RealTech Conference Roundup + Series A benchmarks

Welcome and thank you to all those who attended last night’s event. It was a great evening full of new connections, inspiring talks and questions about how technologies can shape our future.

We heard from founders building silent aircraft engines, tasty lab-grown fats, new sustainable materials for fashion, modern hardware requirements tooling and AI-controlled greenhouses.

We are continuing our mission of bringing Europe’s Frontier Tech community together, elevating startups and demystifying building absurdly ambitious companies.

If you’d like to help grow the community, please consider sharing the above with your network. We expect to host the next event in Q2 2024 and we want it, with your help, to be bigger, better and more inclusive.

If you attended the event and don’t want to receive these emails, feel free to unsubscribe, I won’t be offended 🙏🏻

Series A metrics

As promised, please see the results of the Series A benchmarks survey we did. This formed part of the context for the last night’s panel discussion.

More importantly, I hope for seed-stage founders, this can help inform what is realistically required to raise your A round. If there’s any data missing which would be helpful, HMU

Who are they?

Sectors

44% in robotics

20% in energy

17% in biology

11% in manufacturing

8% in materials

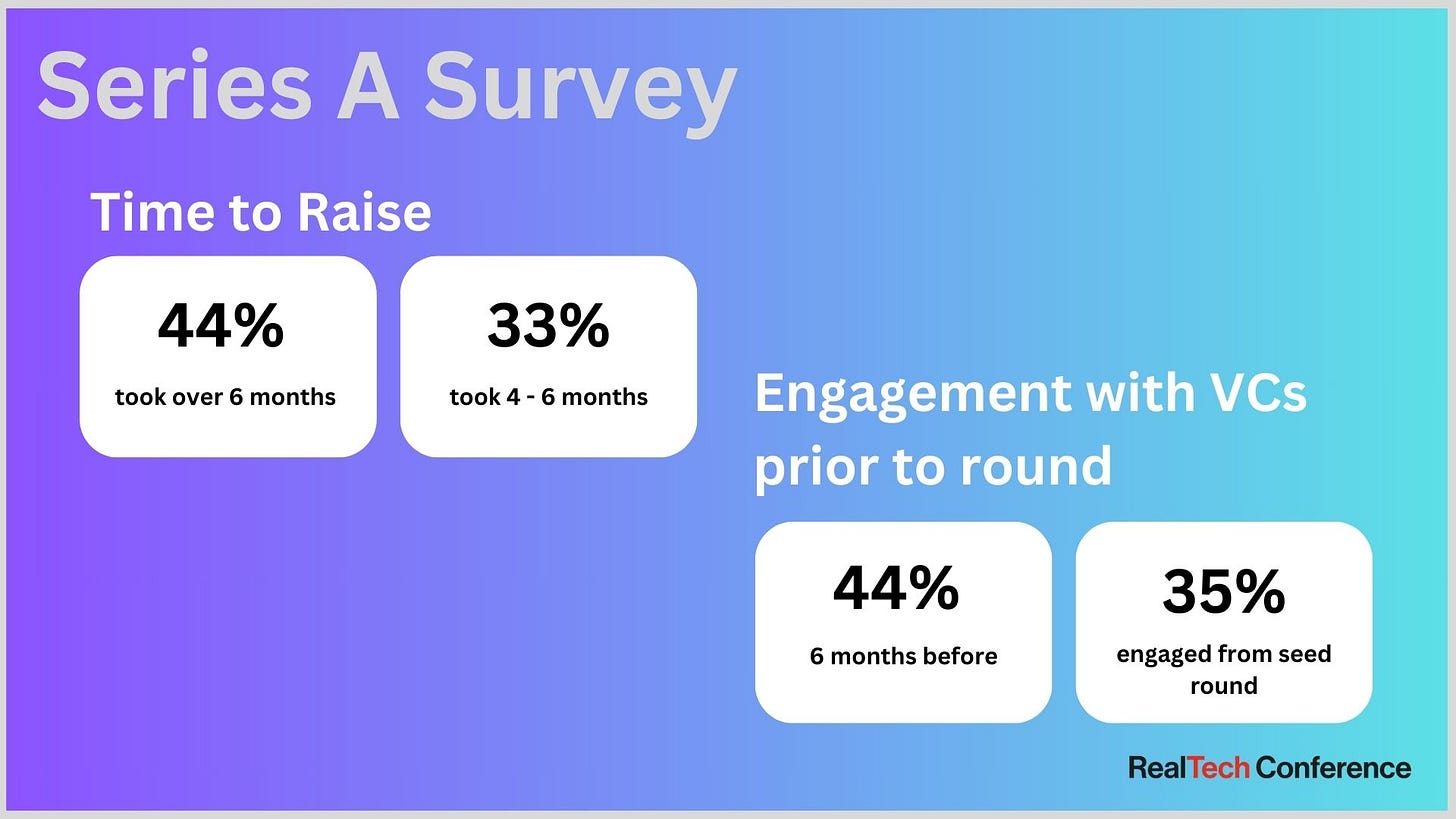

How long did it take to raise their Series A?

44% took over 6 months

33% took 4 - 6 months

22% took under 4 months

How long before your round did they engage with VCs?

44% engaged 6 months before

35% engaged from their seed round

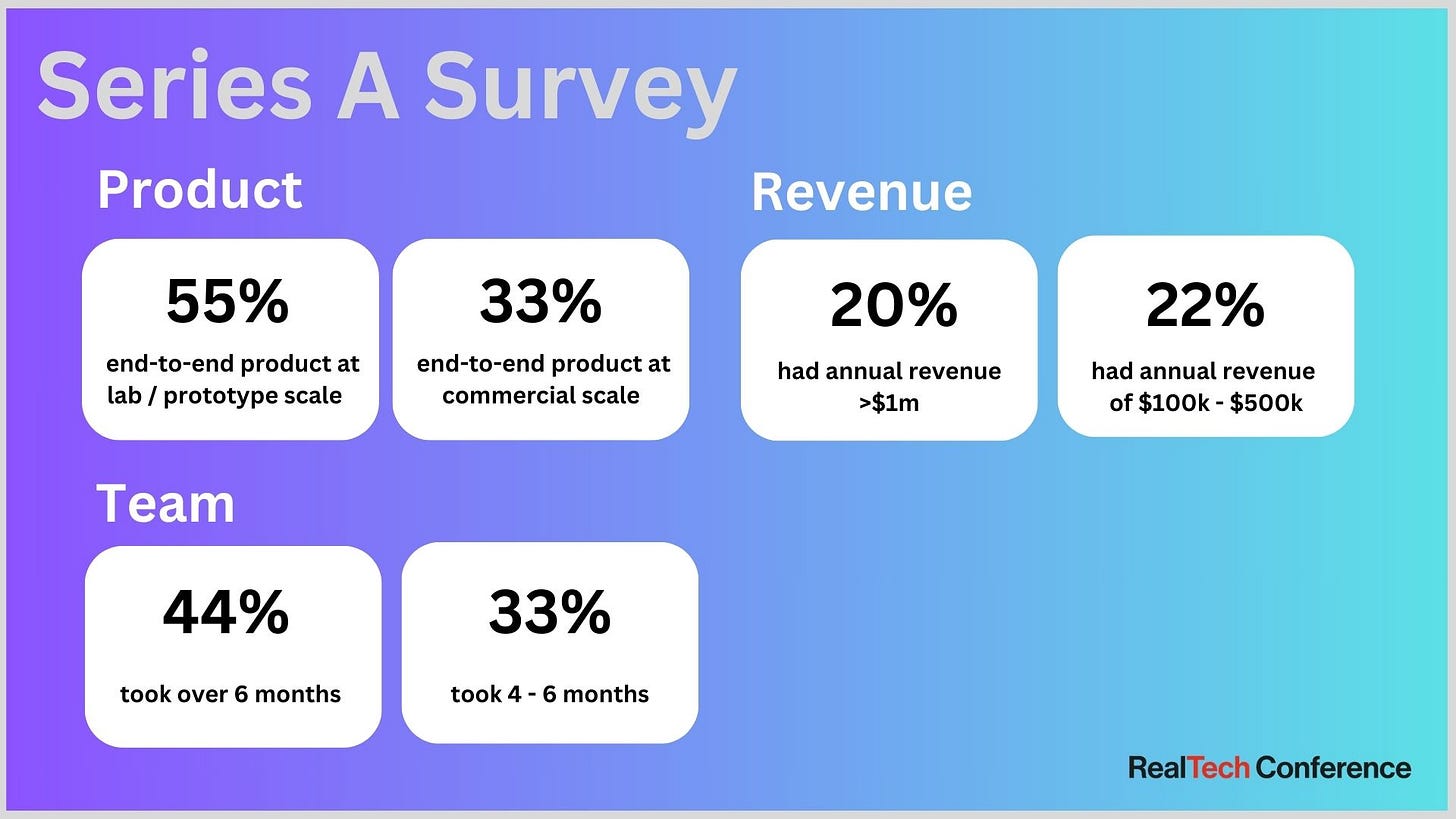

Metrics needed to raise A (not mutually exclusive)

Product build

55% of startups raised on ‘end-to-end product, at small scale (lab/prototype)’

33% of startups raised on ‘end-to-end product, at commercial scale’

Revenue

20% had annual revenue >$1m

22% had revenue between $100k - $500k

Team

33% stated hiring key technical roles as needed

22% stated making VP-level hires as needed

Funding to manufacture products

66% of startups require finance to produce a physical product

VC funding alternatives (not mutually exclusive)

60% are using Venture Debt

62% are using government subsidies

50% are using Asset-backed debt

14% are using Asset leasing (eg RaaS)

14% are using R&D tax credits

Biggest frustration with your Series A raise?

“Leaving $35m+ of capital on the table because there's only so much space in a round”

“Closing legals. Make sure you set a fee cap. Don't let the lawyers start arguing with each other without first checking the counterparty actually gives a damn about what they're going to start racking up fees on.”

“Too small. USA investors hard to engage due to geography”

“Pattern matching behaviour of VCs”

“Could have raised more”

“It went smoothly enough. Was better than other rounds I did in the past. However, it feels that this time there was more excitement towards deep tech and very complex value propositions.”

What do you wish you had known ahead of your raise?

“Better intel on how to build syndicates and what to look out for”

“A wasn't too hard, some people will still back you based purely on vision. B took 1000 meetings. You'll need to make sure you can get to something compelling with that A cash, or at least to a bridge.”

“You can still raise a good Series A with little commercial traction”

“How fast it will go - we underestimated things and it all flew by! Was good overall.”