolationism, with Chinese characteristics

Tehran discovered the downside of tech isolation. Israeli drones blinded and then picked apart Iran’s largely domestically built missile defence system. Within days, Iranian Defence Minister Mohammad-Reza Ashtiani was in Beijing shopping for HQ-17AE SAMs and J-10C fighters, the very same Chinese systems (covered last month) that enabled Pakistan’s PL-15E missiles to swat a Western Rafale out of the sky.

This pivot has significant implications. Iran risks becoming a technological client state of China, eroding its independence. Moreover, Iran's shift away from the Nuclear Non-Proliferation Treaty (NPT) raises serious concerns about regional nuclear proliferation risks, intensifying the erosion of the global rules-based order. Iran may well follow Israel’s path, building nuclear weapons and abandoning international treaty obligations.

This has two immediate implications: first, a potential regional nuclear arms race; second, a further erosion of the rules-based order.

NATO, daddy issues and the 5% fallacy

Meanwhile at The Hague, NATO Secretary-General Mark Rutte earned internet immortality by calling Trump “daddy” - Trump had conspicuously sidelined NATO whilst carrying out the Iranian attacks. The event was largely focused on bringing Trump back into the fold and ensuring his much needed support of the alliance. The implicit expectation being that non-US states would shoulder more of the cost burden. This came just as the US has cancelled significant amounts of equipment for Ukraine.

NATO members pledged to spend 5% of GDP on defence (3.5% direct defence, 1.5% infrastructure). A pledge that member states are unlikely to meet given current structural deficits. Additionally, fragmented national supply chains continue to undermine European efficiency, reinforcing dependency on comparatively "cheap" US hardware. The problem here isn’t raw euro spending; Europe already clocks +€300bn annually; it’s diseconomies of scale. Twenty-seven national supply chains, most too small individually to achieve efficiency, mean European military equipment remains far more expensive than US equivalents.

NATO addressed some of the concerns within the summit;

“The plan aims to improve Allies’ ability to aggregate demand….and accelerate the growth of defence industrial capacity and production”.

The alliance also updated its first Commercial Space Strategy, renewing focus on the space domain.

The deeptech dividend

This month’s Paris Air Show saw notable presence from US officials and contractors, an acceleration of the trend we highlighted in last month’s newsletter. As previously noted, next-gen US defence firms are landing in Europe, particularly the UK, in anticipation of the massive spending increases. I've also seen a marked uptick in US VCs landing in London and Munich, scouting aggressively for deals.

The "re-armament" narrative will likely remain prominent for the foreseeable future, requiring substantial investments in mid-tier manufacturing, currently the weakest link in European industrial capability. Clear indicators of this shift include Anduril’s recent joint venture with Rheinmetall on counter-UAS systems, Renault’s mandated drone production for Ukraine, Helsing’s €600m funding round and acquisition of Grob Aircraft, and Castelion’s $350m raise to accelerate hypersonic capabilities.

Multipolarity you said

Right, yes. The strikes on Iran didn’t just hit underground bunkers, they struck at the foundation of the international rules-based order. A UN-safeguarded nuclear facility was bombed without pretext, further cementing the collapse of political and ideological alignment in favour of raw nation-state power. REALTECH reader, Henry Gladwyn, put out a great piece on the end of neoliberal order and how tech has replaced traditional power structures. Geopolitically, Tehran is being driven into Beijing’s orbit. Iran’s immediate pivot to China for advanced systems signals the potential birth of another client state, deepening China’s leverage in the Middle East.

Meanwhile, Trump’s tariff saga has partially abated, reflected in the S&P’s surge to record highs, though these gains have partly been evaporated in FX terms. The dollar has had its worst YTD performance since 1973, with de-dollarisation gaining momentum. Financially, US bond yields barely contracted after the Iran strikes, historically unthinkable during a geopolitical shock of this scale. European bond yields are 2% lower than the US’ across the yield curve. Rather than triggering the usual flight to safety, yields remained stubbornly high, hinting that the US is no longer the undisputed hegemonic safe haven it once was. China continues to leverage its stranglehold on rare-earth metals, strategically slowing exports and exacerbating supply issues for US advanced technology. In parallel, Taiwan’s sanctions against Huawei and SMIC signal an apparent intensification of global technological fracture. We’re no longer approaching multipolarity, it’s already here.

🤓 Stories you need to know

🧲 Next-gen electric motors that use superconductors (Spectrum IEEE): Hinetics uses cryogen-free superconducting rotor magnets to build high power-density motors. The breakthrough has been enabled by cost declines for magnets in Fusion power research. The company has performed bench-scale tests, the motor is 10x-40x more powerful than EV motors across benchmarks

🇬🇧 Turning UK Innovation Into Prosperity and Power (Tony Blair Institute): The institute focuses on policy levers to address the UK’s inherent lack of scale. I was a small contributor to the research, advocating for policies which encourage domestic industry to adopt new technologies such as AI, embed private sectors specialists inside government, reform R&D tax credits to flow actual science and research

🤗 Hugging Face and Proxima Fusion launch ML challenge (Proxima Fusion): The challenge is for ML practitioners to help design three stellarator boundary shapers for Proxima. This is similar to the work DeepMind and EPFL undertook in 2022, on plasma confinement and control

🇨🇳 China’s evolving industrial policy for AI (RAND): how China is tackling its goal of becoming the global AI leader by 2030: Beijing is optimising for AI delivering value in industrial end applications versus the more nebulous “AGI”. Xi hard-coded in April 2025, “autonomously controllable” hardware & software as a national priority. State-backed “AI pilot zones,” labs (BAAI, Shanghai AI Lab) and robotics programmes blur the line between dual-use R&D and military modernisation

As a follow-up, this is a great read on China’s purported structural advantages in open-source AI. Namely, China is parlaying its trove of sensor-rich industrial data and a “default-open” play to chip away at US closed-source moats. This inverse-transparency paradox speeds dual-use diffusion. A politically opaque state offers the world’s most accessible high-end models, letting PLA or any defence prime retrain them with no gatekeepers

🚀Speed is everything, lessons from SpaceX (Justin Lopas): a practical framework for hardtech founders to move at SpaceX speed. Implementing a culture of speed, how to communicate, removing blockers and how to work with all parties to bring the schedule in

🍪The roadmap for HBM (WCCFTech): High bandwidth memory is critical component for GPUs, Kaist and Tera released the roadmap, showing HBM8 scaling to up to 64TB/s (in 2038). Additionally, near-term HBM4 solutions (launching in 2026) will already offer substantial advancements, with 36-48 GB capacities and up to 2.5 TB/s bandwidth per stack

🦤The White House is bringing back supersonic flight (White House): Donald used his EO powers to roll back regulations on supersonic flight in the US. This move is both pro-business and has national security implications as the development of hypersonic missiles becomes critical. As someone who grew up in North West London in the 90s/00s, I saw Concorde fly on the Heathrow flight path every day around 4pm. I’m excited about this renewed future. Also excited to spend less time on planes :)

🔬Research

Darwin Godel Machine: Open-Ended Evolution of Self-Improving Agents (Sakana AI, Univ of British Columbia): the Darwin Gödel Machine (DGM) is a self-referential AI system capable of autonomously rewriting its own code to iteratively improve itself. Inspired by open-ended evolution, the DGM grows a diverse archive of agents, each modifying and empirically validating its own improvements on real coding benchmarks. Over 80 iterations, it boosted performance from 20% to 50% on SWE-bench and from 14% to 30% on Polyglot, showcasing a path toward recursive, safe, self-improving AI 😳

RIGVid: Robots Imitating Generated Videos Without Physical Demonstrations (UIUC, Univ. of Columbia, Skild AI): RIGVid is a system where robots learn complex tasks, like pouring, lifting, or sweeping, by imitating AI-generated videos without requiring any real-world demonstrations. Given a language command and an initial scene image, a video diffusion model produces potential demonstration videos, which are automatically filtered by a vision-language model. A 6D pose tracker extracts object trajectories, which are retargeted to the robot in an embodiment-agnostic way

Review: Performance, efficiency, and cost analysis of wafer-scale AI accelerators vs. single-chip GPUs (UC Riverside): A comprehensive review comparing wafer-scale accelerators, like Cerebras’ WSE-3 and Tesla’s Dojo, with conventional GPUs for AI workloads. Wafer-scale systems achieve up to 40× higher computational density, extreme bandwidth (e.g., Dojo’s 2 TB/s per die edge), and vastly improved scalability. However, they face challenges in fault tolerance, yield, and software optimisation. The study outlines emerging trends like TSMC’s CoWoS packaging and forecasts order of magnitude improvements in computation by 2027, offering key insights into trade-offs for next-gen compute

1X World Model: Evaluating Bits, not Atoms (1x): 1X proposes a ‘world model’ architecture trained on extensive robotic datasets to unify perception, spatial reasoning, and high-level planning within a single transformer framework. Early benchmarks show it generalises across robotic arms and mobile robots, outperforming task-specific models on real-world manipulation tasks

💰Notable Funding Rounds

Anduril ($2.5bn Series G) the next-gen prime raised from existing investors Founders Fund

Helsing (€600m Series D) the AI-first European defence startup, raised from existing investors

Applied Intuition ($600m Series F) the vehicle autonomy company that recently made a foray into defence, raised a pre-IPO from Blackrock

PhysicsX ($135m Series B) the London-based multi-physics hardware design engineering company, raised from Atomico

Proxima Fusion (€130m Series A) the German fusion energy company raised from Cherry and Balderton

Genesis AI ($105m seed) the robotic simulation company known for the Genesis paper, raised from Eclipse and Khosla

Nominal ($75m Series B) the design engineering data monitoring tool raised from Sequoia

Kraken (undisclosed) the London-based naval autonomy company, raised from NATO Innovation Fund and NSSIF

Gecko Robotics ($125m Series D) the industrial inspection company raised from Cox Enterprises

Aerones ($62m Series B) the Latvian company, who do robotic inspection for wind turbines raised from Activate Capital and S2G Investments

Swarm Biotactics ($10m seed) is a bio-inspired robotics company for defence, they raised from Vertex US

Sunrise Robotics ($8m seed) the warehouse automation company raised from Plural

Senra Systems ($25m Series A) the wire harness assembly company raised from Dylan Field and CIV

Bedrock ($25m Series A-2) the sea floor mapping company raised from Primary and Northzone

Automated Architecture (£5m seed) the Bristol based robotic construction company spun out of UCL raised from Planet A