The economics of limitless energy

+ Tesla pull an Amazon, The State of Manufacturing, GPUs for Fusion energy and Google get into defence

⚡️Energy, Materials and Climate

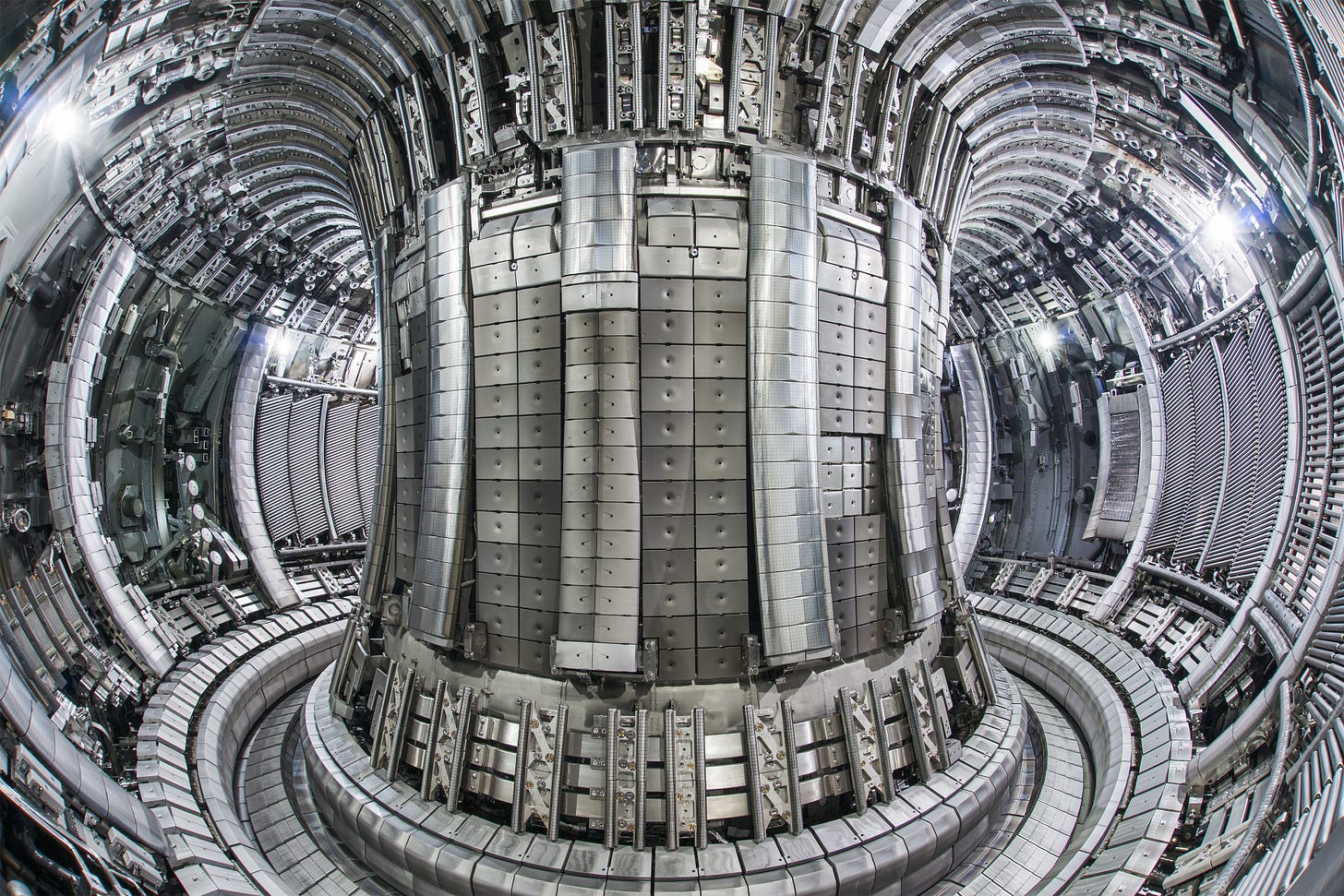

We need GPUs to make Fusion energy a reality

Why it matters: increasing GPU compute is making simulation “software at hardware speed” a reality across an increasing number of domains.

The UK Atomic Energy Authority (UKAEA) is collaborating with Intel and the University of Cambridge to develop a prototype nuclear fusion reactor in the UK

To accelerate the process they are using advanced simulation techniques:

Simulation for physical processes is a recurring theme in this newsletter. We are seeing weekly advances in compute and AI push the boundaries of in silico testing

Powering a fusion reactor is expensive and short-lived. Simulation provides a way to model and test reactors in simulation and measure against limited real-world results (DeepMind previously built an RL model for a Tokamak in ‘22)

They are moving from Dell x86 CPUs to Intel Datacenter GPUs. To avoid vendor lock in, they’re looking at Intel's oneAPI programming model that provides heterogeneous computing so applications can run on Intel, Nvidia or AMD GPUs

Why it matters: we’re seeing a trend of energy solutions using renewables to produce natural gas, skipping grid interconnect issues (eg ETFuels)

Terraform Industries is an ambitious US-based startup, with some bold claims(!)

They just released their first product, designed to produce cheap natural gas from sunlight and air, whilst avoiding the need to plug into the grid

The unit plugs into a 1 MW solar array, which powers Direct Air Capture, a hydrolyser and Sabatier reactor, converting atmospheric hydrocarbons into fuel.

The Terraformer claims to be able to produce 1000 cubic feet of gas per hour of operation. Given the intermittency of solar, this goes against conventional wisdom, that hydrolysers need to run 24/7

They have not invented any kind of perpetual energy machine, it’s a claim around an efficient system with some unclear input costs (do you need Li-Ion batteries, maintenance, where does the water come from?)

What is slightly unclear, is the opportunity cost of deploying a 1MW solar array, which can generate $40k per annum. They are claiming annual net profits of around $25k-$50k, based on 80% of the revenue being driven by subsidies

🚖 Moving things

Tesla charging network; why Tesla won, Standards and taking a tax on North American EVs

Charging networks, really? Bear with me. This is more interesting than it seems. This is a great case study in turning vertical infrastructure spend into a moat.

To date, there has been a battle for the electric vehicle charging standard, the North American Charging Standard (“NACS”) versus the Combined Charging System (“CCS1”). These are the cables that charge vehicles, for both AC and DC charging.

Being early

Tesla was early in building this infrastructure - this vertically integrated approach was critical to the sale of their vehicles. Consumers would not buy a mid-range EV if they didn’t have clear charging coverage.

Tesla has deployed 12,000 charge points across the US since 2012, incurring huge (Capex) costs. They own the whole experience and have had longer to iterate on the charging product than the competition. Their chargers are faster, more widespread than the competition and generally accepted as superior.

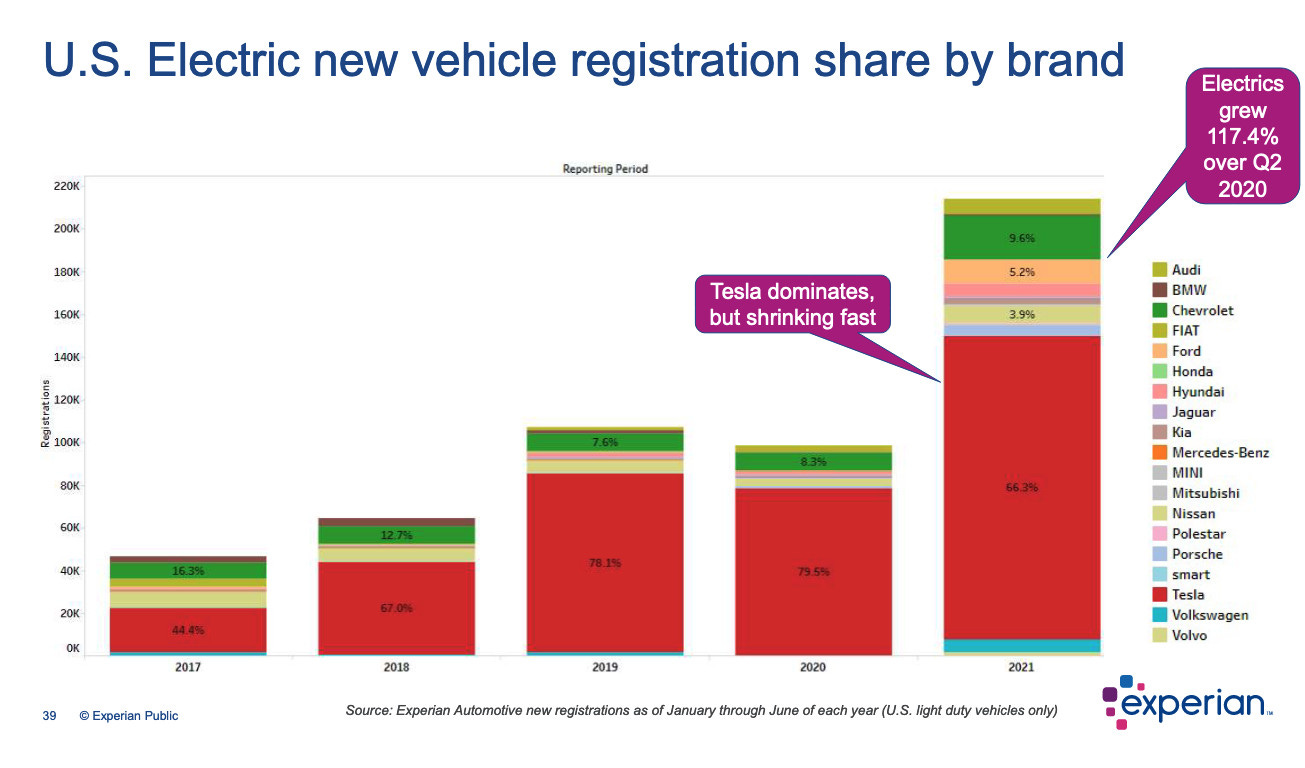

Tesla also benefitted from being able to ‘tip’ the network in their favour - they’ve consistently had the most EVs on the road. This means they have considerably lower per-unit costs to deploy the charging network versus the competition:

Turning costs line items into revenue

Recently, automakers, GM, Ford, Rivian and Volvo, announced their EVs would be using Tesla’s electric chargers in North America. The fundamental business equation for the competition is a simple buy v build;

is it cheaper for me and my customers to pay Tesla a fee or to build my own network?

By some estimates, this would have cost GM $400m in Capex over multiple years, to arguably get to a similar place.

I have previously written about, abstractions in physical industries:

“A good example of the full stack approach is Tesla, who decided to vertically integrate, cut reliance on suppliers and put software at the core of the product. […]. It also means they can use their scale to sell an abstraction to competitors. Could Tesla sell their battery management software or full service driving (FSD) to other companies? Potentially.“

Tesla, have illustrated this strategic advantage of vertical integration.

Whilst, this is a short-term hit to Tesla’s differentiation. It gives them a very profitable, high gross margin business, with most of that revenue falling to the bottom line. They are now collecting an effective tax on most EVs in North America. They have turned a cost disadvantage into a revenue line and moat.

Tech Tax

In many ways, this is a familiar story of technology standards being pushed by rival tech firms. Think VHS v Betamax, or HD DVD v Blu-Ray - Some of the best technology businesses have been created in a similar way:

ARM Holdings: they licence the architecture for all iPhone chips

$2.7 billion revenue (FY22), w/ 95% gross margins

Qualcomm: all US based cell networks use their CDMA standard (Europe has GSM)

$24 billion revenue (FY22), w/ >70% gross margins

Amazon AWS: turned their server infrastructure into their main profit driver

$80 billion revenue (FY22), 60% gross margins, 25% operating margins

If you’re ever building a heavy Capex component for a new business, that has general applicability to other competitors, network effects and superior product features. Keep an eye on opportunities for future monetisation.

🦾 Manufacturing and Robotic

Fictiv launched the State of Manufacturing 2023

Some highlights across priorities, investment areas and AI:

Supply Chain visibility is key concern

80% of Medium-sized manufacturers are searching for new technologies that can help them succeed